Get the free schedule c worksheet

Show details

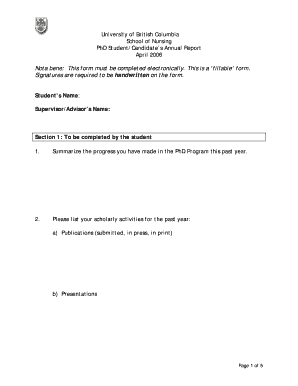

SCHEDULE C GENERAL INFORMATION Business Name Federal Identification Number Activity Code: Accounting method: Cash Accrual Other (Explain) Total Medical Insurance Premiums Paid in $2011 Did you start

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule c worksheet

Edit your schedule c worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule c worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule c worksheet online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule c worksheet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule c worksheet

How to fill out schedule c worksheet? Who needs schedule c worksheet?

01

Start by gathering all the necessary information and documents. This includes records of all your business income and expenses for the year. You may also need your Employer Identification Number (EIN) or Social Security Number (SSN), as well as details about any business assets or vehicles you use for your business.

02

Begin completing the worksheet by providing your personal information, such as your name, address, and tax identification number. Make sure to double-check that all the information is accurate and up to date.

03

Describe your principal business or professional activity. This could be consulting, freelancing, selling goods, or any other type of self-employment. Provide a brief but clear description of your business activity.

04

Calculate your gross receipts or sales. This includes the total amount of money you earned from your business throughout the year. Include income from all sources, such as sales, services, and other business-related transactions.

05

Deduct your business expenses. This step requires careful categorization and documentation of all your business expenses. Common deductible expenses include rent, utilities, office supplies, advertising, travel expenses, and professional fees. Keep in mind that only expenses directly related to your business can be deducted.

06

Determine your net profit or loss. Subtract your total expenses from your gross receipts to calculate your net profit or loss. If your expenses exceed your income, you may have a loss for the year. Conversely, if your income is higher than your expenses, you will have a net profit.

07

Report any other income or deductions. Along with your business income and expenses, you may have additional income or deductions that need to be reported on schedule C. Examples include income from rental properties or deductions related to the use of your home for business purposes.

08

Complete the rest of the schedule C worksheet, answering any remaining questions and providing additional information as needed. Be thorough and accurate with your responses to ensure the proper calculation of your tax liability.

Who needs schedule C worksheet?

01

Self-employed individuals: Schedule C is primarily used by self-employed individuals who operate a sole proprietorship or single-member LLC. It helps them report their business income and deductions when filing their federal income tax return.

02

Independent contractors: If you work as an independent contractor, freelancer, or consultant and receive income from clients or companies, you are likely required to fill out schedule C.

03

Small business owners: Individuals who own and operate a small business, such as a retail store, restaurant, or service-based company, need to complete schedule C to report their business income and expenses accurately.

04

Home-based business owners: If you run a business from your home, even on a part-time basis, you may still need to fill out schedule C if you meet the income thresholds set by the IRS.

Overall, anyone who has self-employment income and meets the criteria outlined by the IRS should use schedule C to report their business activity and ensure compliance with tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a Schedule C worksheet?

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Do sole proprietors have balance sheets?

A balance sheet for a sole proprietorship is similar to a balance sheet for any other kind of business in that it shows how much the business entity owns and owes.

How do I calculate my income if I am self employed?

You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income you derived from your trade or business. You can be liable for paying self-employment tax even if you currently receive social security benefits.

How do you calculate Schedule C gross income?

Schedule C spells out the gross income calculation: Add your gross receipts from the sale of goods or services. Add up any refunds you gave for returned merchandise. Subtract the cost of goods sold, which you work out in Section III of Schedule C.

How do I fill out a Schedule C worksheet?

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

What are Schedule C items?

Schedule C information includes profits and losses earned by you as a sole proprietor or single-member LLC. If you only work as an employee and earn money reported on a W-2, you'll typically not complete a Schedule C for your tax return.

How do I calculate my Schedule C?

Calculating Schedule C Income The formula is relatively simple – you start with the net profit (or less) and then add-back a few items and subtract meals and entertainment.

Is a balance sheet included in a tax return?

The balance sheet and tax reporting. For federal income tax purposes, only C corporations are required to complete a balance sheet as part of their annual return. This balance sheet compares items at the beginning of the year with items at the end of the year.

What is the accounting method for Schedule C?

The Cash Method of accounting is the most commonly used. Using the Cash Method of accounting, you report all items received as gross income at the time you receive them.

Can I fill out my own Schedule C?

Schedule C is the tax form filed by most sole proprietors. As you can tell from its title, "Profit or Loss From Business," it´s used to report both income and losses. Many times, Schedule C filers are self-employed taxpayers who are just getting their businesses started.

How do I calculate taxes owed self employed?

As noted, the self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Self-employment tax is not the same as income tax. For the 2022 tax year, the first $147,000 of earnings is subject to the Social Security portion.

What is a balance sheet for self employed?

A balance sheet is a financial "snapshot" of your business at a given date in time. It includes your assets and liabilities and tells you your business's net worth.

Do you need a P&L for Schedule C?

The IRS requires sole proprietors to use Profit or Loss From Business (Sole Proprietorship) (Schedule C (Form 1040)), to report either income or loss from their businesses.

Is there a balance sheet for Schedule C?

What Information Do I Need to Complete Schedule C? You will need the following information to complete your Schedule C: A profit and loss statement, sometimes called an income statement, for the tax year. A balance sheet for the tax year.

What is Schedule C worksheet?

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit schedule c worksheet from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including schedule c worksheet. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit schedule c worksheet straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing schedule c worksheet.

How do I fill out the schedule c worksheet form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign schedule c worksheet and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your schedule c worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule C Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.