Get the free Symetra Term Life Application - Aevus Insurance

Show details

Life Insurance Application Made Easy Step One: Complete the paper application The paper application is fillable from your computer, or you can print it out first and write the information in by hand.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign symetra term life application

Edit your symetra term life application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your symetra term life application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit symetra term life application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit symetra term life application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out symetra term life application

How to fill out a Symetra term life application:

01

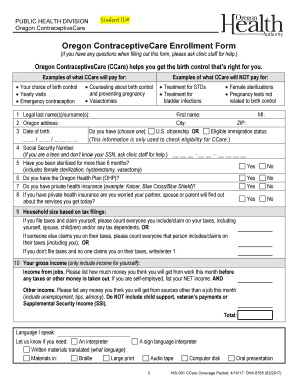

Start by gathering personal information: You will need to provide your full name, date of birth, gender, address, contact information, and social security number. Make sure to double-check the accuracy of this information before proceeding.

02

Determine the coverage amount: Consider your financial needs and select an appropriate coverage amount that will adequately protect your loved ones in the event of your death. Evaluate factors such as outstanding debts, mortgage payments, future expenses, and income replacement.

03

Choose the term length: Decide how long you would like the life insurance coverage to last. Symetra offers term lengths typically ranging from 10 to 30 years. Select a term that aligns with your specific needs and goals.

04

Complete the health questionnaire: Provide detailed information about your medical history and current health status. Be prepared to disclose any pre-existing conditions, medications you are currently taking, and any recent surgeries or hospitalizations. It's important to answer these questions honestly and accurately.

05

Undergo a medical exam (if required): Depending on your age and coverage amount, Symetra may require a medical exam to assess your health condition. If needed, a licensed healthcare professional will conduct the exam, which commonly includes measurements such as blood pressure, weight, and blood tests.

06

Select beneficiaries: Designate the individuals or organizations that you want to receive the proceeds from your life insurance policy upon your death. Ensure you have their full names, dates of birth, and contact information ready.

07

Review and sign the application: Thoroughly review all the information you have provided to ensure its accuracy. Make any necessary corrections or adjustments before signing the application form. By signing, you acknowledge that the information given is true and authorize Symetra to process your application.

Who needs Symetra term life application?

01

Individuals with dependents: If you have people who rely on your income to meet their financial needs, having a term life insurance policy like Symetra's can provide financial protection and support for your loved ones in the event of your passing.

02

Breadwinners: If you are the primary earner in your family, a term life insurance policy can help replace lost income, cover outstanding debts, and maintain your family's standard of living if you were no longer around to provide financial support.

03

Those with specific financial obligations: If you have outstanding debts, such as a mortgage, car loans, or student loans, a term life insurance policy can help ensure that your loved ones are not burdened with these financial responsibilities should you pass away.

04

Business owners: Term life insurance can also be essential for business owners, as it can provide funds to cover business expenses, debts, and even facilitate business succession planning.

In conclusion, anyone who wants to protect their loved ones financially, cover outstanding obligations, or provide for the future well-being of dependents or business interests can benefit from Symetra term life insurance. It is important to carefully review and complete the application with accurate information to ensure a seamless process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is symetra term life application?

Symetra term life application is a form used to apply for a term life insurance policy with Symetra Financial.

Who is required to file symetra term life application?

Anyone interested in purchasing a term life insurance policy from Symetra Financial is required to file a symetra term life application.

How to fill out symetra term life application?

To fill out a symetra term life application, you will need to provide personal information, medical history, and policy preferences as requested on the form.

What is the purpose of symetra term life application?

The purpose of symetra term life application is to gather necessary information from the applicant to determine eligibility for a term life insurance policy.

What information must be reported on symetra term life application?

Information such as personal details, medical history, lifestyle habits, and policy preferences must be reported on symetra term life application.

How can I send symetra term life application to be eSigned by others?

Once your symetra term life application is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit symetra term life application on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing symetra term life application.

How do I fill out symetra term life application on an Android device?

Use the pdfFiller app for Android to finish your symetra term life application. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your symetra term life application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Symetra Term Life Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.