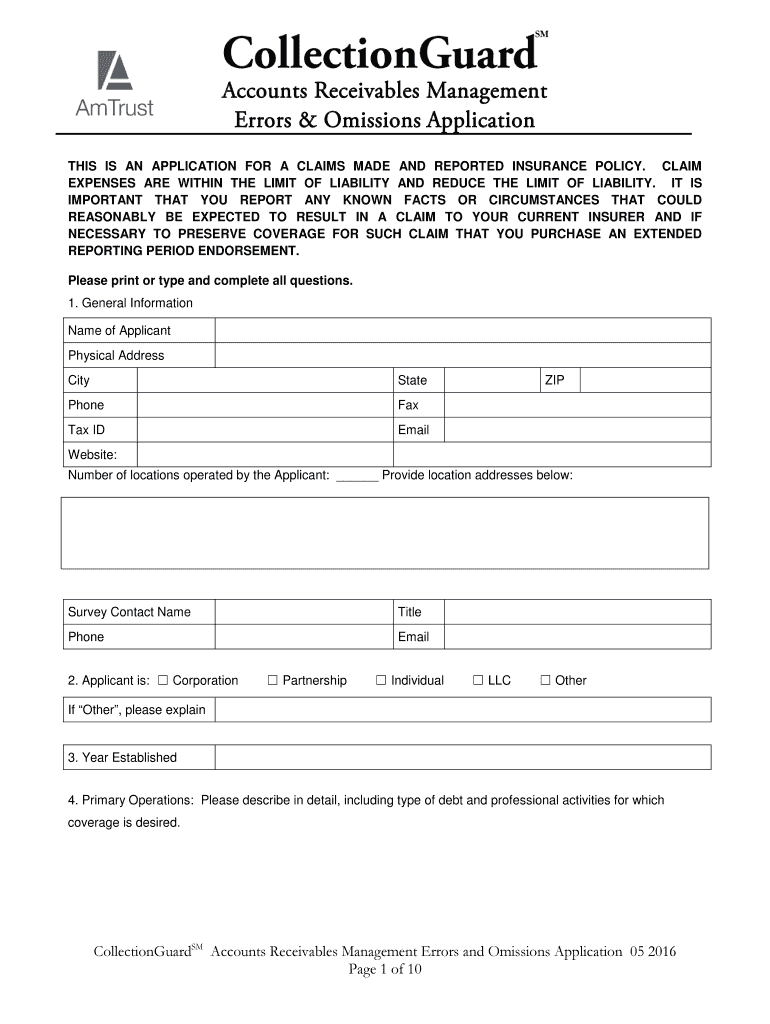

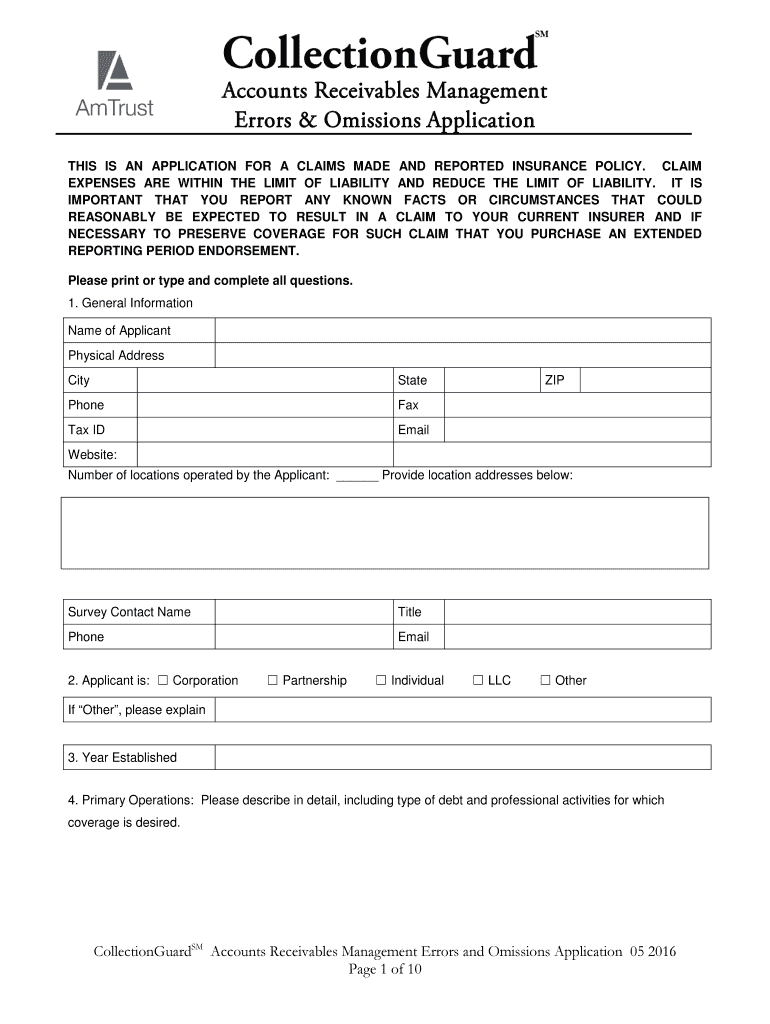

Get the free Accounts Receivables Management

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts receivables management

Edit your accounts receivables management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts receivables management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts receivables management online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit accounts receivables management. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts receivables management

How to fill out accounts receivables management:

01

Start by gathering all the necessary information related to the accounts receivables, such as invoices, customer details, payment terms, and any outstanding amounts.

02

Create a comprehensive spreadsheet or use accounting software to input all the relevant data. This can include invoices issued, payment received, and any outstanding balances.

03

Categorize the accounts receivables based on factors such as customer name, invoice date, due date, and aging brackets (e.g., 30 days, 60 days, 90 days).

04

Regularly update the accounts receivables records to reflect any new invoices, payments received, or adjustments made. This will ensure the information is accurate and up to date.

05

Monitor the aging of accounts receivables to identify any overdue payments. This will help you prioritize follow-ups and take appropriate actions to secure outstanding payments.

06

Implement an effective collection process to manage overdue accounts. This may involve sending reminder emails or letters, making phone calls, or even involving a debt collection agency if necessary.

07

Keep detailed records of all communication regarding accounts receivables, including email correspondence, phone call notes, and payment agreements. This will help in resolving any disputes or inquiries that may arise in the future.

08

Regularly review the accounts receivables report to analyze trends, identify areas for improvement, and make informed decisions regarding credit limits, payment terms, or customer relationships.

Who needs accounts receivables management?

01

Small businesses: Accounts receivables management is crucial for small businesses as they heavily rely on consistent cash flow. It helps them track and collect payments in a timely manner, ensuring the business's financial stability.

02

Medium to large enterprises: These businesses often have a high volume of invoices and customers, making it essential to have an organized system for managing accounts receivables. It enhances efficiency and reduces the risk of payment delays or non-payments.

03

Freelancers and contractors: Individuals offering services or working on projects on a freelance basis can benefit from accounts receivables management to track and collect payments from multiple clients. It helps them maintain a steady cash flow and minimize any potential loss.

Note: The content provided is for informational purposes only and should not be considered as financial or legal advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify accounts receivables management without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including accounts receivables management, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find accounts receivables management?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the accounts receivables management in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in accounts receivables management?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your accounts receivables management to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is accounts receivables management?

Accounts receivables management is the process of overseeing and controlling a company's outstanding invoices, ensuring that payments are received on time.

Who is required to file accounts receivables management?

Any business that extends credit to customers and has outstanding invoices is required to manage their accounts receivables.

How to fill out accounts receivables management?

Accounts receivables management is typically filled out by recording all outstanding invoices, monitoring payment schedules, and following up with customers for timely payments.

What is the purpose of accounts receivables management?

The purpose of accounts receivables management is to optimize cash flow, reduce bad debt losses, and improve the overall financial health of a company.

What information must be reported on accounts receivables management?

Accounts receivables management typically includes information such as customer name, invoice number, invoice amount, due date, and payment status.

Fill out your accounts receivables management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Receivables Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.