Get the free COMMERCIAL CAPITAL

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial capital

Edit your commercial capital form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial capital form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial capital online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit commercial capital. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

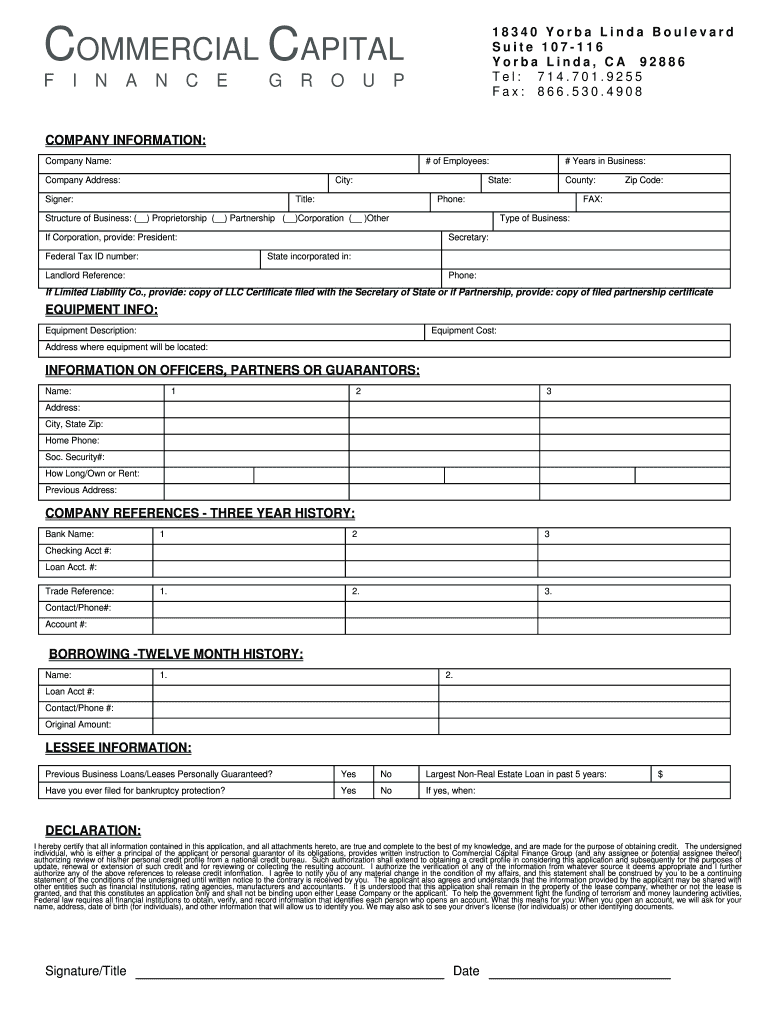

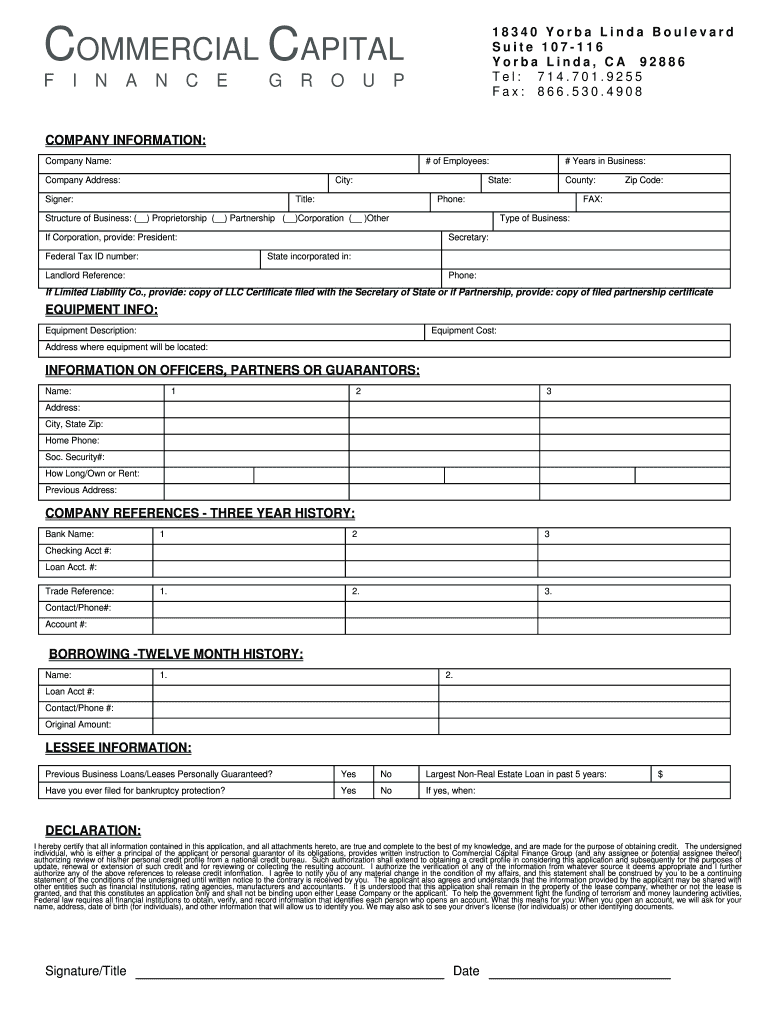

How to fill out commercial capital

How to Fill Out Commercial Capital:

01

Understand the purpose: Before filling out the commercial capital, it is important to understand its purpose. Commercial capital refers to the funds that a business or organization requires to start or expand its operations. It can be used for purchasing assets, covering operating costs, or investing in growth opportunities.

02

Identify funding sources: To fill out commercial capital, you need to identify potential funding sources available to your business. This could include traditional banks, credit unions, private investors, venture capitalists, crowdfunding platforms, or government-backed loans. Research each option to determine which one aligns best with your business needs and financial situation.

03

Prepare a business plan: A well-prepared business plan is crucial when seeking commercial capital. It should include detailed information about your business, market analysis, financial projections, and growth strategies. The business plan will provide lenders or investors with confidence in your ability to manage funds and generate a return on investment.

04

Gather necessary documents: Different funding sources usually require specific documents to evaluate your eligibility for commercial capital. Common documents include financial statements, tax returns, business licenses, permits, contracts, and personal identification. Prepare these documents in advance to speed up the application process.

05

Determine the loan amount: Calculate the specific amount of funding you need for your business. This will depend on the purpose of the capital, such as purchasing equipment, leasing a commercial space, hiring employees, or developing a new product. Having a clear understanding of the required loan amount will help in filling out the commercial capital application accurately.

06

Complete the application: Once you have researched your funding options, prepared your business plan, and gathered the necessary documents, it's time to fill out the commercial capital application. Follow the instructions provided by the lender or funding platform and provide accurate and relevant information. Double-check your application for any errors or missing details before submission.

07

Submit and follow up: After completing the application, submit it to the chosen funding source. Some lenders may require additional information or documents, so it's important to stay in touch and promptly respond to any requests. Track the progress of your application and follow up if there are any delays or issues.

Who Needs Commercial Capital?

01

Startups: Business ventures that are just starting often require commercial capital to cover initial costs such as equipment, marketing, hiring staff, and securing a commercial space. Startups often lack sufficient cash flow in the beginning stages, making commercial capital vital for their survival and growth.

02

Small Businesses: Small businesses looking to expand operations, introduce new products or services, or enter new markets often require commercial capital to finance these endeavors. It allows them to invest in marketing campaigns, technology upgrades, inventory, or larger-scale production facilities.

03

Established Companies: Even well-established companies may require commercial capital for various reasons. They might want to fund mergers or acquisitions, invest in research and development, expand into international markets, or renovate existing facilities. Commercial capital provides the financial flexibility needed to keep growing and adapting to changing business environments.

In conclusion, filling out commercial capital involves understanding its purpose, identifying funding sources, preparing a business plan, gathering necessary documents, determining the loan amount, completing the application, and following up. Commercial capital is essential for startups, small businesses, and established companies alike, enabling them to finance their operations, expansion plans, and strategic initiatives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit commercial capital in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your commercial capital, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the commercial capital electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my commercial capital in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your commercial capital right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your commercial capital online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Capital is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.