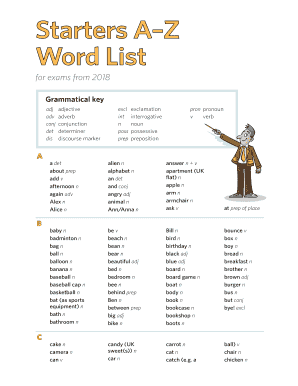

Get the free Gifts and Trusts of

Show details

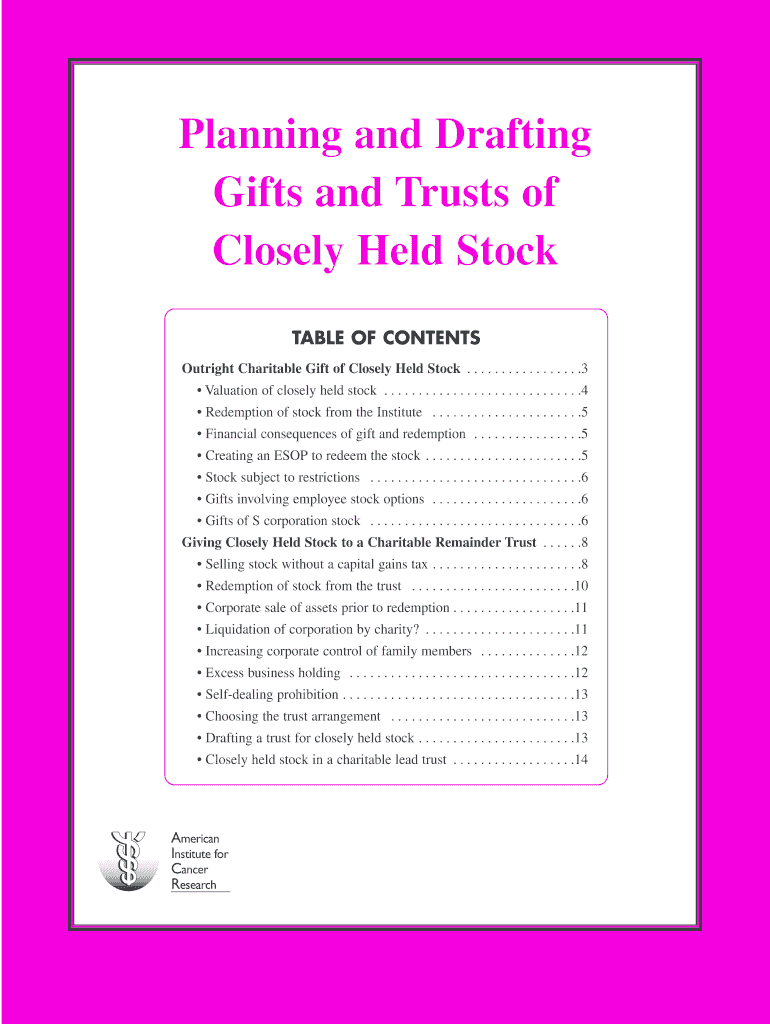

Planning and Drafting Gifts and Trusts of Closely Held Stock TABLE OF CONTENTS Outright Charitable Gift of Closely Held Stock. . . . . . . . . . . . . . . . .3 Valuation of closely held stock. . .

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts and trusts of

Edit your gifts and trusts of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts and trusts of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifts and trusts of online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gifts and trusts of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifts and trusts of

How to fill out gifts and trusts of?

01

Start by gathering all necessary documents: Before you begin filling out the gifts and trusts of, make sure you have all the relevant documents handy. These may include financial statements, legal paperwork, and identification documents.

02

Understand the purpose of the gifts and trusts of: It is important to have a clear understanding of why you are filling out the gifts and trusts of. Whether it is for estate planning, tax advantages, or asset protection, knowing the purpose will guide your decision-making process.

03

Consult with an attorney or financial advisor: If you are not familiar with the legal and financial aspects of gifts and trusts, it is advisable to seek professional advice. An attorney or financial advisor can provide valuable insights and ensure that you complete the necessary forms accurately.

04

Determine the beneficiaries: Decide who will be the beneficiaries for the gifts and trusts of. This could be your family members, friends, or even charitable organizations. Consider the needs and priorities of each beneficiary before making a decision.

05

Specify the assets and properties: Clearly identify the assets and properties that will be included in the gifts and trusts of. These can range from real estate and investments to personal belongings and valuables. Providing detailed descriptions will help avoid any confusion or disputes in the future.

06

Create a trust agreement: If you are establishing a trust as part of the gifts and trusts of, you will need to draft a trust agreement. This document outlines the terms and conditions of the trust, including how the assets will be managed and distributed.

07

Review and finalize the paperwork: Carefully review all the completed paperwork before finalizing it. Double-check for any errors or missing information. Once you are satisfied, sign all the necessary documents and keep copies for your records.

Who needs gifts and trusts of?

01

Individuals with significant assets: Gifts and trusts of are commonly used by individuals who have substantial assets that they wish to protect or pass on to their beneficiaries. These can include high net worth individuals, business owners, or those who have received a significant inheritance.

02

Individuals concerned about estate planning: Estate planning involves managing and distributing assets after death. Gifts and trusts of can be an integral part of an estate plan, allowing individuals to have greater control over their assets and how they will be transferred to their loved ones.

03

Those interested in tax planning: Gifts and trusts of can offer various tax advantages, such as reducing estate taxes or minimizing income taxes. Individuals who want to optimize their tax planning strategies may choose to incorporate gifts and trusts into their overall financial plan.

In conclusion, filling out gifts and trusts of involves gathering necessary documents, understanding the purpose, seeking professional advice if needed, determining beneficiaries, specifying assets, creating a trust agreement, and reviewing and finalizing the paperwork. Individuals with significant assets, those concerned about estate planning, and individuals interested in tax planning are among those who may benefit from gifts and trusts of.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute gifts and trusts of online?

pdfFiller has made it easy to fill out and sign gifts and trusts of. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the gifts and trusts of in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your gifts and trusts of.

Can I edit gifts and trusts of on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign gifts and trusts of. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is gifts and trusts of?

Gifts and trusts are a way to transfer assets to beneficiaries while potentially reducing estate taxes.

Who is required to file gifts and trusts of?

Individuals who have given gifts exceeding the annual gift tax exclusion amount or have set up trusts are required to file gifts and trusts.

How to fill out gifts and trusts of?

You can fill out gifts and trusts by gathering all the necessary information related to the gifts or trusts, and then completing the appropriate tax forms as required by the IRS.

What is the purpose of gifts and trusts of?

The purpose of gifts and trusts is to transfer assets, distribute wealth, and potentially reduce estate taxes for the beneficiaries.

What information must be reported on gifts and trusts of?

Information such as the value of gifts given, details of trusts set up, and any relevant tax information must be reported on gifts and trusts forms.

Fill out your gifts and trusts of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts And Trusts Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.