Get the free IRA Distribution Form - eOption

Show details

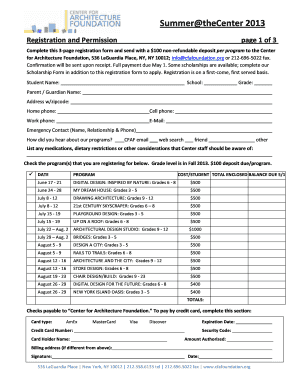

Approval for Distribution of IRAs, SEP/IRAs, Roth IRAs, & Cover dell Education Savings Trust Accounts Mailing Address: P.O. Box 8963 Wilmington, DE 19899-8963 800-209-9010 Fax: 302-999-9554 Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira distribution form

Edit your ira distribution form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira distribution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira distribution form online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ira distribution form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira distribution form

How to fill out an IRA distribution form:

01

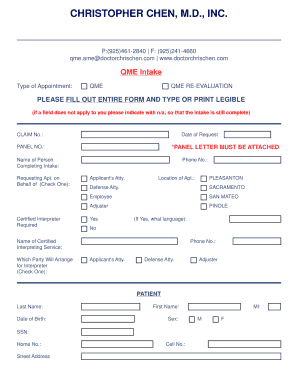

Start by gathering all the necessary documents. You will need your IRA account information, including account number, account balance, and the type of distribution you want to take (e.g., lump sum, periodic payments, etc.).

02

Carefully read the instructions provided with the IRA distribution form. This will give you a clear understanding of the requirements and any specific details you need to provide.

03

Begin filling out the form by entering your personal information, such as your name, address, and social security number. Make sure all the information is accurate and up-to-date.

04

Specify the type of distribution you want to take from your IRA. If you are unsure, consult with a financial advisor or tax professional to make the best decision for your financial situation.

05

If you are opting for periodic payments, indicate the frequency and duration of these payments. You may also need to specify the payment method (e.g., check, direct deposit).

06

If you are taking a lump sum distribution, make sure to indicate the exact amount you wish to withdraw. Be mindful of any tax implications or penalties associated with early withdrawals.

07

Consider whether you want to have taxes withheld from your distribution or if you prefer to handle tax payments separately. If you choose to have taxes withheld, specify the percentage to be withheld.

08

If you have designated any beneficiaries for your IRA, ensure that you update their information accordingly on the form. This is important for accurate record-keeping and distribution of funds in the future.

09

Review the form thoroughly before submitting it. Double-check all the information provided and make any necessary corrections or additions. Any mistakes could lead to delays or complications in processing your distribution.

10

Once you are confident that all information is accurate, sign and date the IRA distribution form. Keep a copy for your records and submit it to the appropriate entity according to the instructions provided.

Who needs an IRA distribution form?

01

Individuals who have an Individual Retirement Account (IRA) and wish to make a withdrawal or take a distribution from their account.

02

Anyone who has reached the age of 59 ½ and wants to start accessing their retirement savings.

03

Individuals who are facing financial difficulties or unforeseen circumstances and need to access their IRA funds.

04

Beneficiaries who have inherited an IRA and need to take distributions according to the rules and regulations governing inherited IRAs.

05

Individuals who want to rollover their IRA funds into another retirement account or a different investment vehicle.

06

People who are nearing retirement age and want to carefully plan their IRA distributions to ensure a steady income stream throughout their retirement years.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira distribution form?

IRA distribution form is a form that individuals use to request a distribution from their Individual Retirement Account (IRA).

Who is required to file ira distribution form?

Individuals who want to take a distribution from their IRA are required to file an IRA distribution form.

How to fill out ira distribution form?

To fill out an IRA distribution form, individuals need to provide their personal information, IRA account details, distribution amount and method, and any applicable tax withholding preferences.

What is the purpose of ira distribution form?

The purpose of an IRA distribution form is to request a distribution from an IRA account, which may be subject to taxes and penalties depending on the individual's age and circumstances.

What information must be reported on ira distribution form?

Information such as the individual's name, address, social security number, IRA account number, distribution amount, distribution method, and any tax withholding preferences must be reported on an IRA distribution form.

How can I edit ira distribution form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your ira distribution form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out ira distribution form using my mobile device?

Use the pdfFiller mobile app to complete and sign ira distribution form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I fill out ira distribution form on an Android device?

Use the pdfFiller mobile app and complete your ira distribution form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your ira distribution form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Distribution Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.