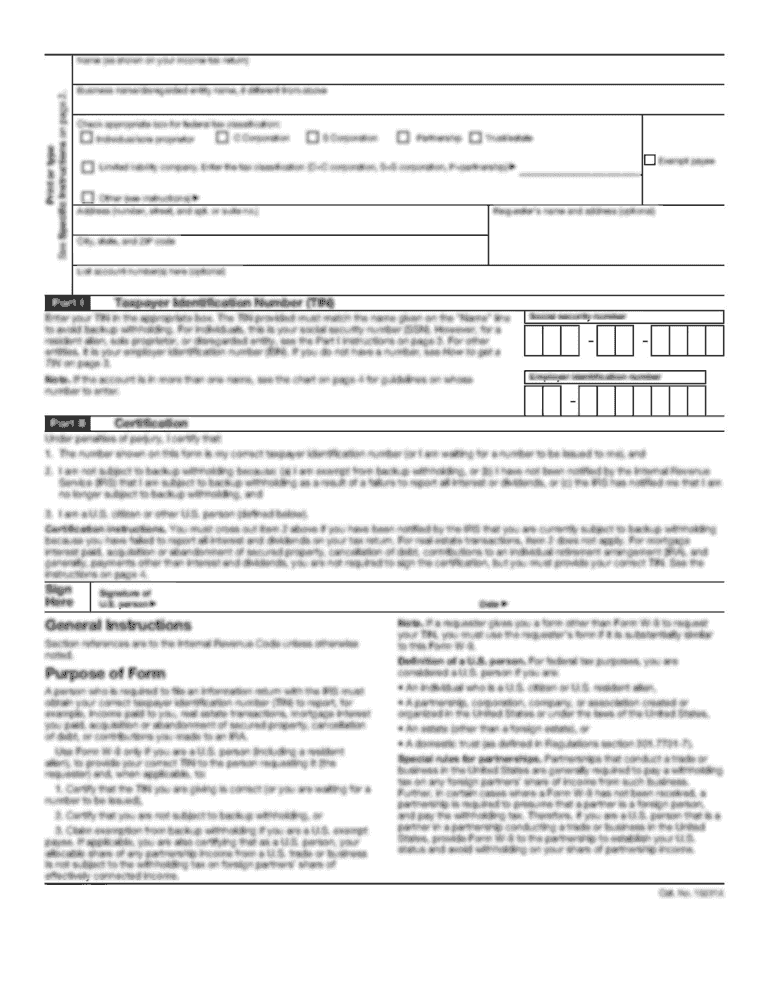

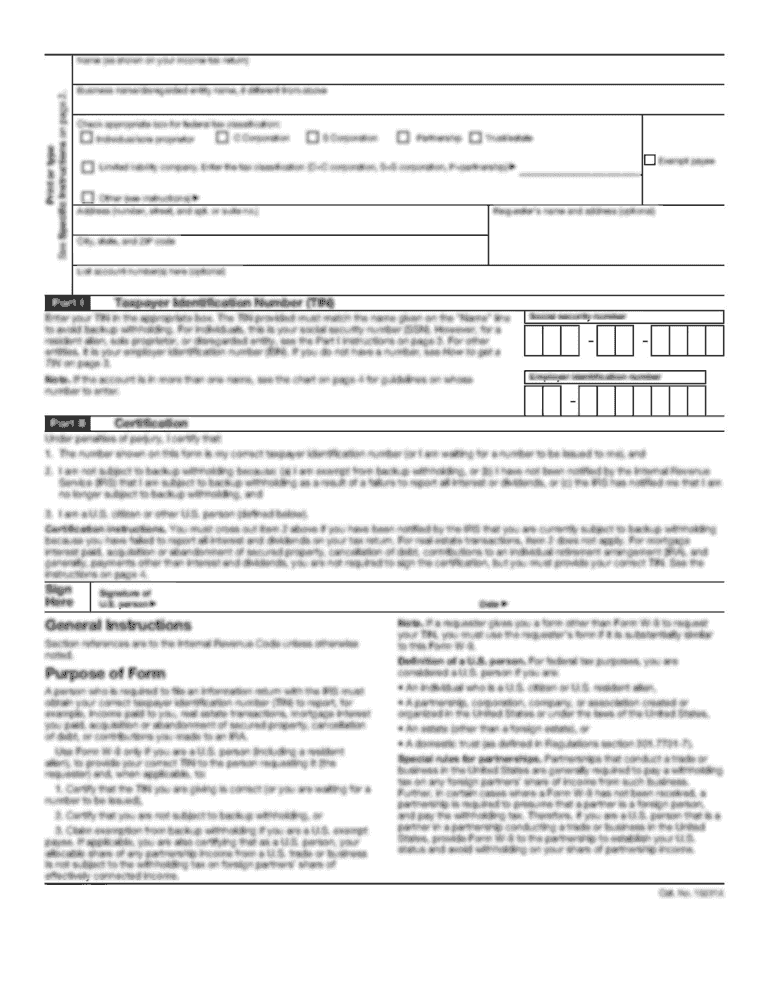

Accountable Financial Planning Personal Information Collection Sheet 2012-2026 free printable template

Show details

This document is designed to collect personal and financial information from clients and co-clients for the purpose of providing financial planning services. It includes fields for personal details,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign financial planning data gathering form

Edit your data gathering form for financial plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial planning data gathering form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit data sheet online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Accountable Financial Planning Personal Information Collection. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Accountable Financial Planning Personal Information Collection

How to fill out Accountable Financial Planning Personal Information Collection Sheet

01

Start with your personal details: Enter your full name as it appears on legal documents.

02

Provide your contact information: Fill in your phone number, email address, and mailing address.

03

Enter your date of birth: Ensure that the format is correct (MM/DD/YYYY).

04

Fill out family information: Include details about your spouse and dependents, if applicable.

05

Disclose financial information: List your income sources, assets, and any liabilities you have.

06

Provide your employment details: Include your current job title, employer name, and length of employment.

07

Specify your financial goals: Write down short-term and long-term financial objectives.

08

Review for accuracy: Double-check all entries for errors before submission.

Who needs Accountable Financial Planning Personal Information Collection Sheet?

01

Individuals seeking personalized financial guidance and planning services.

02

Couples looking to manage joint finances effectively.

03

Families wanting to plan for education, retirement, and other major life events.

04

Anyone looking to gain a deeper understanding of their financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Accountable Financial Planning Personal Information Collection in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Accountable Financial Planning Personal Information Collection and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify Accountable Financial Planning Personal Information Collection without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including Accountable Financial Planning Personal Information Collection, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send Accountable Financial Planning Personal Information Collection to be eSigned by others?

Once you are ready to share your Accountable Financial Planning Personal Information Collection, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

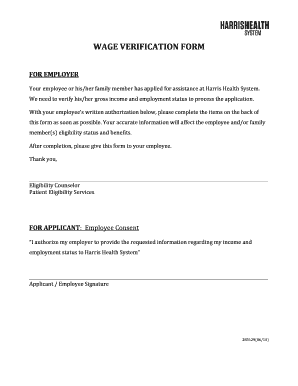

What is Accountable Financial Planning Personal Information Collection Sheet?

The Accountable Financial Planning Personal Information Collection Sheet is a document used by financial planners to gather essential personal information from clients to create tailored financial plans.

Who is required to file Accountable Financial Planning Personal Information Collection Sheet?

Individuals seeking financial planning services or advice from a financial planner are required to fill out the Accountable Financial Planning Personal Information Collection Sheet.

How to fill out Accountable Financial Planning Personal Information Collection Sheet?

To fill out the Accountable Financial Planning Personal Information Collection Sheet, clients should provide accurate and complete information regarding their financial situation, goals, assets, liabilities, income, and any other relevant personal details as instructed.

What is the purpose of Accountable Financial Planning Personal Information Collection Sheet?

The purpose of the Accountable Financial Planning Personal Information Collection Sheet is to facilitate the collection of necessary personal and financial information to help financial planners understand clients' needs and develop appropriate financial strategies.

What information must be reported on Accountable Financial Planning Personal Information Collection Sheet?

The information that must be reported includes personal identification details, income sources, expenses, assets, liabilities, financial goals, insurance coverage, and any other relevant financial data.

Fill out your Accountable Financial Planning Personal Information Collection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accountable Financial Planning Personal Information Collection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.