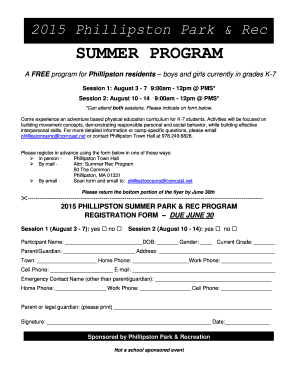

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Get the free Non-Foreign Affidavit

Show details

This affidavit is required to certify that the seller is not a 'foreign person' in accordance with Section 1445 of the Internal Revenue Code, and is used to avoid withholding requirements during property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-foreign affidavit

Edit your non-foreign affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-foreign affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-foreign affidavit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-foreign affidavit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-foreign affidavit

How to fill out Non-Foreign Affidavit

01

Obtain the Non-Foreign Affidavit form from a reliable source or your legal advisor.

02

Fill in your full legal name at the top of the affidavit.

03

Provide your current address, ensuring it is accurate and complete.

04

Indicate your tax identification number (such as a Social Security Number or Employer Identification Number).

05

Answer questions regarding your residency status and ownership of the property involved.

06

Sign and date the affidavit in front of a notary public to validate the document.

07

Submit the completed affidavit to the appropriate party, such as a lender or title company, as required.

Who needs Non-Foreign Affidavit?

01

Individuals or entities selling real estate in the U.S. who are not foreign persons.

02

Buyers or lenders involved in real estate transactions requiring verification of seller's non-foreign status.

Fill

form

: Try Risk Free

People Also Ask about

What is a certificate that seller is not a foreign person?

This Standard Document is delivered by the owner of a seller that is a disregarded entity in a stock or asset sale to inform the buyer that the seller's owner is not a foreign (non-US) individual or entity and therefore not subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA).

What is a non-foreign affidavit?

Whenever you sell real property in the United States, the buyer will require you to sign a FIRPTA affidavit swearing that you are or are not a foreign person. FIRPTA refers to the Foreign Investment in Real Property Tax Act of 1980.

What is an example of a FIRPTA statement?

By this Affidavit, the undersigned hereby gives sworn representation that it, as seller(s) of a United States real property interest, is not a foreign person as defined in the Internal Revenue Code Section 1445, thus permitting the transferee of the property to waive the ten (10%) percent withholding requirement in

Who provides the FIRPTA affidavit?

Seller shall provide a completed affidavit to the qualified substitute, who will furnish a statement (C.A.R.

What is a non-affidavit?

An affidavit of non-prosecution is simply a sworn statement (typically notarized) from the victim stating that he or she does not wish to pursue charges and wishes charges against the defendant to be dismissed (here is an example of what an affidavit of non-prosecution looks like).

What is the purpose of a non-foreign affidavit?

Internal Revenue Code (“IRC”) §1445 provides that a transferee (Buyer) of a U.S. real property interest must withhold tax if the transferor (Seller) is a “foreign person.” In order to avoid withholding, IRC §1445 (b) requires that the Seller (a) provides an affidavit to the Buyer with the Seller's taxpayer

What is an example of a non prosecution affidavit?

I am the complaining witness against __, the Defendant in the above referenced case. It is my wish and desire that all charges in relation to these matters be dismissed, that there be no further action taken thereon and I do not intend to pursue the prosecution of said Defendant.

What is a certificate that seller is not a foreign person?

This Standard Document is delivered by the owner of a seller that is a disregarded entity in a stock or asset sale to inform the buyer that the seller's owner is not a foreign (non-US) individual or entity and therefore not subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-Foreign Affidavit?

A Non-Foreign Affidavit is a legal document used to affirm that a seller of real property is not a foreign person as defined by the Foreign Investment in Real Property Tax Act (FIRPTA).

Who is required to file Non-Foreign Affidavit?

The seller of the property is required to file a Non-Foreign Affidavit to certify their status as a non-foreign person to the buyer and ensure that no withholding tax is required under FIRPTA.

How to fill out Non-Foreign Affidavit?

To fill out a Non-Foreign Affidavit, the seller must provide their full name, address, tax identification number (TIN), and sign the affidavit affirming they are not a foreign person. It may also require notarization.

What is the purpose of Non-Foreign Affidavit?

The purpose of the Non-Foreign Affidavit is to help real estate buyers and title companies confirm that the seller is a U.S. citizen or resident, thereby avoiding withholding taxes that apply to foreign sellers.

What information must be reported on Non-Foreign Affidavit?

The Non-Foreign Affidavit must report the seller's name, address, TIN, and a declaration of their non-foreign status, along with the seller's signature and sometimes a notary's acknowledgment.

Fill out your non-foreign affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Foreign Affidavit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.