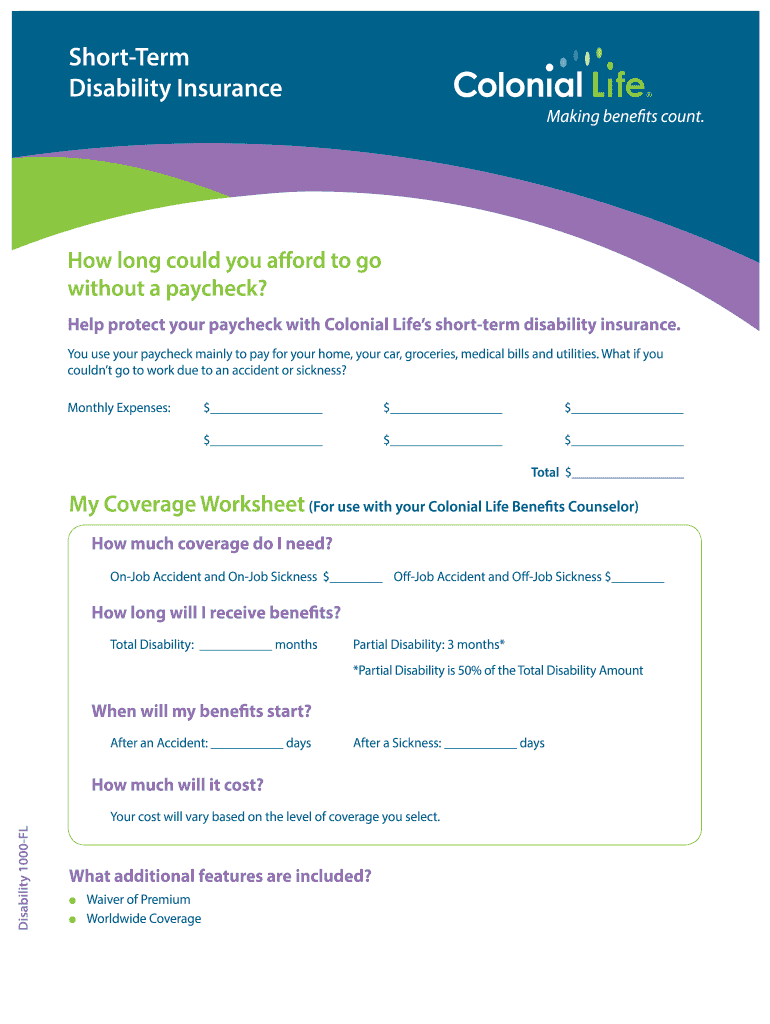

Get the free ShortTerm Disability Insurance How long could you afford to go without a paycheck - ...

Show details

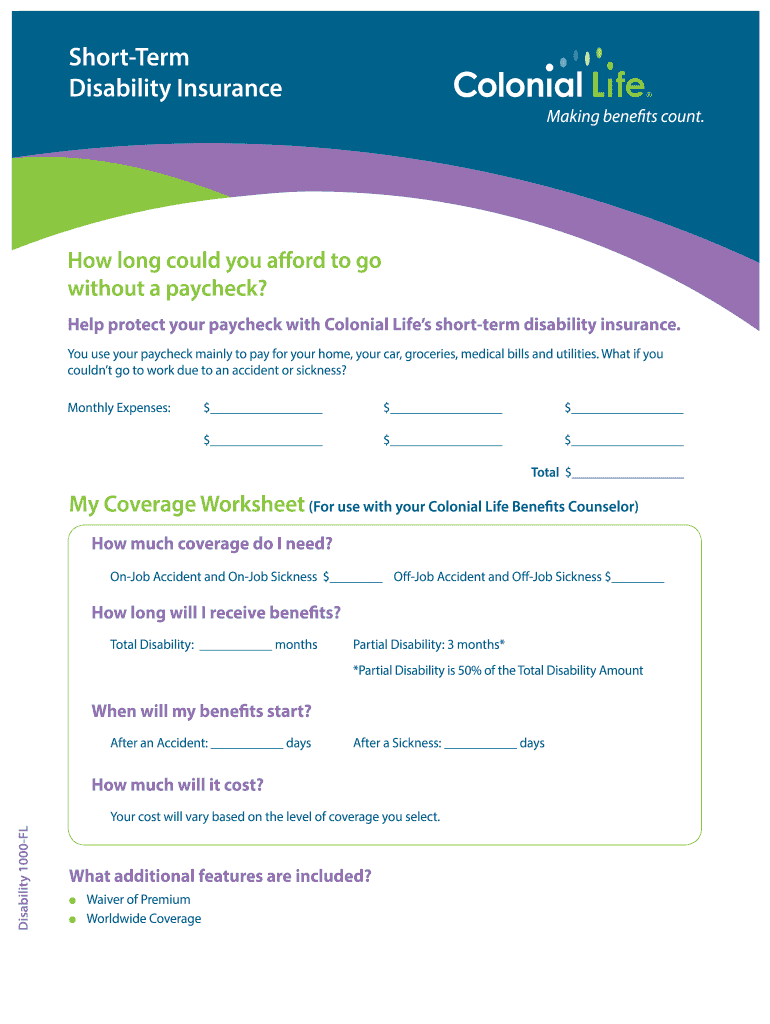

Help protect your paycheck with Colonial Life#39’s short-term disability insurance. You use your paycheck mainly to pay for ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign shortterm disability insurance how

Edit your shortterm disability insurance how form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your shortterm disability insurance how form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing shortterm disability insurance how online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit shortterm disability insurance how. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out shortterm disability insurance how

How to fill out short-term disability insurance and who needs it:

01

Start by gathering the necessary information: You will need your personal details such as name, address, date of birth, and social security number. Additionally, have your employment information, including your employer's contact information and your job title.

02

Determine the duration and coverage amount: Short-term disability insurance typically covers a portion of your income for a specified period, usually up to six months. Calculate the amount of coverage you require based on your monthly expenses and financial obligations during this period.

03

Understand the eligibility criteria: Each insurance provider may have specific eligibility requirements. Ensure that you meet the necessary conditions, which could include being employed for a certain period, working a minimum number of hours, or being enrolled in your employer's benefits program.

04

Obtain the necessary forms: Contact your insurance provider or human resources department to request the appropriate forms for filing a short-term disability insurance claim. These forms may include an application, medical release form, and employer verification form.

05

Complete the application form: Fill out the application form accurately and thoroughly. Provide all the required personal information, employment details, and medical history. Be sure to read the instructions carefully and include any supporting documentation requested, such as medical records or test results.

06

Seek medical certification: As part of the short-term disability insurance process, you will likely need your healthcare provider to complete a medical certification form. This form verifies your medical condition and provides details on how it prevents you from performing your job duties.

07

Submit the completed forms: Once you have completed all the necessary forms and gathered any required documentation, submit them according to the instructions provided by your insurance provider or employer. Be sure to keep copies of all documents for your records.

Who needs short-term disability insurance and why:

01

Individuals reliant on employment income: Short-term disability insurance is particularly vital for individuals who rely on their income to cover living expenses. It provides financial protection if they are unable to work due to a covered illness, injury, or childbirth.

02

Employees without sufficient sick leave: If your employer offers limited or no sick leave, short-term disability insurance can be a crucial safety net. It helps bridge the income gap during the initial days or weeks of your disability.

03

Self-employed individuals: Self-employed individuals do not have the luxury of employer-sponsored disability benefits. Short-term disability insurance offers them protection by replacing a portion of their income when they are unable to work due to a covered event.

Remember, specific coverage and eligibility criteria may vary between insurance providers. It's important to carefully review the terms and conditions of any short-term disability insurance policy before enrolling or making a claim.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute shortterm disability insurance how online?

Filling out and eSigning shortterm disability insurance how is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit shortterm disability insurance how on an iOS device?

Create, edit, and share shortterm disability insurance how from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete shortterm disability insurance how on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your shortterm disability insurance how. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is shortterm disability insurance how?

Short-term disability insurance provides income replacement for employees who are unable to work due to a covered medical condition for a short period of time.

Who is required to file shortterm disability insurance how?

Employers are typically required to offer short-term disability insurance to their employees. Some states may also have specific requirements for employers.

How to fill out shortterm disability insurance how?

Employees can typically fill out short-term disability insurance forms provided by their employer or insurance company. The forms typically require information about the employee's medical condition and expected time off work.

What is the purpose of shortterm disability insurance how?

The purpose of short-term disability insurance is to provide financial support to employees who are unable to work due to a covered medical condition for a short period of time.

What information must be reported on shortterm disability insurance how?

Employees may need to report information about their medical condition, expected time off work, and any other relevant details needed to process the claim.

Fill out your shortterm disability insurance how online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Shortterm Disability Insurance How is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.