Get the free INSURANCE SECONDARY

Show details

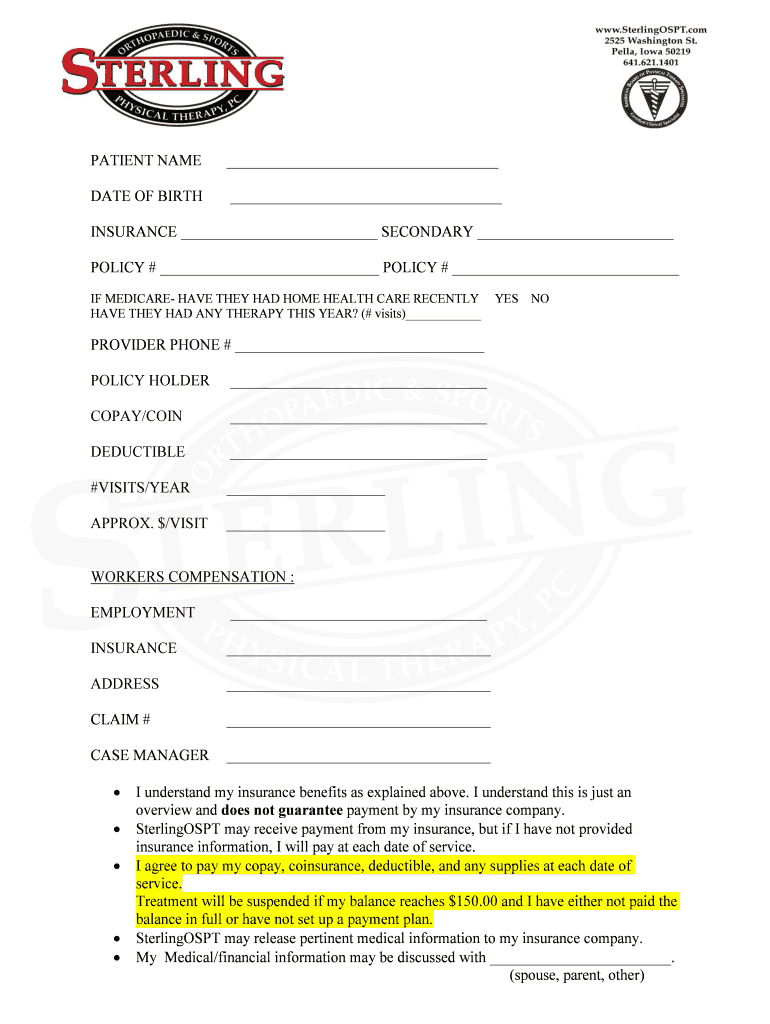

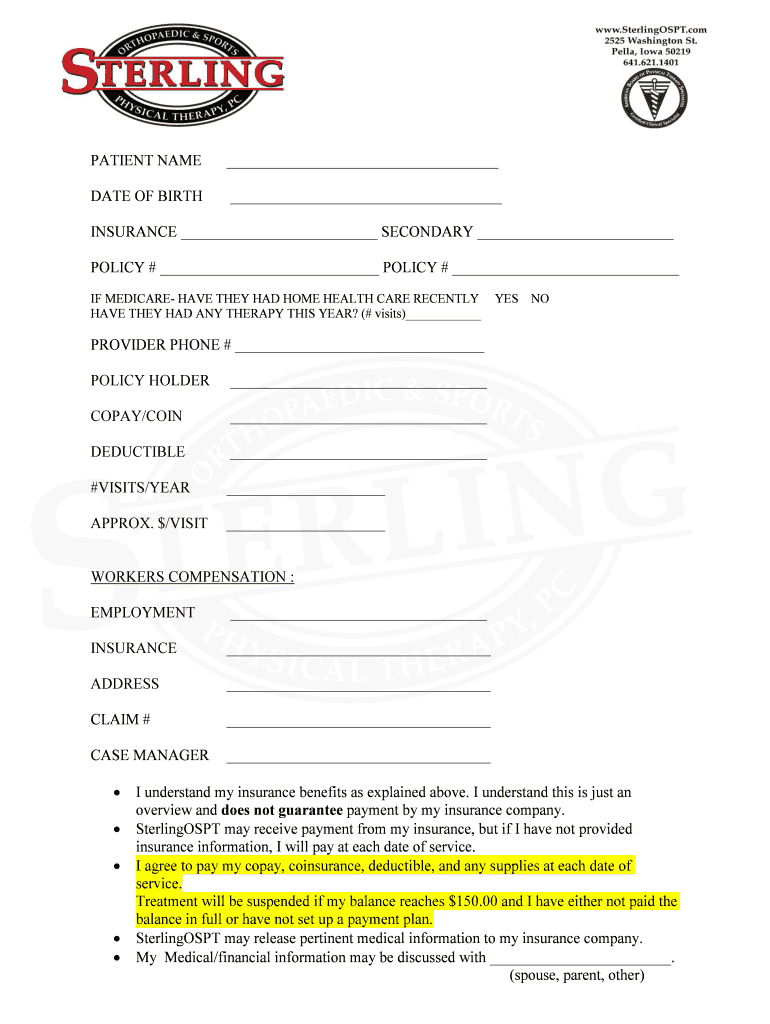

PATIENT NAME DATE OF BIRTH INSURANCE SECONDARY POLICY # POLICY # IF MEDICARE HAVE THEY HAD HOME HEALTH CARE RECENTLY HAVE THEY HAD ANY THERAPY THIS YEAR? (# visits) YES NO PROVIDER PHONE # policyholder

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance secondary

Edit your insurance secondary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance secondary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance secondary online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit insurance secondary. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance secondary

How to fill out insurance secondary?

01

Gather necessary information: Before filling out the insurance secondary, make sure you have all the required information on hand. This includes the primary insurance policy details, such as the policy number, coverage limits, and any deductible or copayment information.

02

Contact the primary insurance provider: Reach out to your primary insurance provider and notify them that you will be submitting a claim for reimbursement through your secondary insurance. They may provide you with specific instructions or additional documentation requirements.

03

Obtain a claim form: Request a claim form from your secondary insurance provider. This can typically be done by calling their customer service department or downloading the form from their website. Make sure to use the most up-to-date version of the form.

04

Fill out the claim form: Complete the claim form accurately and thoroughly. Provide all the necessary information, including your personal details, primary insurance information, and details of the services or treatments for which you are seeking reimbursement.

05

Attach supporting documents: Gather any supporting documentation that may be required by your secondary insurance provider. This may include itemized bills, receipts, medical reports, or any other relevant documents that verify the services rendered and their associated costs.

06

Submit the claim: Send the completed claim form and supporting documents to your secondary insurance provider using the preferred method of submission. This could be via mail, fax, or online through their secure portal. Make sure to keep copies of everything for your records.

07

Follow up on the claim: After submitting the claim, keep track of its progress. You can contact the secondary insurance provider to inquire about the status or any additional information they may need.

Who needs insurance secondary?

01

Individuals with multiple insurance policies: Insurance secondary is typically needed by individuals who have more than one insurance policy. This could be due to having coverage through their employer as well as through their spouse's employer or through government assistance programs.

02

Those seeking additional coverage: Insurance secondary is useful for individuals looking to maximize their insurance benefits. By having secondary coverage, they can potentially receive additional reimbursement for services that may not be fully covered by their primary insurance policy.

03

Individuals with high deductible plans: People with high deductible insurance plans might opt for secondary insurance to help cover the costs until their primary deductible is met. This can help reduce their out-of-pocket expenses for medical treatments or services.

In summary, filling out insurance secondary requires gathering necessary information, contacting the primary insurance provider, obtaining and completing a claim form, attaching supporting documents, and submitting the claim. Insurance secondary is beneficial for individuals with multiple policies, those seeking additional coverage, and those with high deductible plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my insurance secondary in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign insurance secondary and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out insurance secondary using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign insurance secondary. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit insurance secondary on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign insurance secondary. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is insurance secondary?

Insurance secondary refers to a type of insurance coverage that kicks in after the primary insurance has reached its limits.

Who is required to file insurance secondary?

The policyholder or the insured party is usually required to file insurance secondary.

How to fill out insurance secondary?

To fill out insurance secondary, you will need to provide information about the primary insurance policy and the details of the claim.

What is the purpose of insurance secondary?

The purpose of insurance secondary is to provide additional coverage beyond the limits of the primary insurance policy.

What information must be reported on insurance secondary?

You must report details of the claim, the primary insurance policy information, and any additional coverage options.

Fill out your insurance secondary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Secondary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.