Get the free MASTER CREDIT AGREEMENT - ECB

Show details

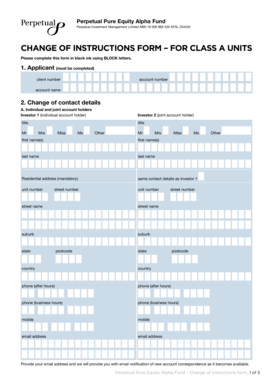

Master credit agreement. Client ID number: date: company information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign master credit agreement

Edit your master credit agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your master credit agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit master credit agreement online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit master credit agreement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out master credit agreement

How to fill out a master credit agreement?

01

Start by carefully reviewing the entire master credit agreement document. Take note of any specific terms, conditions, and obligations mentioned.

02

Make sure to gather all the necessary information and documentation required for the agreement. This may include personal identification, financial statements, and any other relevant paperwork.

03

Begin by filling out the introductory sections of the master credit agreement, which typically include the names and addresses of both parties involved. Double-check for accuracy and spellings.

04

Proceed to the terms and conditions section of the agreement. Carefully read and understand each clause, ensuring that you are comfortable with the obligations and responsibilities outlined. If any terms are unclear, don't hesitate to seek legal advice.

05

Provide the requested information related to the credit terms, such as the credit limit, interest rates, payment frequency, and any associated fees or penalties.

06

Ensure that any collateral or security required for the credit agreement is properly documented. Include details about the assets being used as collateral, their value, and any relevant legal references or registration numbers.

07

If there are any special provisions or specific conditions that need to be included in the agreement, make sure to clearly outline them in the appropriate section. This may include requirements for insurance coverage, guarantees, or limitations on credit usage.

08

Review the agreement thoroughly before signing it. Ensure that all the information provided is accurate and complete. Take note of any areas that may require amendments or additional information.

09

If possible, have a legal professional or financial advisor review the completed agreement before submitting it to the appropriate authority.

Who needs a master credit agreement?

A master credit agreement is typically required by businesses or individuals who are seeking to establish a long-term credit relationship with a financial institution or lender. This agreement sets out the terms and conditions under which credit will be extended, allowing both parties to understand their rights and obligations throughout the credit relationship. Whether it's a company looking for a line of credit or an individual seeking a personal credit facility, a master credit agreement helps provide a clear framework for the credit arrangement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the master credit agreement electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your master credit agreement in seconds.

How do I edit master credit agreement on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign master credit agreement. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out master credit agreement on an Android device?

On an Android device, use the pdfFiller mobile app to finish your master credit agreement. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is master credit agreement?

A master credit agreement is a document that outlines the terms and conditions of a credit arrangement between a lender and a borrower.

Who is required to file master credit agreement?

The lender and borrower are required to file the master credit agreement.

How to fill out master credit agreement?

The master credit agreement can be filled out by including all relevant information about the credit arrangement, such as loan amount, interest rate, repayment terms, and any collateral.

What is the purpose of master credit agreement?

The purpose of a master credit agreement is to establish the terms and conditions of a credit arrangement to protect both the lender and borrower.

What information must be reported on master credit agreement?

The master credit agreement must include details about the loan amount, interest rate, repayment terms, collateral, and any other relevant information about the credit arrangement.

Fill out your master credit agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Master Credit Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.