Get the free Money market account

Show details

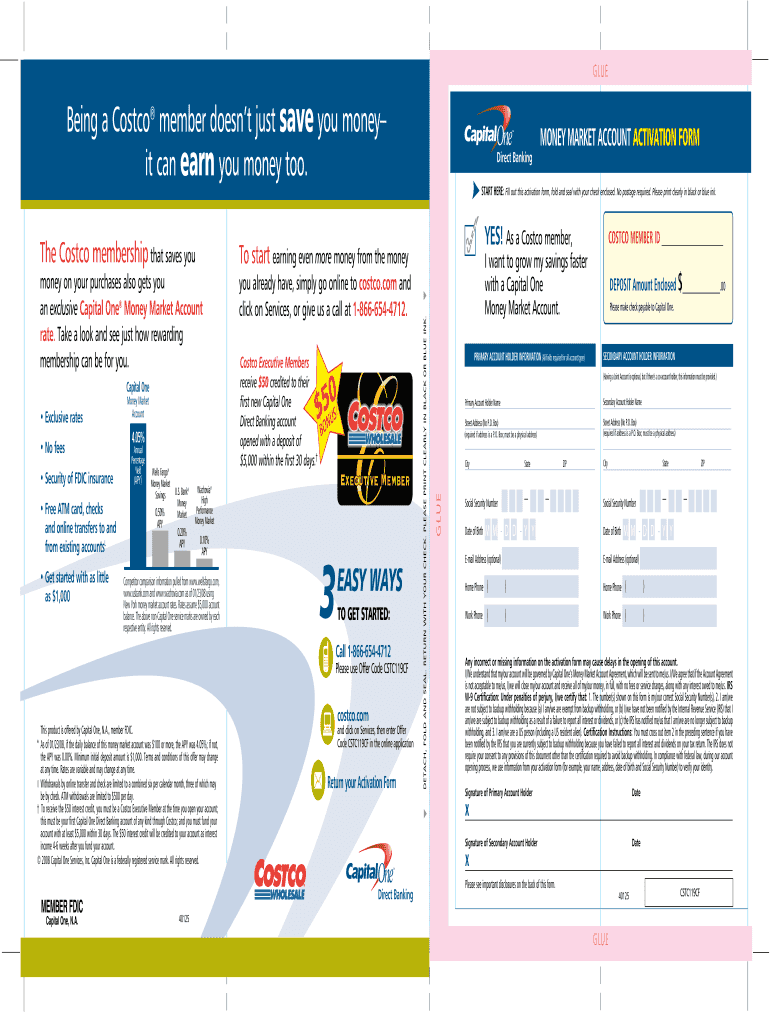

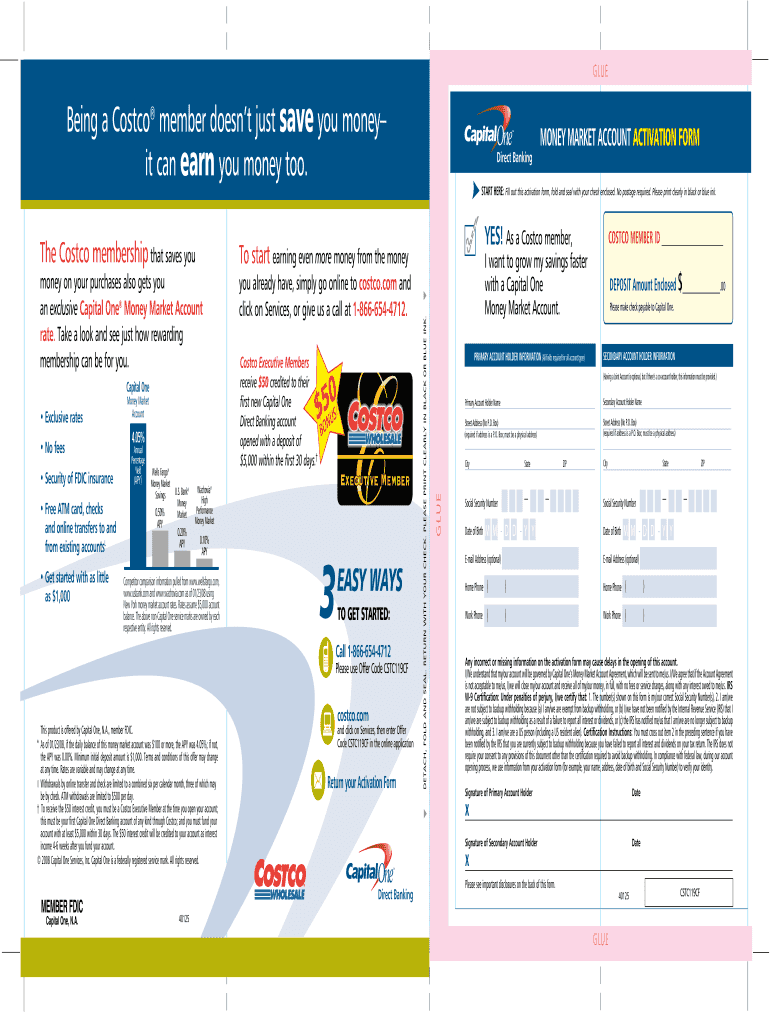

GLUE Being a Costco member doesn't just save you money it can earn you money too. Exclusive rates No fees Security of FDIC insurance Free ATM card, checks and online transfers to and from existing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money market account

Edit your money market account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money market account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit money market account online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit money market account. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money market account

How to fill out a money market account:

01

Research and choose a reputable bank or financial institution that offers money market accounts. Look for competitive interest rates and favorable account terms.

02

Gather the necessary documents and information required to open a money market account. This typically includes a valid identification, social security number, proof of address, and sometimes an initial deposit.

03

Visit the selected bank or financial institution in person or explore their online banking options to open the money market account. If applying online, fill out the necessary forms accurately and provide the requested information.

04

Read and understand the terms and conditions of the money market account, including any fees, withdrawal limits, and minimum balance requirements. It's important to be aware of the restrictions and benefits associated with the account.

05

If required, make an initial deposit into the money market account. Some institutions may allow you to fund the account with a check, transfer funds from another account, or deposit cash.

06

Select any additional features or services that may be offered with the money market account, such as mobile banking, overdraft protection, or direct deposit. These can enhance your account management and convenience.

07

Monitor and manage your money market account regularly. Keep track of your account balance, review statements, and take advantage of any benefits like high-interest rates or promotional offers.

08

Consider setting up automatic transfers or contributions to maximize your savings and investment potential within the money market account.

09

Stay informed about changes in interest rates or account policies. Regularly review the terms and conditions to ensure that the money market account continues to be a suitable choice for your financial goals.

Who needs a money market account?

01

Individuals who desire a more secure and predictable return on their savings compared to traditional savings accounts may benefit from a money market account.

02

Those looking for a low-risk investment option with relatively easy access to their funds may find a money market account suitable.

03

Savers who anticipate needing their funds in the near future but still want to earn a competitive interest rate can consider a money market account.

04

Individuals looking for a financial product that offers a higher yield than a regular savings account, along with some flexibility and convenience, may find a money market account appealing.

05

Investors who value the stability of their principal investment and seek a short-term parking place for their funds may choose a money market account as part of their overall financial strategy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the money market account electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your money market account.

Can I edit money market account on an iOS device?

Create, modify, and share money market account using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete money market account on an Android device?

Use the pdfFiller mobile app to complete your money market account on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is money market account?

A money market account is a type of savings account that typically offers higher interest rates than a regular savings account.

Who is required to file money market account?

Individuals who have a money market account with a financial institution are required to file it.

How to fill out money market account?

To fill out a money market account, you will need to provide information about the account holder, the financial institution, and the account balance.

What is the purpose of money market account?

The purpose of a money market account is to provide a safe and secure place to save money while earning a higher interest rate.

What information must be reported on money market account?

Information such as account holder's name, account number, financial institution's name, and account balance must be reported on a money market account.

Fill out your money market account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Market Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.