Get the free INTEREST RATE SWAP

Show details

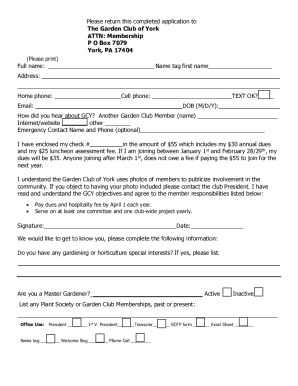

INTEREST RATE SWAP ADDITIONAL INTEREST ENDORSEMENT Issued by Attached to Policy No.: Order No.: 1. The insurance provided by this endorsement is subject to the exclusions in Section 3 of this endorsement,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interest rate swap

Edit your interest rate swap form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interest rate swap form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit interest rate swap online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit interest rate swap. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interest rate swap

How to fill out interest rate swap:

01

Determine the interest rate exposure: Before filling out an interest rate swap, it is important to identify the underlying interest rate exposure that you need to hedge against. This could be a fixed or floating interest rate that you want to exchange with a counterparty.

02

Find a counterparty: Once you know your interest rate exposure, you need to find a suitable counterparty to enter into the swap agreement with. This can be done through financial intermediaries such as banks, brokers, or other financial institutions.

03

Agree on terms and conditions: After selecting a counterparty, both parties need to negotiate and agree on the terms and conditions of the interest rate swap. This includes the notional amount, fixed or floating rate, payment dates, payment frequency, maturity, and any other specific details related to the swap.

04

Execute the swap agreement: Once the terms are agreed upon, the swap agreement needs to be executed. This involves signing legal documentation, such as an ISDA Master Agreement, which outlines the rights, obligations, and responsibilities of both parties involved.

05

Monitor and manage the swap: After the interest rate swap is in effect, it is crucial to monitor and manage the swap on an ongoing basis. This includes tracking interest rate movements, calculating and exchanging periodic payments, and ensuring compliance with the terms of the agreement.

Who needs interest rate swap:

01

Corporations: Companies with exposure to interest rate fluctuations may use interest rate swaps to manage their interest rate risk. For example, a company with a floating-rate loan might enter into a swap to convert it to a fixed rate if they anticipate interest rates rising in the future.

02

Financial institutions: Banks and other financial institutions use interest rate swaps to manage their interest rate risk and optimize their balance sheets. They can use swaps to match their assets and liabilities, hedge against interest rate volatility, or speculate on interest rate movements.

03

Investors: Institutional investors and fund managers may use interest rate swaps as a trading or hedging strategy to generate returns or protect against adverse interest rate movements. They can enter into swaps to speculate on interest rate spreads or to hedge against potential losses in their portfolios.

04

Governments and central banks: Governments and central banks can utilize interest rate swaps to manage their debt portfolios, stabilize interest rates, or implement monetary policies. They may also use swaps to influence or control the yield curve and support their respective economies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get interest rate swap?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the interest rate swap. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in interest rate swap without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit interest rate swap and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the interest rate swap electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your interest rate swap in minutes.

What is interest rate swap?

Interest rate swap is a financial derivative contract in which two parties agree to exchange interest rate cash flows, based on a specified notional amount, over a set period of time.

Who is required to file interest rate swap?

Entities that engage in interest rate swap transactions, such as financial institutions, corporations, and investment funds, are required to file interest rate swap.

How to fill out interest rate swap?

To fill out an interest rate swap, parties must agree on the terms of the swap, including the notional amount, fixed interest rate, floating interest rate, and payment frequency.

What is the purpose of interest rate swap?

The purpose of interest rate swap is to manage interest rate risk, hedge against fluctuations in interest rates, and reduce borrowing costs.

What information must be reported on interest rate swap?

Information reported on interest rate swap includes the names of the parties, notional amount, interest rates, payment dates, and any other relevant terms of the swap.

Fill out your interest rate swap online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interest Rate Swap is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.