Get the free Understanding the Mortgage Documents - Freddie Mac

Show details

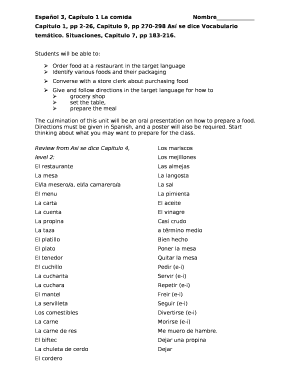

Understanding the Mortgage Documents Completing the Mortgage Documents Required for Home Purchase Many families feel overwhelmed by the homebuying process because of the amount of paperwork they must complete. But with the right information and support from a housing professional such as a housing counselor real estate agent or lender you can be better equipped to understand what you are signing. Mortgage Documents documents used in the mortgage process will help you navigate more...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding form mortgage documents

Edit your understanding form mortgage documents form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding form mortgage documents form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding form mortgage documents online

Follow the steps below to take advantage of the professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding form mortgage documents. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

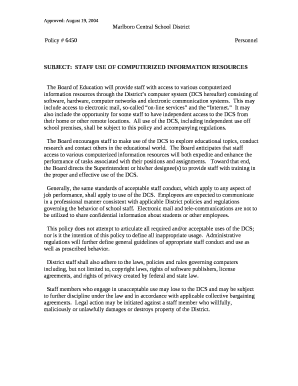

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding form mortgage documents

01

To fill out understanding form mortgage documents, you need to gather all necessary information and documents such as your personal details, employment history, income statements, and asset information.

02

Carefully review the form and understand each section, including terms, conditions, and legal implications. Take your time to read every detail and seek clarification if needed.

03

Provide accurate and complete information. Double-check all the details you input to avoid any mistakes or misleading information.

04

If you are unsure about any question or section, don't hesitate to seek professional advice from a mortgage specialist or lawyer to ensure you understand everything accurately.

05

Submit the form by the designated deadline or as requested by the lender or mortgage provider.

06

Keep copies of all the documents you submit for your records.

07

Understanding form mortgage documents are needed by individuals or borrowers who are applying for a mortgage loan or seeking refinancing options.

08

It is crucial for borrowers to complete these forms to provide detailed information about their financial situation, which helps lenders assess their eligibility and determine the terms of the mortgage.

09

Mortgage lenders require these forms to assess the borrower's ability to repay the loan and to comply with legal and regulatory obligations in the mortgage process.

10

Anyone who is seeking to obtain a mortgage or engage in any mortgage-related transaction will need to fill out understanding form mortgage documents.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my understanding form mortgage documents in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign understanding form mortgage documents and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete understanding form mortgage documents online?

pdfFiller has made it easy to fill out and sign understanding form mortgage documents. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit understanding form mortgage documents straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing understanding form mortgage documents.

What is understanding form mortgage documents?

Understanding form mortgage documents are legal agreements that outline the terms and conditions of a mortgage loan. They provide detailed information about the loan amount, interest rate, repayment schedule, and any additional fees or charges associated with the loan.

Who is required to file understanding form mortgage documents?

Both the lender and the borrower are required to file understanding form mortgage documents. The lender is responsible for creating and providing the documents, while the borrower must review and sign them to acknowledge their understanding of the terms.

How to fill out understanding form mortgage documents?

To fill out understanding form mortgage documents, you will typically need to provide basic personal and financial information, such as your name, address, employment details, and income information. You may also need to provide documentation to support your financial statements, such as pay stubs or tax returns.

What is the purpose of understanding form mortgage documents?

The purpose of understanding form mortgage documents is to ensure that both the lender and the borrower have a clear understanding of the terms and conditions of the mortgage loan. This helps to protect the rights and interests of both parties and minimize potential disputes or misunderstandings in the future.

What information must be reported on understanding form mortgage documents?

Understanding form mortgage documents typically require the reporting of the loan amount, interest rate, repayment terms, any prepayment penalties or fees, the estimated monthly payment amount, and any other important terms and conditions of the loan.

Fill out your understanding form mortgage documents online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Form Mortgage Documents is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.