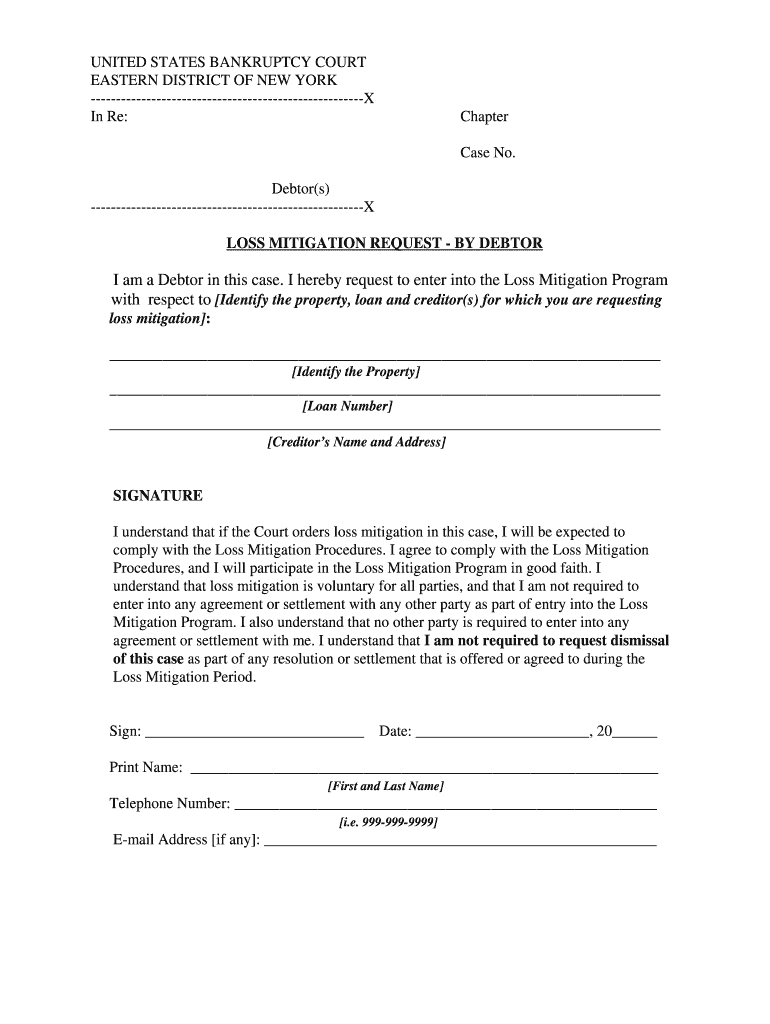

Get the free LOSS MITIGATION REQUEST - BY DEBTOR

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loss mitigation request

Edit your loss mitigation request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loss mitigation request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loss mitigation request online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit loss mitigation request. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loss mitigation request

How to Fill Out a Loss Mitigation Request:

01

Start by gathering all necessary documentation. This may include financial statements, pay stubs, bank statements, tax returns, and any other relevant financial information.

02

Review the loss mitigation request form provided by your lender or loan servicer. Familiarize yourself with the sections and questions on the form.

03

Fill in your personal information accurately. This includes your name, address, phone number, email, and any other required contact details.

04

Provide details about your loan. This includes the loan number, the amount borrowed, and the date the loan was originated.

05

Outline the reasons for your financial hardship. Clearly explain the circumstances that have led to your inability to pay your mortgage. This may include job loss, reduction in income, medical expenses, or other significant financial challenges. Be honest and provide as much detail as possible.

06

Include a detailed breakdown of your monthly income and expenses. Provide accurate figures for your household income, including any additional sources of income. Then, list all your monthly expenses, including mortgage payments, utilities, groceries, transportation, healthcare, and any other financial obligations. Be thorough and transparent.

07

Attach all required supporting documentation. This may include pay stubs, bank statements, tax returns, proof of unemployment benefits, medical bills, or any other evidence that supports your financial situation. Make sure to include copies and keep the originals for your records.

08

Review your completed loss mitigation request form to ensure all sections are filled out accurately and completely. Double-check for any errors or missing information.

09

Submit your loss mitigation request to your lender or loan servicer. Follow their specified submission instructions, which may include mailing the form, submitting it online, or delivering it to a physical location. Keep a copy of the submission confirmation for your records.

Who Needs a Loss Mitigation Request?

A loss mitigation request is typically needed by homeowners who are facing financial difficulties and are at risk of foreclosure. It is a formal document submitted to the lender or loan servicer to request assistance in resolving the delinquency and finding a solution that can help prevent foreclosure. Individuals who have experienced job loss, reduction in income, increased expenses, or other significant financial setbacks may be eligible for loss mitigation options such as loan modifications, repayment plans, forbearance agreements, or short sales. It is important to reach out to your lender or loan servicer as soon as you encounter financial difficulties to explore the available options and submit a loss mitigation request if necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the loss mitigation request electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your loss mitigation request in seconds.

Can I create an eSignature for the loss mitigation request in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your loss mitigation request and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete loss mitigation request on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your loss mitigation request. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is loss mitigation request?

Loss mitigation request is a formal request submitted by a borrower to a lender or servicer to explore options for avoiding foreclosure or reducing the impact of delinquency.

Who is required to file loss mitigation request?

Any borrower who is facing financial hardship and having difficulty making mortgage payments is encouraged to file a loss mitigation request.

How to fill out loss mitigation request?

To fill out a loss mitigation request, borrowers typically need to provide information about their financial situation, including income, expenses, assets, debts, and the reason for the hardship.

What is the purpose of loss mitigation request?

The purpose of a loss mitigation request is to begin the process of exploring alternative options to foreclosure, such as loan modifications, repayment plans, forbearance, or short sale.

What information must be reported on loss mitigation request?

The information required on a loss mitigation request typically includes the borrower's contact information, loan number, hardship explanation, income documentation, expense details, and any supporting documents requested by the lender or servicer.

Fill out your loss mitigation request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loss Mitigation Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.