Get the free Vanguard Investor Index Funds

Show details

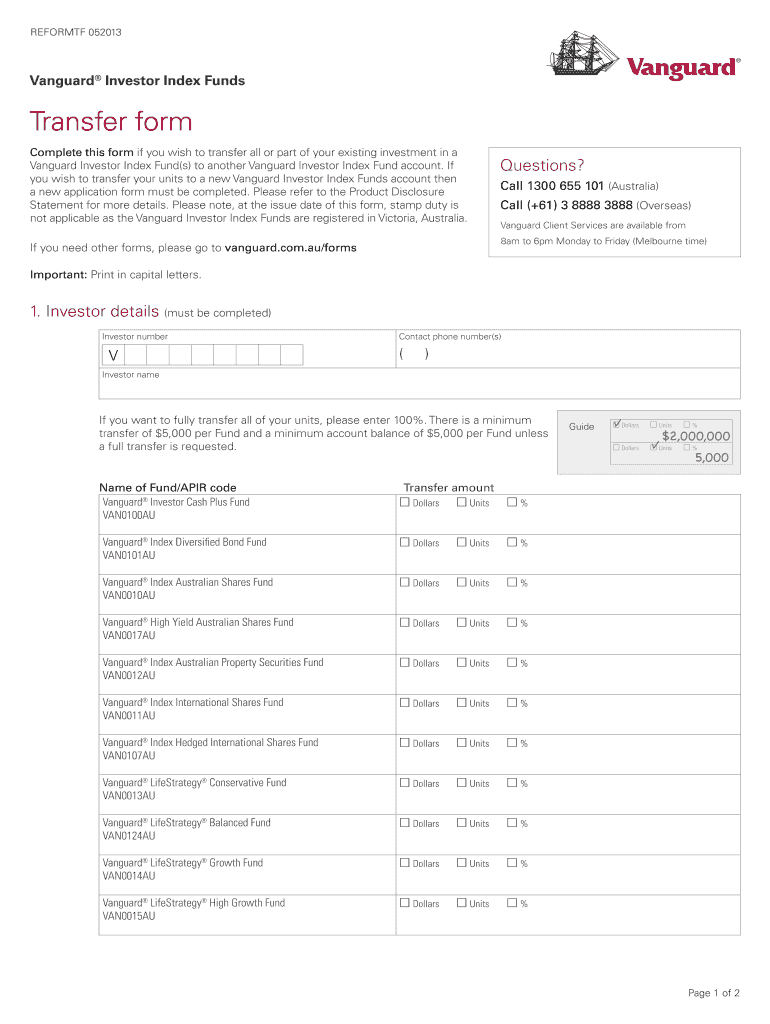

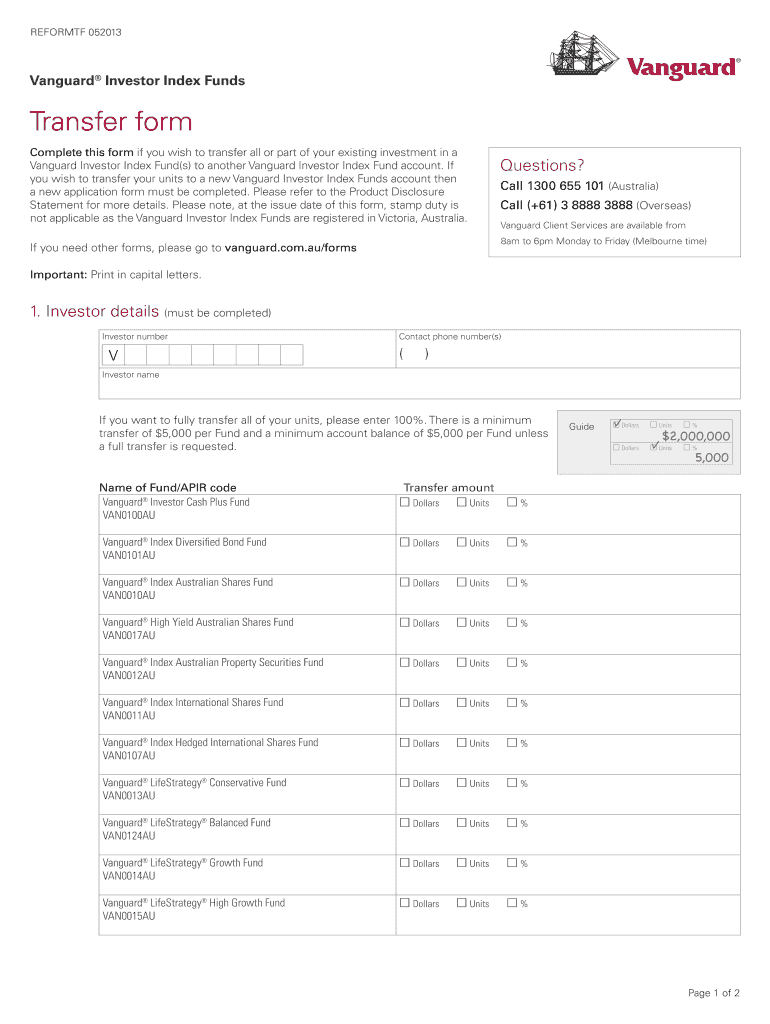

REFORM TF 052013 Vanguard Investor Index Funds Transfer form Complete this form if you wish to transfer all or part of your existing investment in a Vanguard Investor Index Fund(s) to another Vanguard

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vanguard investor index funds

Edit your vanguard investor index funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vanguard investor index funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vanguard investor index funds online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vanguard investor index funds. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vanguard investor index funds

How to fill out Vanguard Investor Index Funds:

01

Visit the Vanguard website or speak to a financial advisor to gather information about the different index funds available. Vanguard offers a wide range of index funds covering various asset classes and market segments.

02

Consider your investment goals and risk tolerance. Vanguard Investor Index Funds are designed for long-term investors who are seeking low-cost diversification.

03

Determine the appropriate asset allocation for your investment portfolio. This involves deciding how much of your investment should be allocated to stocks, bonds, or other asset classes. Vanguard provides tools and resources to help investors determine an appropriate asset allocation based on their investment objectives and risk tolerance.

04

Select the specific index funds that align with your desired asset allocation. Vanguard offers a variety of index funds that track different market indexes, such as the S&P 500 or the Total Stock Market Index.

05

Open a Vanguard account if you don't already have one. This can be done online or by contacting Vanguard directly. The account opening process typically requires providing personal information and funding your account with an initial investment.

06

Once your account is set up, navigate to the "Buy & sell" section of your Vanguard account. Here, you can enter the ticker symbol of the index fund you wish to invest in and specify the amount you want to invest.

07

Decide whether you want to make a one-time investment or set up automatic investments. Vanguard allows you to schedule recurring investments to add to your index funds regularly. This can help with dollar-cost averaging and maintaining a disciplined investment approach.

Who needs Vanguard Investor Index Funds:

01

Long-term investors seeking low-cost diversification: Vanguard Investor Index Funds are designed for individuals who are looking for a simple and cost-effective way to achieve broad market exposure. These funds are suitable for those planning for long-term goals, such as retirement or saving for education expenses.

02

Passive investors: Vanguard Investor Index Funds are passively-managed funds that aim to track specific market indexes. They are a good fit for investors who believe in the efficient market hypothesis and prefer a passive investment approach over active stock picking.

03

Investors with a long-term investment horizon: Index funds, including Vanguard Investor Index Funds, are generally better suited for investors with a long time horizon. This is because they aim to provide broad market exposure and are not typically designed for short-term speculation.

04

Investors seeking low-cost investment options: Vanguard is known for its low-cost investment offerings. The expense ratios of Vanguard Investor Index Funds tend to be lower than those of actively-managed mutual funds, making them attractive for cost-conscious investors.

Remember, it is always important to do thorough research and consult with a financial advisor to ensure that Vanguard Investor Index Funds are suitable for your specific financial situation and investment goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit vanguard investor index funds from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your vanguard investor index funds into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in vanguard investor index funds?

With pdfFiller, it's easy to make changes. Open your vanguard investor index funds in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the vanguard investor index funds electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your vanguard investor index funds in minutes.

What is vanguard investor index funds?

Vanguard Investor Index Funds are a type of mutual fund that passively tracks a specific market index, such as the S&P 500.

Who is required to file vanguard investor index funds?

Investors who own shares in vanguard investor index funds are required to report their holdings to the IRS.

How to fill out vanguard investor index funds?

To fill out vanguard investor index funds, investors must report their holdings, dividend income, and any capital gains or losses.

What is the purpose of vanguard investor index funds?

The purpose of vanguard investor index funds is to provide investors with exposure to a diversified portfolio of securities that track a specific market index.

What information must be reported on vanguard investor index funds?

Investors must report their holdings in vanguard investor index funds, any dividends received, and any capital gains or losses incurred.

Fill out your vanguard investor index funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vanguard Investor Index Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.