Get the free Employee Payroll Deduction Donation Form - Army and Navy ... - armyandnavyacademy

Show details

Payroll Deduction Form for Donations to the Army and Navy Academy Name ANNUAL FUND CONTRIBUTION Please deduct $ per paycheck, beginning. This will lead to an annual donation of $. I would like my

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee payroll deduction donation

Edit your employee payroll deduction donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee payroll deduction donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee payroll deduction donation online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employee payroll deduction donation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee payroll deduction donation

How to fill out employee payroll deduction donation:

01

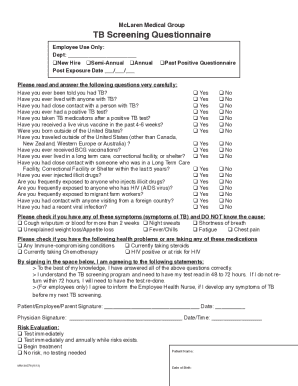

Obtain the necessary forms: You will need to request the employee payroll deduction donation form from your employer's human resources department. This form typically includes details such as the donation amount, frequency (one-time or recurring), and the charity or organization to which you wish to donate.

02

Review your finances: Before deciding on an amount for your payroll deduction donation, it's important to take a close look at your financial situation. Assess your monthly budget and determine the amount you can comfortably afford to donate each pay period without straining your finances.

03

Select a charity or organization: Research various charities or organizations that align with causes you are passionate about. Consider their mission, impact, and transparency in order to make an informed decision. Once you have chosen a charity, find out if they are eligible to receive payroll deduction donations from your employer.

04

Complete the form accurately: Take your time to fill out the employee payroll deduction donation form accurately and legibly. Provide the requested information, such as your name, employee identification number, donation amount, frequency, and the name of the charity or organization.

05

Submit the form to HR: Once you have completed the form, submit it to your employer's human resources department. Make sure to follow any specific instructions they may have, such as submitting a physical copy or using an online portal.

Who needs employee payroll deduction donation:

01

Individuals who want to support charities or organizations: Employee payroll deduction donation is ideal for individuals who wish to contribute to charitable causes regularly. It allows them to make automatic deductions from their paychecks, making the process convenient and hassle-free.

02

Employees with a stable income: It is beneficial for employees who have a steady income and can afford to donate a portion of their earnings. Regular contributions through payroll deduction ensure a consistent flow of support to the chosen charity or organization.

03

Those seeking tax benefits: Donating through employee payroll deductions may provide tax benefits, depending on the country's tax regulations. Employees looking to decrease their taxable income while supporting causes they care about may find this option advantageous.

04

Companies promoting corporate social responsibility: Many organizations encourage their employees to participate in charitable giving programs. Companies committed to corporate social responsibility often facilitate employee payroll deduction donations, fostering a sense of philanthropy within their workforce.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employee payroll deduction donation online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your employee payroll deduction donation to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the employee payroll deduction donation in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your employee payroll deduction donation right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete employee payroll deduction donation on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your employee payroll deduction donation, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is employee payroll deduction donation?

Employee payroll deduction donation is a voluntary contribution made by an employee through payroll deductions to support a specific cause or charity.

Who is required to file employee payroll deduction donation?

Employers are required to file employee payroll deduction donations on behalf of their employees.

How to fill out employee payroll deduction donation?

Employee payroll deduction donations can be filled out by the employer on behalf of the employee or the employee can choose to fill it out themselves.

What is the purpose of employee payroll deduction donation?

The purpose of employee payroll deduction donation is to allow employees to easily contribute to charitable causes or organizations of their choice.

What information must be reported on employee payroll deduction donation?

Employee payroll deduction donations must include the amount of the deduction, the designated charity or cause, and the employee's authorization.

Fill out your employee payroll deduction donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Payroll Deduction Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.