WI PW-1 2013 free printable template

Show details

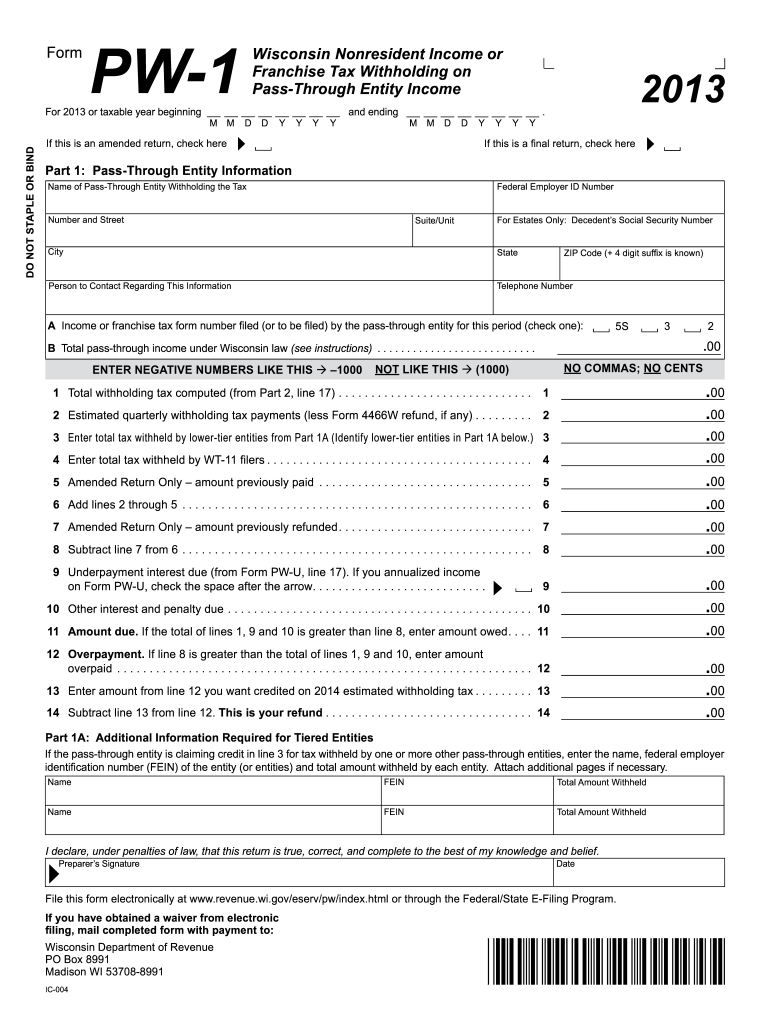

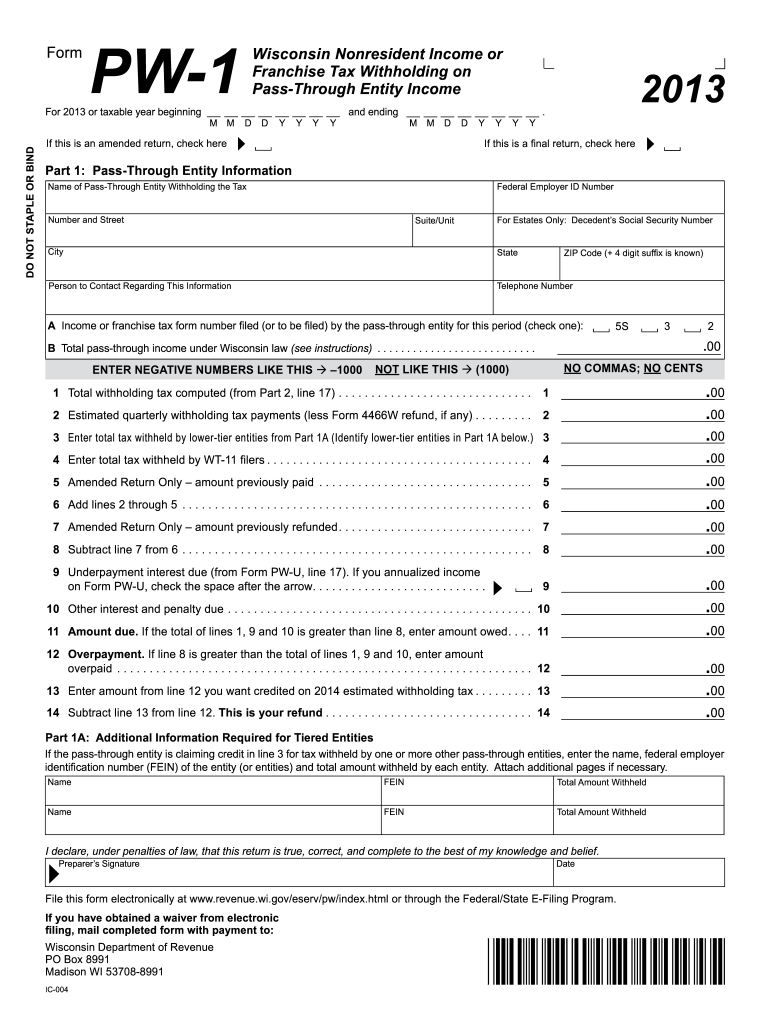

Form PW-1 DO NOT STAPLE OR BIND For 2013 or taxable year beginning M Wisconsin Nonresident Income or Franchise Tax Withholding on Pass-Through Entity Income D Y Y Y Y and ending M D If this is an

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI PW-1

Edit your WI PW-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI PW-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI PW-1 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI PW-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI PW-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI PW-1

How to fill out WI PW-1

01

Begin by downloading the WI PW-1 form from the official Wisconsin Department of Revenue website.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the type of income you are reporting, such as wages, tips, or other compensation.

04

Complete the sections regarding deductions and exemptions, if applicable.

05

Calculate your total income and any taxes owed following the instructions provided on the form.

06

Review your completed form for accuracy to ensure all information is correctly entered.

07

Sign and date the form before submission.

08

Submit the form by mail or electronically as instructed on the official website.

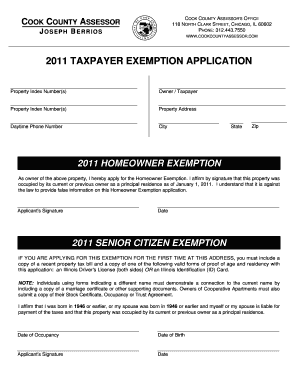

Who needs WI PW-1?

01

Individuals who are Wisconsin residents and need to report income and wages for tax purposes.

02

Employees receiving wages or tips from employers in Wisconsin.

03

Self-employed individuals who must report their income to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for filing PW 1 late in Wisconsin?

Interest, penalties, and fees apply if the pass-through entity files Form PW-1 later than the unextended due date of its income or franchise tax return or files after the extended due date. A $50 late filing fee applies for returns filed after the extension date.

What is Wisconsin pw-2?

Member, Shareholder, or Beneficiary. Pass-Through Withholding Exemption Affidavit. Form. Form PW-2 is filed by nonresident owners (partners, members, shareholders, or beneficiaries) to request an exemption from withhold- ing on income from a pass-through entity.

How do I find my Wisconsin withholding number?

Find Your Wisconsin Tax ID Numbers and Rates Look up your Department of Revenue Tax Number online by selecting “Look up account number and filing frequency.” Locate your Department of Revenue Tax Number on any previously filed quarterly tax return (WT-6). Call the Department of Revenue at 608-266-2776.

Do I need a Wisconsin withholding tax number?

Every employer who is required to withhold Wisconsin income tax must register with the Wisconsin Department of Revenue for a Wisconsin withholding tax account number.

How do I know if I am exempt from Wisconsin withholding?

Employee is a resident of a state with which Wisconsin has a reciprocity agreement. Wisconsin currently has reciprocity agreements with Illinois, Indiana, Kentucky, and Michigan. If you employ residents of those states, you are not required to withhold Wisconsin income taxes from wages paid to such employees.

What is form pw 1 payment Wisconsin?

What form is PW 1 in Wisconsin? Note: Form PW-1 is used to compute the entity's passthrough withholding tax liability for the year. The computation includes withholding received from lower-tier entities or from Form WT-11 payments made on the entity's behalf.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute WI PW-1 online?

Completing and signing WI PW-1 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit WI PW-1 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing WI PW-1 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the WI PW-1 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your WI PW-1 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is WI PW-1?

WI PW-1 is a tax form known as the Wisconsin Partnership Withholding Tax Form, used by partnerships to report and remit withholding taxes on non-resident partners' income.

Who is required to file WI PW-1?

Partnerships that have non-resident partners earning income in Wisconsin are required to file WI PW-1 to report and remit the withholding tax.

How to fill out WI PW-1?

To fill out WI PW-1, partnerships must provide their identification information, detail the non-resident partners' income, calculate the withholding tax based on the applicable rates, and submit the form to the Wisconsin Department of Revenue.

What is the purpose of WI PW-1?

The purpose of WI PW-1 is to ensure that Wisconsin taxes are collected on income earned by non-resident partners, helping to facilitate compliance with state tax laws.

What information must be reported on WI PW-1?

Information that must be reported on WI PW-1 includes the name and address of the partnership, the names and addresses of non-resident partners, the amount of income allocated to each partner, and the corresponding withholding tax amount.

Fill out your WI PW-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI PW-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.