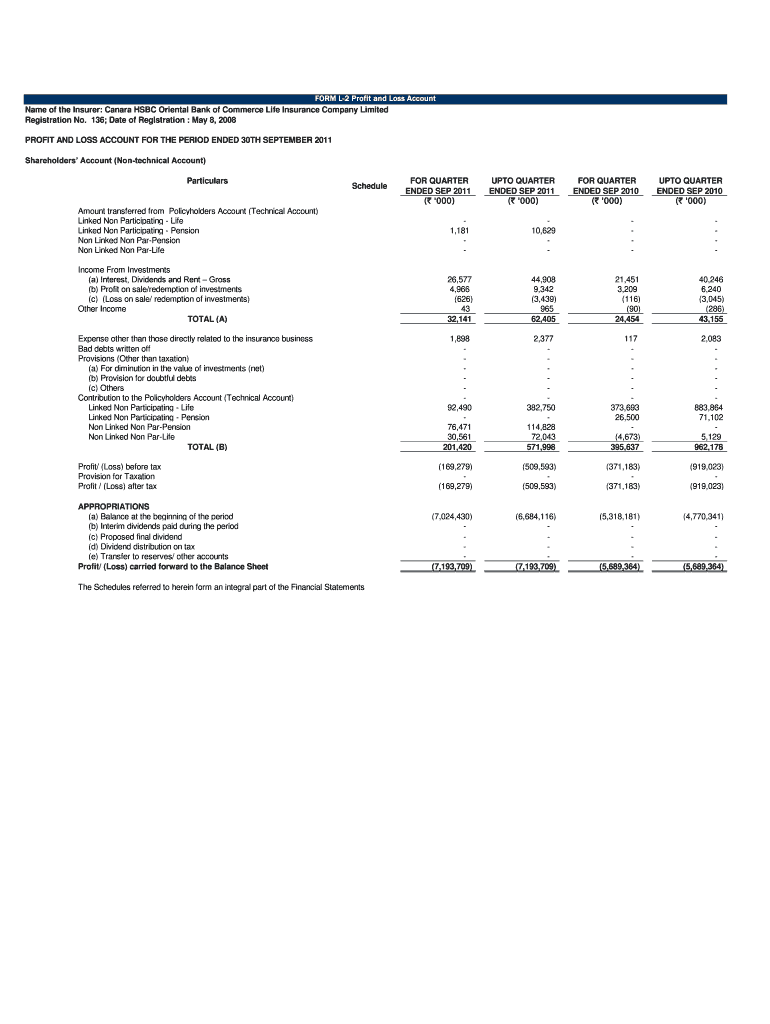

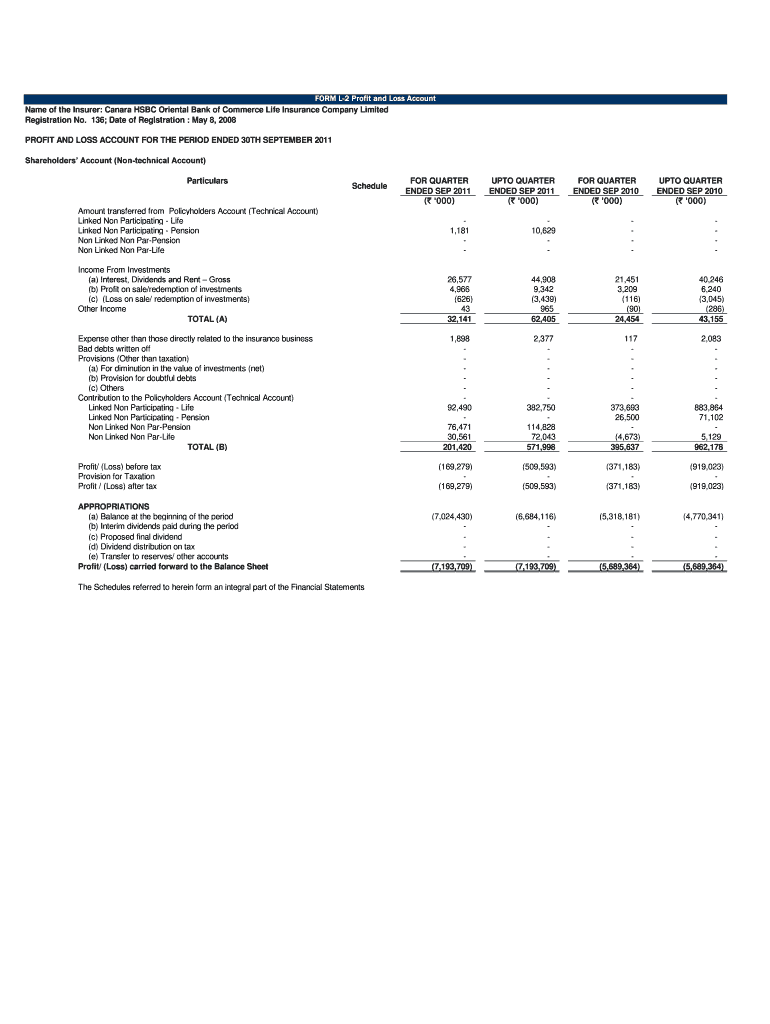

Get the free PROFIT AND LOSS ACCOUNT FOR THE PERIOD ENDED 30TH SEPTEMBER

Show details

PROFIT AND LOSS ACCOUNT FOR THE PERIOD ENDED 30TH SEPTEMBER ... (b) Profit on sale/redemption of investments ... FORM L-2 Profit and Loss Account ... Canada HSBC Oriental Bank of Commerce Life Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign profit and loss account

Edit your profit and loss account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your profit and loss account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing profit and loss account online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit profit and loss account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out profit and loss account

How to fill out a profit and loss account:

01

Start by gathering all relevant financial information such as sales revenue, cost of goods sold, operating expenses, and other income or expenses.

02

Calculate the net sales revenue by subtracting any returns, discounts, or allowances from the total sales.

03

Determine the cost of goods sold by considering the direct costs associated with producing or acquiring the products or services being sold.

04

Calculate the gross profit by subtracting the cost of goods sold from the net sales revenue.

05

List all operating expenses such as rent, utilities, salaries, and marketing expenses. Include any other expenses that are necessary for running the business.

06

Subtract the operating expenses from the gross profit to obtain the operating profit or loss.

07

Consider any non-operating income or expenses, such as interest income, investment gains or losses, or taxes, and include them in the profit and loss account.

08

Finally, calculate the net profit or loss by subtracting the non-operating income or expenses from the operating profit or loss.

Who needs a profit and loss account?

01

Business owners or managers: A profit and loss account provides valuable information about the financial performance of a business. It helps owners or managers assess the profitability and make informed decisions for the future.

02

Investors or shareholders: Shareholders and potential investors often rely on profit and loss accounts to evaluate the financial health and profitability of a company they are interested in. It helps them make investment decisions and assess the return on their investment.

03

Lenders or creditors: When businesses apply for loans or credit, lenders or creditors usually require a profit and loss account to assess the financial viability and creditworthiness of the business. It helps them determine the ability of the company to repay debt obligations.

04

Tax authorities: Profit and loss accounts provide essential information for calculating taxable income and determining the amount of tax owed by a business. Tax authorities rely on these accounts to assess and verify tax liabilities.

05

Potential buyers or acquirers: When selling a business, potential buyers or acquirers often request profit and loss accounts to evaluate the financial performance and profitability of the company. It helps them make informed decisions about the acquisition or purchase price.

In summary, a profit and loss account is essential for various stakeholders who have an interest in understanding the financial performance and profitability of a business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my profit and loss account in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your profit and loss account along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get profit and loss account?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific profit and loss account and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the profit and loss account in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your profit and loss account directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is profit and loss account?

A profit and loss account is a financial statement that shows a company's revenues and expenses over a specific period of time, typically a fiscal quarter or year.

Who is required to file profit and loss account?

Companies, including limited liability companies and partnerships, are required to file profit and loss accounts as part of their financial reporting obligations.

How to fill out profit and loss account?

To fill out a profit and loss account, one must list all sources of revenue and categorize expenses to calculate the company's net income or loss for the period.

What is the purpose of profit and loss account?

The purpose of a profit and loss account is to provide stakeholders with insights into a company's financial performance and profitability over a specific period.

What information must be reported on profit and loss account?

Key information reported on a profit and loss account includes revenue, expenses, gross profit, operating income, net income, and earnings per share.

Fill out your profit and loss account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Profit And Loss Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.