Get the free Fiscal Years 2017 - 2021 Capital Improvements Plan - Jacksonville

Show details

City of Jacksonville Adopted Capital Improvement Plan Fiscal Year 20172021 Jack Annette Splash pad CITY OF JACKSONVILLE CAPITAL IMPROVEMENT PLAN FY20172021 TABLE OF CONTENTS Introduction: Capital

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal years 2017

Edit your fiscal years 2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal years 2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal years 2017 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fiscal years 2017. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal years 2017

How to fill out fiscal years 2017?

01

Gather all relevant financial documents and records from the year 2017. This includes income statements, balance sheets, expenses reports, receipts, and any other financial information.

02

Review and analyze the financial data to ensure accuracy and completeness. This step involves verifying that all transactions have been accounted for correctly, checking for any discrepancies or errors, and reconciling any discrepancies found.

03

Prepare the necessary forms and schedules for fiscal year 2017. This may include completing tax forms, such as Form 1040 for individuals or Form 1120 for businesses, as well as any additional schedules or attachments required by the tax authorities. Ensure that all information provided is accurate and up-to-date.

04

Calculate and report the income, expenses, deductions, and credits for fiscal year 2017. This involves accurately determining and recording the taxable income, deducting eligible expenses, and applying any applicable tax credits to reduce the overall tax liability.

05

Submit the completed fiscal year 2017 documentation to the relevant authorities. This may include filing the tax returns electronically or by mail, depending on the requirements of the tax authorities and the jurisdiction in which you are filing.

Who needs fiscal years 2017?

01

Individuals who are required to file income tax returns for the year 2017 need to have fiscal years 2017. This includes salaried employees, self-employed individuals, and those with other sources of income, such as rental property or investments.

02

Businesses of all types and sizes also need fiscal years 2017. This includes sole proprietors, partnerships, limited liability companies (LLCs), and corporations. Properly documenting and reporting the financial activities for the fiscal year 2017 is essential for tax compliance and business planning purposes.

03

Organizations and non-profit entities that are required to report their financial activities to regulatory bodies or stakeholders also need fiscal years 2017. This includes charities, foundations, government agencies, and educational institutions, among others.

In summary, anyone who had financial activities during the year 2017, whether as an individual, business, or organization, needs to fill out and properly document their fiscal years 2017 for tax and reporting purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

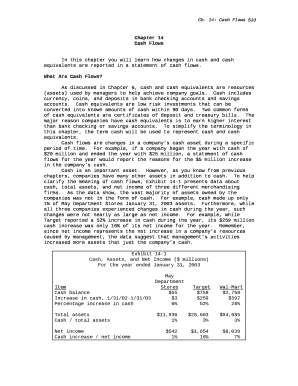

What is fiscal years - capital?

Fiscal years - capital refer to the financial period during which a company's capital expenditures are calculated and reported.

Who is required to file fiscal years - capital?

All companies that engage in capital expenditures are required to file fiscal years - capital.

How to fill out fiscal years - capital?

To fill out fiscal years - capital, companies need to accurately report all capital expenditures made during the fiscal year.

What is the purpose of fiscal years - capital?

The purpose of fiscal years - capital is to track and analyze the company's investment in capital assets and determine the impact on financial performance.

What information must be reported on fiscal years - capital?

Companies must report all capital expenditures, depreciation, and any changes in capital assets during the fiscal year.

How can I send fiscal years 2017 for eSignature?

Once your fiscal years 2017 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for signing my fiscal years 2017 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your fiscal years 2017 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out fiscal years 2017 using my mobile device?

Use the pdfFiller mobile app to fill out and sign fiscal years 2017 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your fiscal years 2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Years 2017 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.