Get the free Market Valued Call Option (MVCO) Bid Sheet - Entergy Louisiana

Show details

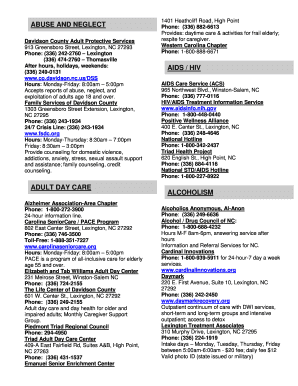

Market Valued Call Option (MVC) Bid Sheet Company Main contact Address Phone Email Fax Site name Address of site Energy Acct # Note: Account Manager If aggregating multiple sites under this MVC bid,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign market valued call option

Edit your market valued call option form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your market valued call option form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing market valued call option online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit market valued call option. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out market valued call option

How to fill out market valued call option:

01

Begin by understanding the concept of a market valued call option. A call option gives the holder the right, but not the obligation, to buy an underlying asset at a specific price (strike price) within a certain period of time. Market valued call options are those where the price of the option is determined by the market.

02

Research and analyze the underlying asset. Before filling out the market valued call option, it's crucial to thoroughly understand the asset for which you are seeking the option. This includes studying its historical performance, current market conditions, and any relevant news or events that may impact its price.

03

Determine your desired strike price and expiration date. The strike price is the price at which you have the right to purchase the underlying asset. The expiration date is the deadline by which the option must be exercised. Consider your investment goals, risk tolerance, and market expectations when deciding these parameters.

04

Find a reputable options brokerage firm. Look for a brokerage firm that specializes in options trading and offers competitive pricing, a user-friendly platform, and reliable customer support. Ensure the brokerage firm is regulated and has positive reviews from other traders.

05

Open an options trading account. Follow the brokerage firm's process for opening an options trading account. This usually involves providing personal information, financial details, and completing any necessary forms or agreements.

06

Access the options trading platform. Once your account is opened, log in to the brokerage firm's options trading platform. Familiarize yourself with the various tools, charts, and features available for analyzing and executing options trades.

07

Search for the specific market valued call option you want to fill out. Use the platform's search function to find the market valued call option based on the underlying asset, strike price, and expiration date you have determined. Review the available options and their corresponding prices.

08

Select the desired market valued call option. After identifying the appropriate option, click on it to view more details. Check the option price, bid-ask spread, volume, and any relevant data that may impact your decision.

09

Decide the quantity and review the trade information. Determine the number of contracts you want to fill out and review the trade information, including the total cost, potential profit or loss, and any associated fees or commissions.

10

Finally, execute the trade. Once you are confident in your decision, click the appropriate button to execute the trade. Your brokerage firm will confirm the trade and the market valued call option will be filled out accordingly.

Who needs market valued call option?

01

Investors looking for potential upside gains: Market valued call options can be appealing to investors who believe the price of an underlying asset will increase within a certain time frame. By purchasing call options, they can participate in the potential upside gains without committing to buying the asset outright.

02

Speculators seeking short-term trading opportunities: Traders who specialize in options trading and are experienced in analyzing market trends may use market valued call options as a way to generate short-term profits. They carefully assess market conditions and execute trades based on their expectations of price movements.

03

Portfolio hedgers: Market valued call options can serve as a form of insurance for investors who hold a large amount of a particular asset. By purchasing call options, they can protect against potential price declines, providing a level of risk management for their portfolio.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is market valued call option?

A market valued call option is a financial contract that gives the holder the right, but not the obligation, to purchase an asset at a specified price within a specific time frame.

Who is required to file market valued call option?

Individuals or entities who hold market valued call options are required to file the necessary forms with the relevant regulatory authorities.

How to fill out market valued call option?

To fill out a market valued call option, you will need to provide specific details about the asset, the strike price, the expiration date, and other relevant information.

What is the purpose of market valued call option?

The purpose of a market valued call option is to provide investors with the opportunity to profit from the price movements of an underlying asset without actually owning it.

What information must be reported on market valued call option?

Information such as the asset details, strike price, expiration date, and other relevant terms must be reported on the market valued call option.

How can I get market valued call option?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the market valued call option in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the market valued call option form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign market valued call option and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit market valued call option on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as market valued call option. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your market valued call option online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Market Valued Call Option is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.