Get the free Long Term Disability - Insurance Specialists, Inc.

Show details

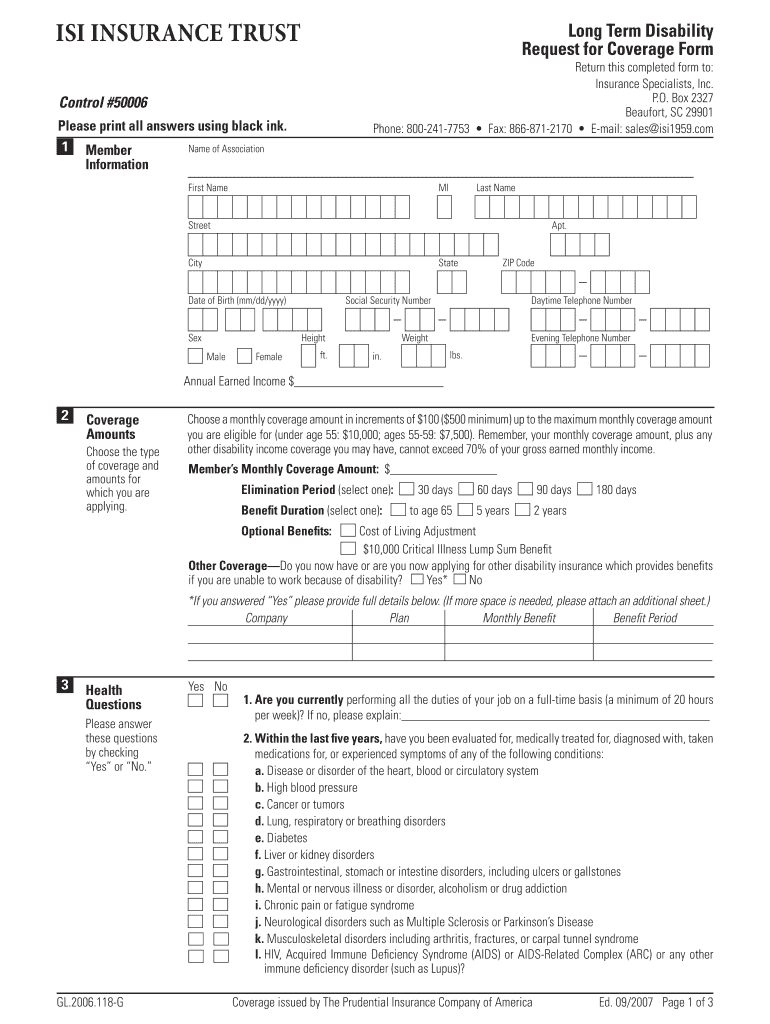

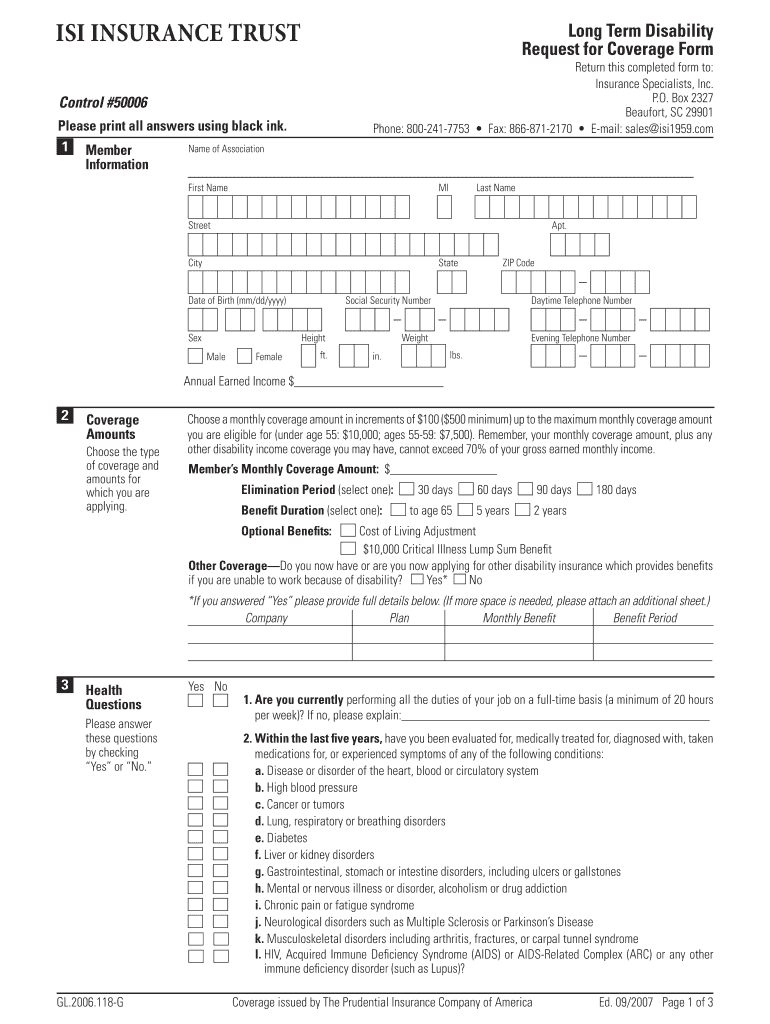

ISI INSURANCE TRUST Long Term Disability Request for Coverage Form Return this completed form to: Insurance Specialists, Inc. P.O. Box 2327 Beaufort, SC 29901 Phone: 800-241-7753 Fax: 866-871-2170

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term disability

Edit your long term disability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term disability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long term disability online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit long term disability. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long term disability

How to fill out long term disability:

01

Gather necessary documents: Start by collecting all relevant documents for your long term disability claim. This may include medical records, employment information, and any other supporting documents.

02

Understand the eligibility criteria: Familiarize yourself with the requirements for long term disability coverage. This could include having a qualifying medical condition or meeting specific employment criteria.

03

Complete the application form: Fill out the long term disability application form carefully and accurately. Provide all requested information, such as personal details, employment history, and medical information.

04

Include supporting documents: Attach all necessary supporting documents to your application. These may include medical records, doctor's notes, and any other evidence that strengthens your case.

05

Provide clear and concise explanations: When answering questions on the application form, be sure to provide clear and detailed explanations. This will help the insurance company better understand your situation and evaluate your claim.

06

Seek professional assistance if needed: If you are unsure or overwhelmed by the process, consider seeking guidance from a long term disability lawyer or a disability advocate. They can provide expert advice and assistance in filling out the application correctly.

Who needs long term disability:

01

Individuals with physically demanding jobs: People with physically demanding jobs, such as construction workers or athletes, may need long term disability coverage to protect themselves in case of injuries that could prevent them from working.

02

Individuals with chronic medical conditions: Those with chronic illnesses or medical conditions that could potentially cause long-term disability may benefit from having long term disability insurance. This could ensure financial stability and support during their recovery period.

03

Self-employed individuals: Unlike traditional employees, self-employed individuals may not have access to employer-sponsored disability insurance. Therefore, it is essential for self-employed individuals to consider long term disability insurance to protect their income in case they are unable to work.

04

Breadwinners or primary earners: If you are the main source of income for your household, it is crucial to have long term disability coverage. In the event of a disability that prevents you from working, this insurance can provide financial support to meet your family's needs.

05

Individuals without sufficient savings: If you do not have significant savings to rely on during a period of disability, long term disability insurance can offer you a safety net. It can help cover your living expenses, medical bills, and other financial obligations while you are unable to work.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in long term disability?

The editing procedure is simple with pdfFiller. Open your long term disability in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the long term disability in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your long term disability and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the long term disability form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign long term disability and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is long term disability?

Long term disability refers to a type of insurance that provides income replacement for individuals who are unable to work due to a qualifying disability for an extended period of time.

Who is required to file long term disability?

Individuals who have this type of insurance coverage through their employer or have purchased it privately may be required to file for long term disability benefits if they are unable to work due to a qualifying disability.

How to fill out long term disability?

To file for long term disability, individuals typically need to complete claim forms provided by their insurance provider and submit supporting medical documentation detailing their disability and inability to work.

What is the purpose of long term disability?

The purpose of long term disability insurance is to provide financial support to individuals who are unable to work due to a disabling condition for an extended period of time.

What information must be reported on long term disability?

Individuals filing for long term disability typically need to report details about their medical condition, treatment received, inability to work, and other relevant information requested by their insurance provider.

Fill out your long term disability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Disability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.