Get the free Salary Deduction Form for All Others.doc

Show details

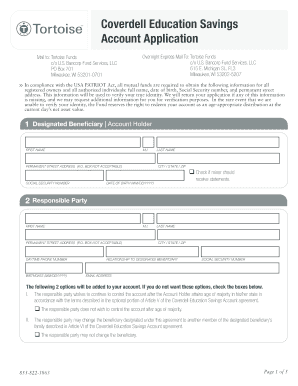

San Diego Community College District Taxed Sheltered Annuity Deduction Authorization Managers, Supervisors/Professional, Confidential, Military, SEU, College Police, Adult Educators Name (last, first,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary deduction form for

Edit your salary deduction form for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary deduction form for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary deduction form for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit salary deduction form for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary deduction form for

How to fill out a salary deduction form:

01

Obtain the form: The first step is to obtain the salary deduction form from your employer or human resources department. This form is typically required when you have certain expenses that need to be deducted from your salary, such as health insurance premiums, retirement contributions, or loan repayments.

02

Provide personal information: Start by filling out your personal information accurately. This includes your full name, employee identification number, and contact details. Make sure all the information provided is correct to avoid any issues with processing.

03

Specify deduction details: Next, you will need to specify the details of the deduction. This involves identifying the specific expense or reason for the deduction. For example, if you are deducting health insurance premiums, you will need to provide the name of the insurance provider and the amount to be deducted.

04

Provide supporting documents: In some cases, supporting documentation may be required to validate the deduction. For instance, if you are deducting childcare expenses, you may need to attach receipts or invoices to prove the expenses incurred. It is important to gather and attach all necessary documents accurately.

05

Review and sign: Before submitting the form, take a moment to review all the information you have provided. Double-check for any errors or omissions. Once you are confident that everything is accurate, sign the form in the designated area. Your signature acknowledges your understanding and agreement with the deductions mentioned.

Who needs a salary deduction form:

01

Employees with benefits: Employees who have benefits offered by their employers may need to fill out a salary deduction form. This form helps in deducting the necessary amount from their salary to cover these benefits, such as healthcare, dental, or vision insurance premiums, retirement contributions, or life insurance premiums.

02

Individuals with loan repayments: Those who have taken out loans from their employers, such as a tuition loan or relocation assistance, may be required to fill out a salary deduction form. This form allows the designated amount to be deducted from their salary until the loan is fully repaid.

03

Employees with voluntary deductions: Employees who choose to participate in voluntary programs like flexible spending accounts (FSAs) or health savings accounts (HSAs) need to fill out salary deduction forms. These forms enable the deduction of pre-tax funds from their paycheck, which can then be used for medical expenses or other eligible expenses.

In essence, anyone who has specific expenses or obligations that need to be deducted from their salary will likely need to fill out a salary deduction form. It is essential to follow the instructions provided and accurately complete the form to ensure seamless processing of the requested deductions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is salary deduction form for?

The salary deduction form is used to track and record any deductions made from an employee's salary, such as taxes, insurance, or any other withholdings.

Who is required to file salary deduction form for?

Employers are required to file salary deduction forms for each of their employees.

How to fill out salary deduction form for?

To fill out a salary deduction form, the employer needs to list the employee's name, salary, and all deductions made from their pay.

What is the purpose of salary deduction form for?

The purpose of the salary deduction form is to ensure that all deductions made from an employee's pay are accurately recorded and reported.

What information must be reported on salary deduction form for?

The salary deduction form must report the employee's name, salary, and a detailed list of all deductions taken from their pay.

How do I modify my salary deduction form for in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your salary deduction form for and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send salary deduction form for to be eSigned by others?

When you're ready to share your salary deduction form for, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit salary deduction form for on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign salary deduction form for. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your salary deduction form for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Deduction Form For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.