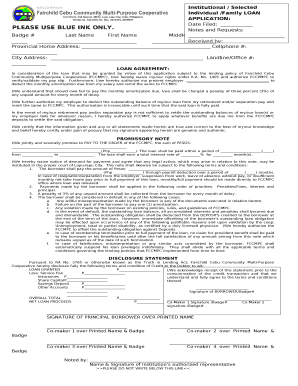

Get the free Life Insurance Quote

Show details

Term Life Insurance Quote. Fill out the following form as completely as possible. Once you have completed the form, click the Submit button to send your...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance quote

Edit your life insurance quote form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance quote form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance quote online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit life insurance quote. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance quote

How to fill out a life insurance quote:

01

Start by gathering necessary information - Before filling out a life insurance quote, gather important information such as your personal details, including age, gender, and contact information, as well as the details of potential beneficiaries.

02

Determine the coverage amount - Decide on the amount of coverage you need based on your financial responsibilities and goals. Consider factors such as mortgage payments, debts, childcare expenses, and future financial support for your family.

03

Choose the type of life insurance - There are various types of life insurance policies, including term life insurance and permanent life insurance. Consider your needs and budget to determine which type suits you best.

04

Select additional riders - Depending on your requirements, consider adding riders to your life insurance policy. Riders provide additional coverage for specific situations such as critical illness or disability.

05

Provide health and lifestyle information - Life insurance quotes often require you to disclose your health and lifestyle details. This typically includes information on your medical history, current health status, tobacco or alcohol use, and participation in risky activities.

06

Compare quotes - Once you've filled out the necessary information, it's time to compare life insurance quotes from different insurance providers. Compare the coverage, premiums, and any additional benefits or riders offered by each company.

07

Consult an insurance professional - If you're unsure about any aspect of the life insurance quote or need guidance in making a decision, consider consulting an insurance professional. They can help clarify any doubts and provide expert advice based on your specific needs.

Who needs a life insurance quote:

01

Individuals with dependents - If you have dependents who rely on your financial support, such as a spouse or children, getting a life insurance quote is essential. It ensures that your loved ones are financially protected in the event of your untimely demise.

02

Family breadwinners - If you are the primary earner in your family, a life insurance quote is crucial. It provides a financial safety net to replace lost income and cover ongoing expenses, enabling your family to maintain their standard of living.

03

Business owners - Business owners may need a life insurance quote to protect their businesses and ensure their continuity in the event of their passing. This can help cover business debts, employee salaries, and smooth succession planning.

04

Individuals with financial obligations - If you have significant financial obligations, such as a mortgage, loans, or debts, a life insurance quote can help cover these obligations and prevent them from burdening your loved ones.

05

Estate planners - People who want to ensure a smooth transfer of assets and minimize potential estate taxes may also require a life insurance quote. Life insurance proceeds can be used to cover estate taxes and provide liquidity to beneficiaries.

Remember, when considering life insurance, it's important to evaluate your own circumstances, financial goals, and seek advice from professionals to determine the most appropriate coverage for your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get life insurance quote?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific life insurance quote and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I fill out life insurance quote on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your life insurance quote, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete life insurance quote on an Android device?

On Android, use the pdfFiller mobile app to finish your life insurance quote. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is life insurance quote?

A life insurance quote is an estimate of the cost of a life insurance policy based on the information provided by the applicant.

Who is required to file life insurance quote?

Individuals who are looking to purchase a life insurance policy are required to file a life insurance quote.

How to fill out life insurance quote?

To fill out a life insurance quote, applicants must provide personal information such as age, gender, health history, and desired coverage amount.

What is the purpose of life insurance quote?

The purpose of a life insurance quote is to give individuals an idea of how much they would need to pay for a specific life insurance policy.

What information must be reported on life insurance quote?

Information such as age, gender, health history, and desired coverage amount must be reported on a life insurance quote.

Fill out your life insurance quote online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Quote is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.