Get the free Young CPAs 26-27 - arcpa

Show details

NEWSLETTER Arkansas Society of Certified Public Accountants November 2009 President Jim C. Petty Executive Director Barbara S. Angel Published Monthly By THE ARKANSAS SOCIETY OF CERTIFIED PUBLIC ACCOUNTANTS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign young cpas 26-27

Edit your young cpas 26-27 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your young cpas 26-27 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing young cpas 26-27 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit young cpas 26-27. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

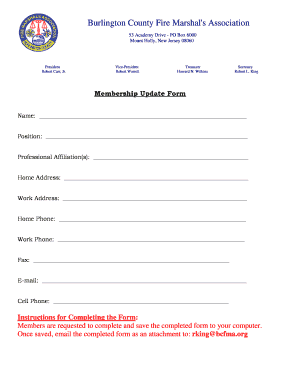

How to fill out young cpas 26-27

How to fill out young cpas 26-27?

01

Start by obtaining a copy of the young cpas 26-27 form. You can typically find this form on the official website of the organization or institution requiring it.

02

Carefully read the instructions provided with the form to familiarize yourself with the requirements and any specific guidelines for filling it out.

03

Begin by filling out your personal information, including your full name, contact details, and any other requested details such as your date of birth or social security number.

04

If applicable, provide information about your current employment or educational institution, including the name, address, and contact details.

05

The young cpas 26-27 form may include sections or questions related to your professional qualifications, certifications, or licenses. Fill out these sections accurately and provide any necessary supporting documentation if requested.

06

Some sections of the form may require you to provide information about your previous work experience or internships. Include details such as the name of the employer, your position, dates of employment, and a description of your responsibilities and accomplishments.

07

If the form includes any sections for additional comments or explanations, take the opportunity to provide further details or clarify any aspects that may require further explanation.

08

Once you have completed filling out all the required sections of the young cpas 26-27 form, review it carefully to ensure all information is accurate and legible.

09

Follow any specified guidelines for submitting the form, such as submitting it online, mailing it to a specific address, or hand-delivering it to the appropriate office.

Who needs young cpas 26-27?

01

Young professionals in the field of accounting or finance who are seeking certification or licensure as a Certified Public Accountant (CPA).

02

College students or recent graduates pursuing a career in accounting who are required to complete this form as part of their education or job application process.

03

Individuals who are already working in the accounting industry and seeking additional certifications or professional advancement opportunities.

04

Accounting firms or organizations that require their employees to complete the young cpas 26-27 form as part of their professional development or compliance requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my young cpas 26-27 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your young cpas 26-27 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit young cpas 26-27 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share young cpas 26-27 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit young cpas 26-27 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like young cpas 26-27. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is young cpas 26-27?

Young CPAs 26-27 is a specific tax form for individuals aged 26-27 who are certified public accountants.

Who is required to file young cpas 26-27?

Individuals aged 26-27 who are certified public accountants are required to file Young CPAs 26-27.

How to fill out young cpas 26-27?

Young CPAs 26-27 can be filled out by providing all required personal and financial information as per the form's instructions.

What is the purpose of young cpas 26-27?

The purpose of Young CPAs 26-27 is to accurately report the income and tax information of individuals aged 26-27 who are certified public accountants.

What information must be reported on young cpas 26-27?

Young CPAs 26-27 requires reporting of income, deductions, and other relevant financial information for individuals aged 26-27 who are certified public accountants.

Fill out your young cpas 26-27 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Young Cpas 26-27 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.