Clergy Housing Allowance Worksheet 2010-2025 free printable template

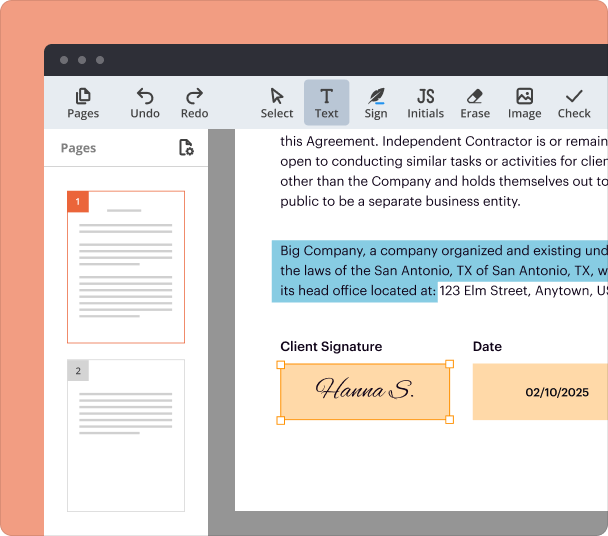

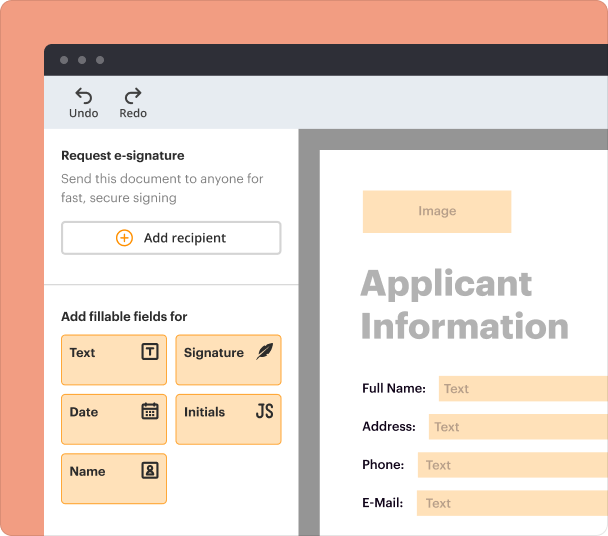

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

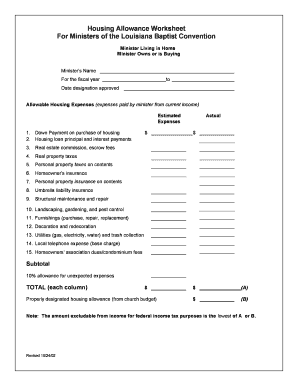

Understanding the Clergy Housing Allowance Worksheet Form

What is the clergy housing allowance worksheet form

The clergy housing allowance worksheet form is a document used by clergy members to determine the eligible housing allowance for tax purposes. This form outlines various housing expenses and assists in calculating the total amount that can be excluded from taxable income. Understanding this form is crucial for clergy to manage their finances well and comply with IRS regulations.

Key features of the clergy housing allowance worksheet form

This worksheet includes important sections where individuals can report actual housing costs, including mortgage payments, property taxes, insurance, and utilities. It facilitates the organization of various expenses and calculates the total housing allowance, ensuring that clergy can accurately report their housing-related financial details.

When to use the clergy housing allowance worksheet form

Clergy should use this worksheet annually when preparing their tax returns. It is especially important to complete this form if the church or employer has designated a housing allowance. Completing the form helps clergy maximize their tax benefits associated with housing.

How to fill the clergy housing allowance worksheet form

Filling out the clergy housing allowance worksheet requires specific information related to housing costs. Start by detailing actual expenses incurred during the year, such as mortgage and utility payments. Next, calculate the total housing expenses and compare it with the officially designated housing allowance from the church. Utilize current real estate rental values to evaluate housing allowances accurately.

Best practices for accurate completion

To ensure accurate completion of the worksheet, keep thorough records of all housing-related expenses throughout the year. Cross-verify figures for accuracy, and consult tax professionals if questions arise. It is also beneficial to review the worksheet with a church financial advisor to confirm alignment with IRS guidelines and to optimize the housing allowance.

Common errors and troubleshooting

Common errors include miscalculating total expenses, omitting essential costs, or failing to verify the designated housing allowance amount. To troubleshoot, carefully review each section of the form against receipts and bank statements, ensuring all applicable expenses are included. If discrepancies occur, adjusting entries based on bank statements or expense logs can minimize errors.

Frequently Asked Questions about clergy allowance worksheet form

Who needs the clergy housing allowance worksheet form?

Clergy members who wish to claim a housing allowance for tax exemption must complete this worksheet. It is typically required for pastors, rabbis, and other religious leaders who receive a designated housing allowance from their employing church or religious organization.

pdfFiller scores top ratings on review platforms