Get the free Interest Rate Risk Management Seminar

Show details

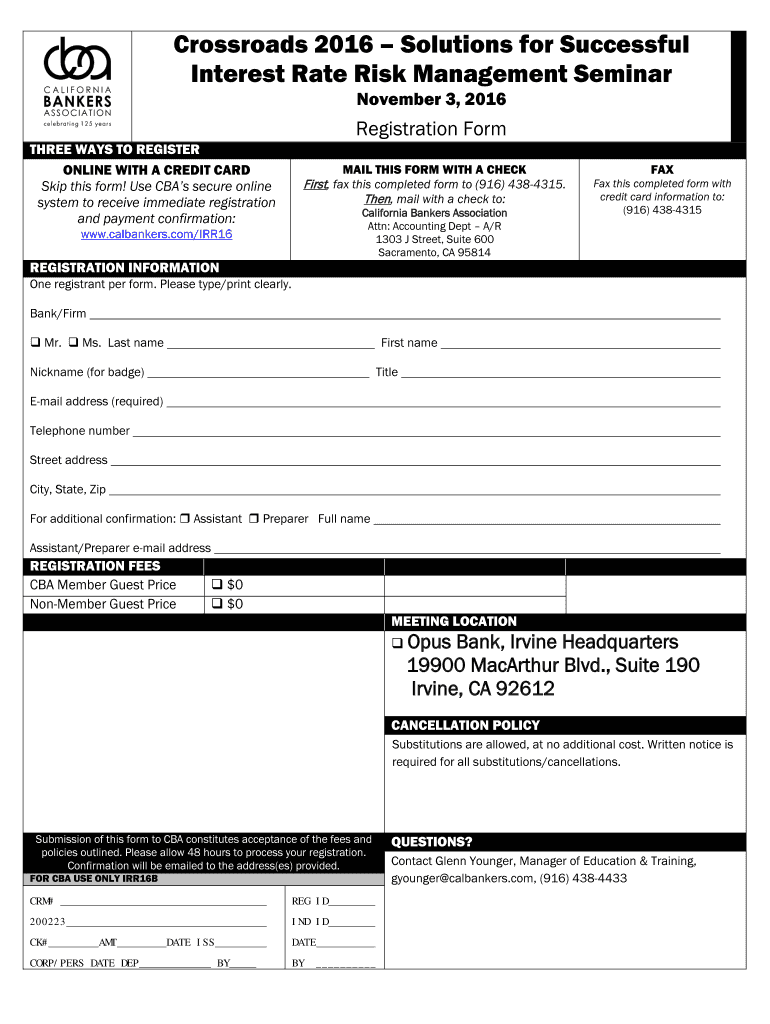

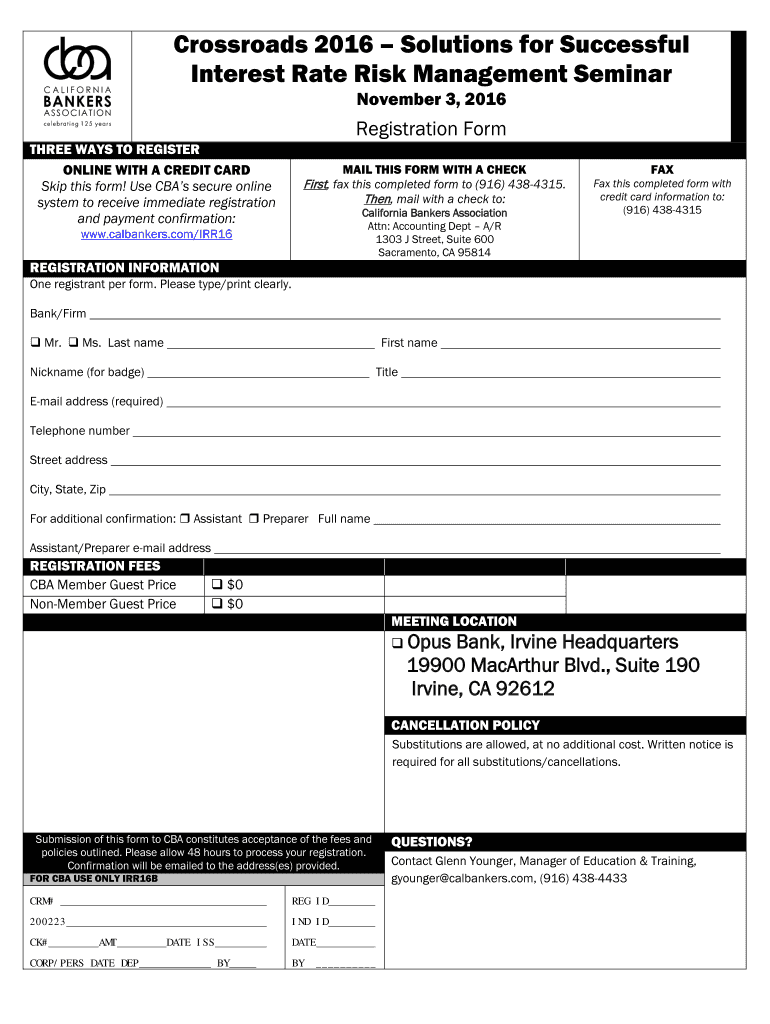

Crossroads 2016 Solutions for Successful. Interest Rate Risk Management Seminar. November 3, 2016. Registration Form. THREE WAYS TO REGISTER.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interest rate risk management

Edit your interest rate risk management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interest rate risk management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit interest rate risk management online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit interest rate risk management. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interest rate risk management

Point-by-point steps to fill out interest rate risk management:

01

Identify and assess the potential risks: Begin by understanding the different types of interest rate risks your organization might face, such as basis risk, yield curve risk, or repricing risk. Assess the potential impact of these risks on your financial health.

02

Set risk management objectives: Determine the specific objectives you aim to achieve through interest rate risk management. This could include reducing the volatility of interest rate-sensitive income or preserving the value of your fixed income assets.

03

Establish risk tolerance levels: Define the acceptable levels of risk for your organization based on your risk appetite and financial goals. Determine how much you are willing to expose your organization to interest rate fluctuations.

04

Develop risk management strategies: Based on your risk assessment and objectives, identify appropriate strategies to manage interest rate risks. This may include diversifying your investments, using interest rate derivatives, or implementing hedging strategies.

05

Monitor and measure risks: Continuously monitor and measure the effectiveness of your risk management strategies. Regularly review interest rate exposures, market conditions, and the performance of your risk mitigation activities.

06

Review and update policies: Periodically review and update your interest rate risk management policies and procedures to ensure they remain aligned with your organization's goals and changing market conditions.

Who needs interest rate risk management?

01

Financial institutions: Banks, credit unions, and other financial institutions are exposed to interest rate risks due to their lending, borrowing, and investment activities. Interest rate risk management helps them mitigate potential losses and optimize their balance sheets.

02

Corporations: Companies with significant amounts of debt or investments that are sensitive to changes in interest rates may need interest rate risk management. This ensures they can adapt to market fluctuations and minimize negative impacts on their financial performance.

03

Investors: Individual or institutional investors who hold fixed income assets like bonds or have exposure to interest rates through their investments may require interest rate risk management. It helps protect their portfolios and optimize returns.

Note: The specific need for interest rate risk management may vary depending on the organization's size, business activities, and risk profile. It is advisable to consult with financial professionals or risk management experts for tailored guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify interest rate risk management without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including interest rate risk management, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in interest rate risk management?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your interest rate risk management to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out interest rate risk management using my mobile device?

Use the pdfFiller mobile app to fill out and sign interest rate risk management. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is interest rate risk management?

Interest rate risk management is the process of monitoring and controlling potential losses arising from fluctuations in interest rates.

Who is required to file interest rate risk management?

Financial institutions such as banks, credit unions, and other organizations that are exposed to interest rate risk are typically required to file interest rate risk management.

How to fill out interest rate risk management?

Interest rate risk management can be filled out by collecting relevant data on interest rate exposures, assessing risks, implementing risk mitigation strategies, and documenting the process.

What is the purpose of interest rate risk management?

The purpose of interest rate risk management is to protect financial institutions from potential losses due to changes in interest rates and to ensure stability and profitability.

What information must be reported on interest rate risk management?

Information such as interest rate exposures, risk assessment, mitigation strategies, and results of risk management activities must be reported on interest rate risk management.

Fill out your interest rate risk management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interest Rate Risk Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.