FL DBPR CPA 7 2015 free printable template

Show details

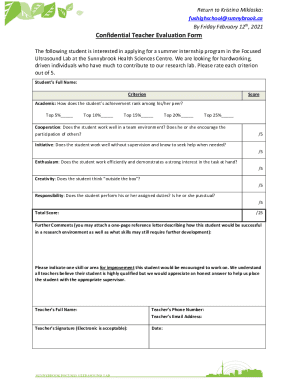

1 of 7 State of Florida Department of Business and Professional Regulation Board of Accountancy CPA Change of Status Application Form # BPR CPA 7 APPLICATION CHECKLIST IMPORTANT Submit all items on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DBPR CPA 7

Edit your FL DBPR CPA 7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DBPR CPA 7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DBPR CPA 7 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL DBPR CPA 7. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DBPR CPA 7 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DBPR CPA 7

How to fill out FL DBPR CPA 7

01

Begin by downloading the FL DBPR CPA 7 form from the Florida Department of Business and Professional Regulation website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Specify the type of application you are submitting, such as original, renewal, or inactive status.

04

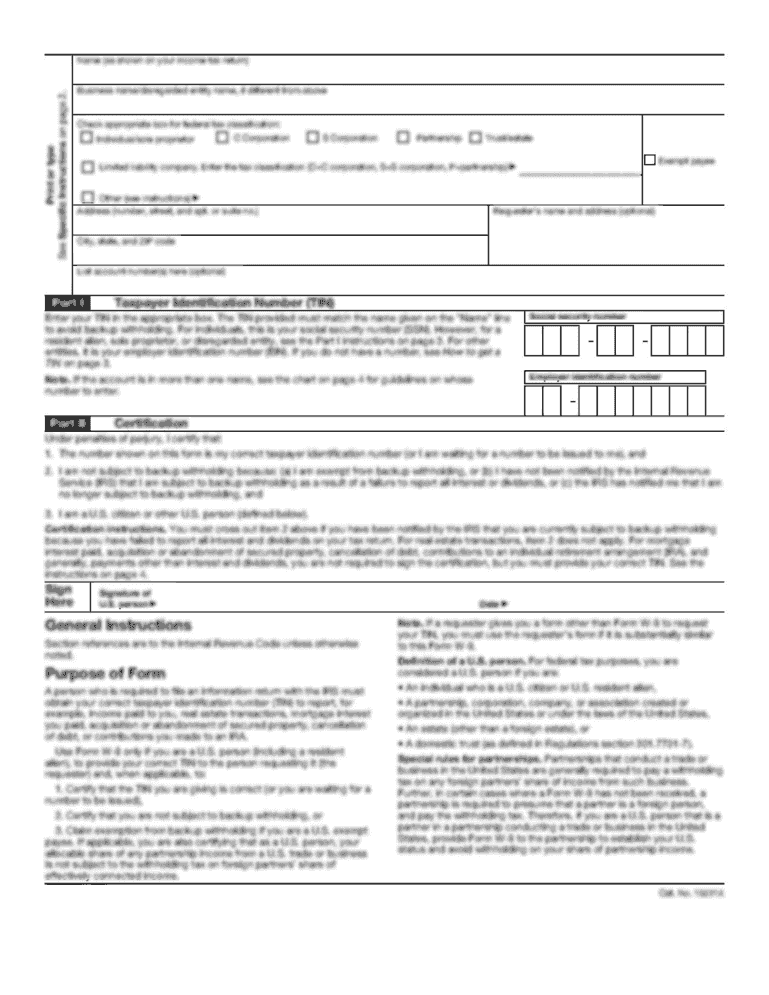

Provide your Social Security number and the necessary identifiers as required in the application.

05

Answer all questions honestly and thoroughly, including any criminal history and disciplinary actions.

06

Include any required documentation, such as proof of education or exams taken.

07

Review the application for accuracy and completeness to ensure all sections are filled out correctly.

08

Sign and date the application at the designated section.

09

Submit the completed form along with the application fee to the appropriate address indicated on the form.

Who needs FL DBPR CPA 7?

01

Individuals seeking to obtain or renew a CPA license in Florida.

02

Certified public accountants who want to change their license status.

03

Those who have completed their education and examination requirements and wish to practice in Florida.

Fill

form

: Try Risk Free

People Also Ask about

What is the CPE hours requirements?

1. Members Holding a Certificate of Practice (COP), Under 60 Years of Age and Residing in India. ICAI members in this category are required to complete at least 40 CPE credit hours in each calendar year, which should include a minimum of 20 CPE credit hours of structured learning during the calendar year.

How to become a CPA without an accounting degree Florida?

In order to be eligible to sit for the CPA Exam in Florida, you must complete 120 semester credit hours. No Bachelor's degree is required to sit for the exam. These semester-hour requirements include the 120 semester or 180 quarter hours.

Does Florida have reciprocity for CPAs?

I have a Certified Public Accountant (CPA) license in another state. Can I obtain a license in Florida through reciprocity? No, Florida does not have reciprocity. However, if you hold an active license in another state, you may apply for Licensure by Endorsement.

What are the CPE requirements for a CPA license in Florida?

What are the FL CPE Requirements? Florida CPAs must complete at least 80 hours of CPE every 2 years including at least 4 hours in Florida-Specific Ethics and at least 8 hours in Accounting or Auditing. FL CPAs are limited to a maximum of 20 Behavioral subject hours.

How do I transfer my CPA credits to Florida?

Florida CPA license reciprocity can be obtained if you have a current CPA license in another state. This is done through an application and the completion of interstate exchange information forms. You must verify work experience and send in a $300 fee.

Does Florida have reciprocity for Cpas?

I have a Certified Public Accountant (CPA) license in another state. Can I obtain a license in Florida through reciprocity? No, Florida does not have reciprocity. However, if you hold an active license in another state, you may apply for Licensure by Endorsement.

What are the categories for CPE in Florida?

There are four categories into which all acceptable subject matter for CPE credit is classified: 1) Accounting and Auditing, 2) Technical Business, 3) Behavioral and 4) Ethics.

How do I transfer my CPA license to Florida?

Transfer CPA license to Florida Meet all education requirements, including a bachelor's degree. Pass the Florida Law and Rules examination. Complete 80 CPE hours if you passed the CPA Exam two or more years ago. Plus, you need 5+ years of experience in public or governmental accounting after you received your license.

What is the minimum number of hours in continuing professional education programs required by Florida Certified public Accountants?

What are the FL CPE Requirements? Florida CPAs must complete at least 80 hours of CPE every 2 years including at least 4 hours in Florida-Specific Ethics and at least 8 hours in Accounting or Auditing. FL CPAs are limited to a maximum of 20 Behavioral subject hours.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete FL DBPR CPA 7 online?

Completing and signing FL DBPR CPA 7 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out FL DBPR CPA 7 using my mobile device?

Use the pdfFiller mobile app to fill out and sign FL DBPR CPA 7. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out FL DBPR CPA 7 on an Android device?

Use the pdfFiller app for Android to finish your FL DBPR CPA 7. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is FL DBPR CPA 7?

FL DBPR CPA 7 is a form used in Florida for the reporting of certain financial information by certified public accountants (CPAs) in relation to public accounting practice.

Who is required to file FL DBPR CPA 7?

Certified public accountants who are licensed to practice in Florida and are involved in public accounting are required to file FL DBPR CPA 7.

How to fill out FL DBPR CPA 7?

To fill out FL DBPR CPA 7, individuals must provide specific financial information related to their public accounting business, following the instructions provided on the form.

What is the purpose of FL DBPR CPA 7?

The purpose of FL DBPR CPA 7 is to ensure compliance with state regulations and to maintain transparency in the financial operations of public accounting firms.

What information must be reported on FL DBPR CPA 7?

The information that must be reported on FL DBPR CPA 7 includes details about income, expenses, and other financial metrics pertinent to the CPA's public accounting practice.

Fill out your FL DBPR CPA 7 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DBPR CPA 7 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.