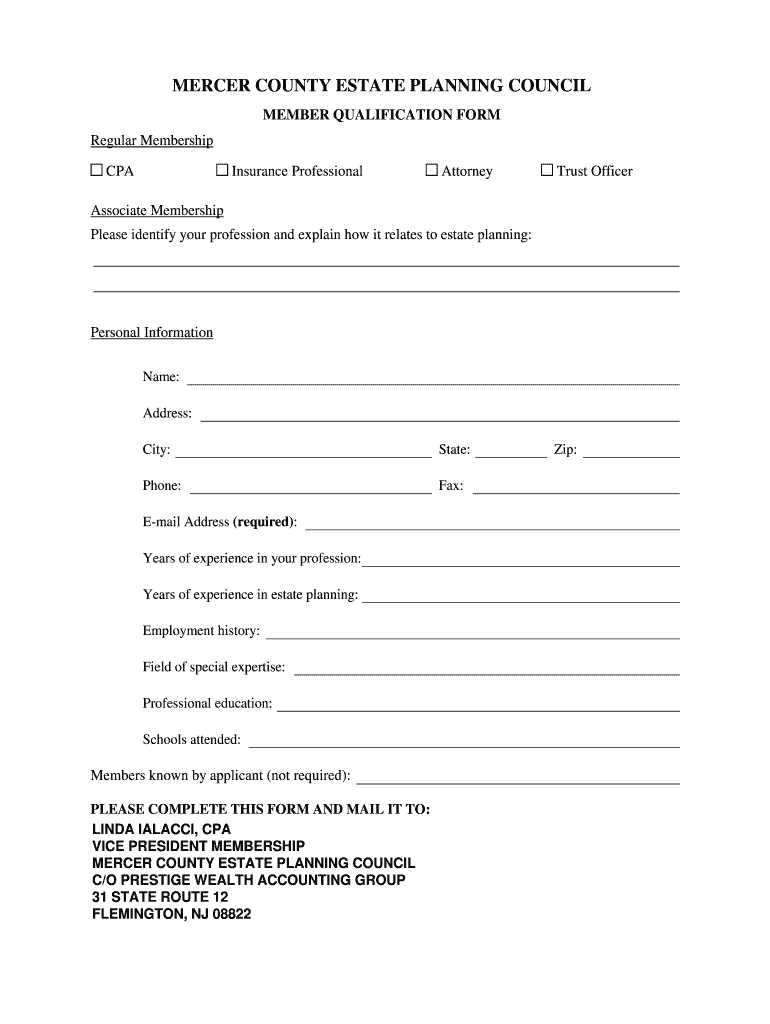

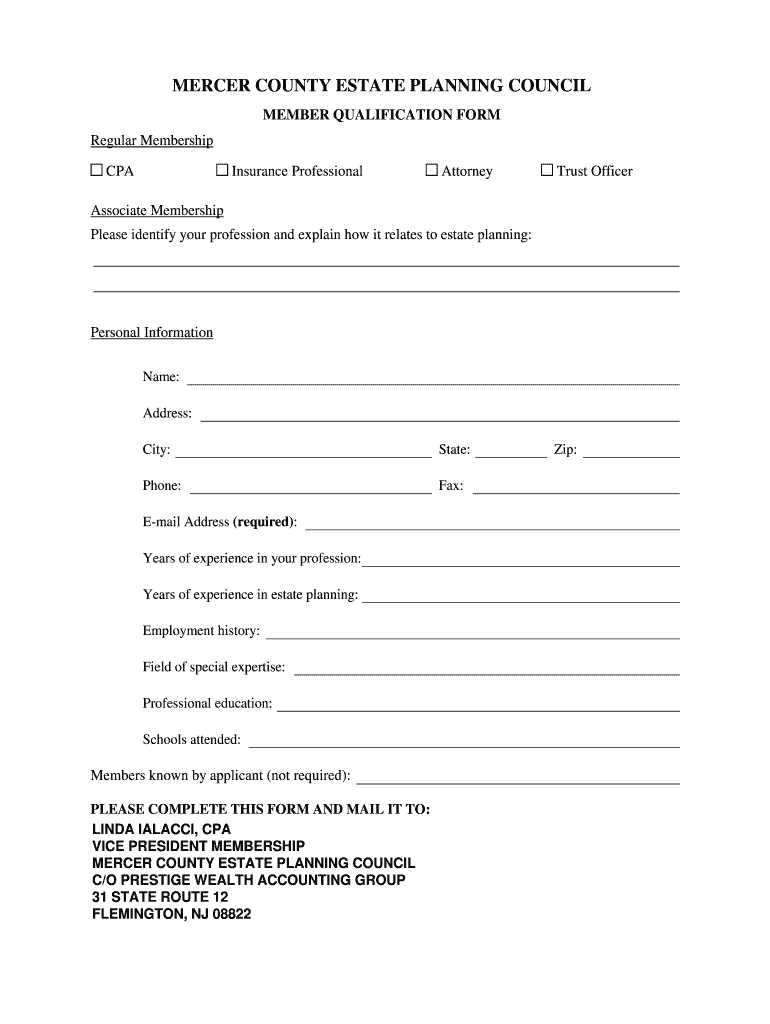

Get the free MERCER COUNTY ESTATE PLANNING COUNCIL - mercercountyestateplanningcouncil

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mercer county estate planning

Edit your mercer county estate planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mercer county estate planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mercer county estate planning online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mercer county estate planning. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mercer county estate planning

How to Fill Out Mercer County Estate Planning:

01

Gather necessary documents: Begin by collecting all relevant documents such as property deeds, investment statements, insurance policies, wills, trusts, and any other legal documents related to your assets and estate.

02

Assess your assets: Take an inventory of all your assets, including bank accounts, retirement accounts, real estate properties, vehicles, valuable possessions, and any other significant holdings. This step will help determine what needs to be included in your estate plan.

03

Identify beneficiaries: Decide who will inherit your assets and property after your passing. It is crucial to make clear and detailed instructions regarding your beneficiaries to avoid any confusion or disputes in the future.

04

Choose an executor: Select a trustworthy and responsible individual to serve as the executor of your estate. This person will be responsible for carrying out your wishes, paying off debts, distributing assets, and managing any legal matters.

05

Consider healthcare directives: Include advanced healthcare directives, such as a living will or healthcare power of attorney, to specify your preferences regarding medical treatment and end-of-life decisions. These directives ensure your wishes are respected if you are unable to communicate them yourself.

06

Consult with professionals: Seek guidance from an estate planning attorney who specializes in Mercer County laws and regulations. They will advise you on specific requirements and assist in drafting the necessary legal documents, such as wills, trusts, and healthcare directives.

Who needs Mercer County Estate Planning?

01

Individuals with significant assets: Anyone who owns valuable assets, such as real estate properties, investment portfolios, or business interests, should consider estate planning. Having a carefully crafted estate plan ensures the preservation and proper distribution of these assets according to your wishes.

02

Parents with minor children: Estate planning is particularly essential for parents with dependents. It allows you to designate guardianship for your children in case something happens to you, providing reassurance and protection for your loved ones.

03

Individuals with specific healthcare preferences: Those with specific healthcare preferences, such as religious or ethical considerations, should include healthcare directives in their estate plan. This ensures that their medical treatment aligns with their beliefs and values, even if they are unable to communicate them personally.

04

Business owners: If you own a business or have significant business interests, estate planning helps ensure a smooth transition and continuity of operations. This can involve outlining succession plans or incorporating business-specific provisions into your estate plan.

05

Individuals concerned about privacy and control: Estate planning can also provide privacy and control over your assets and personal affairs. By establishing trusts or implementing other estate planning strategies, you can protect your estate from public probate proceedings and exert more control over its distribution.

Remember, estate planning is a highly personalized process, and it is advisable to seek professional advice to ensure your plan meets all legal requirements and addresses your specific needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mercer county estate planning without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including mercer county estate planning, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete mercer county estate planning online?

pdfFiller has made it easy to fill out and sign mercer county estate planning. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the mercer county estate planning form on my smartphone?

Use the pdfFiller mobile app to fill out and sign mercer county estate planning. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is mercer county estate planning?

Mercer County estate planning refers to the process of arranging for the management and distribution of a person's assets and wealth after their death.

Who is required to file mercer county estate planning?

Individuals who have assets and wealth to be distributed after their death are required to file Mercer County estate planning.

How to fill out mercer county estate planning?

Mercer County estate planning can be filled out with the assistance of an estate planning attorney or by using online estate planning tools.

What is the purpose of mercer county estate planning?

The purpose of Mercer County estate planning is to ensure that a person's assets are distributed according to their wishes after they pass away.

What information must be reported on mercer county estate planning?

Mercer County estate planning typically requires information about assets, beneficiaries, guardians for minor children, and funeral arrangements.

Fill out your mercer county estate planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mercer County Estate Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.