Get the free Short-term medical insurance

Show details

Secure STM Short-term medical insurance for individuals and families Underwritten by Standard Security Life Insurance Company of New York, a member of The IOC Group. For more information about Standard

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short-term medical insurance

Edit your short-term medical insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short-term medical insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

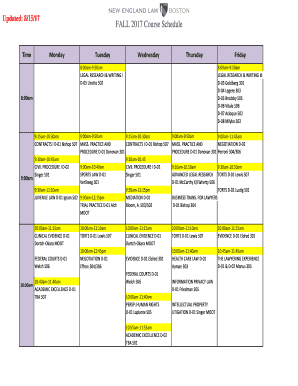

Editing short-term medical insurance online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit short-term medical insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short-term medical insurance

How to fill out short-term medical insurance:

01

Start by gathering all the necessary information and documentation. This usually includes personal details such as name, address, date of birth, and social security number. Also, have your employment information and any existing medical conditions on hand.

02

Research different insurance providers and plans available in your area. Compare their coverage, benefits, and pricing options to find the best fit for your needs. Make sure to check if your preferred healthcare providers are included in the network.

03

Once you have selected an insurance plan, visit the website or contact the insurance provider's customer service to initiate the application process. They may provide an online form or send you the necessary paperwork via mail or email.

04

Fill out the application form accurately and completely. Double-check all the information provided to avoid any errors or omissions. Depending on the insurance provider, the application form may require details about your medical history and previous insurance coverage.

05

Attach any supporting documents required by the insurance provider, such as proof of identification, proof of residency, or any medical records if requested. Make sure to make copies of these documents for your records.

06

Review the terms and conditions of the insurance policy before signing any agreements. Pay close attention to the coverage details, deductibles, co-pays, and any exclusions or limitations. If you have any doubts or questions, reach out to the insurance provider for clarification.

07

Submit the completed application form along with the necessary documents to the insurance provider. Follow their instructions on how to submit the application, whether it's through mail, email, or an online portal. Be sure to meet any deadlines mentioned.

08

After submitting the application, wait for a response from the insurance provider. They will review your application and may require additional information or clarification. Stay in touch with the insurance company to ensure a smooth application process.

Who needs short-term medical insurance?

01

Individuals between jobs: If you recently lost your job or are transitioning between jobs, short-term medical insurance can provide temporary coverage until you secure permanent health insurance.

02

Graduating students: Many college graduates lose their student health insurance plans. Short-term medical insurance can act as a bridge until they find job-based coverage or other long-term options.

03

Early retirees: If you retire before becoming eligible for Medicare, short-term medical insurance can help cover your medical expenses until you reach the eligible age.

04

Individuals waiting for open enrollment: If you missed the open enrollment period for major medical insurance, short-term medical insurance can provide you with some coverage until the next open enrollment period.

05

International travelers: Short-term medical insurance can be useful for individuals traveling abroad who want coverage for unexpected medical emergencies or illnesses that may occur during their trip.

Remember, it's important to evaluate your specific needs and circumstances to determine if short-term medical insurance is the right choice for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is short-term medical insurance?

Short-term medical insurance provides coverage for a limited period of time, typically for up to 12 months.

Who is required to file short-term medical insurance?

Individuals who are in need of temporary health coverage or are transitioning between health insurance plans may opt for short-term medical insurance.

How to fill out short-term medical insurance?

To fill out short-term medical insurance, individuals must provide personal information, medical history, and select coverage options.

What is the purpose of short-term medical insurance?

The purpose of short-term medical insurance is to provide temporary coverage for medical expenses during gaps in traditional health insurance coverage.

What information must be reported on short-term medical insurance?

Information such as personal details, medical history, coverage options, and payment information must be reported on short-term medical insurance applications.

How can I modify short-term medical insurance without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like short-term medical insurance, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit short-term medical insurance straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit short-term medical insurance.

How do I complete short-term medical insurance on an Android device?

Complete short-term medical insurance and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your short-term medical insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short-Term Medical Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.