Get the free AZ Form 301 Nonrefundable Individual Tax Credits and Recapture.

Instructions and Help about az form 301 nonrefundable

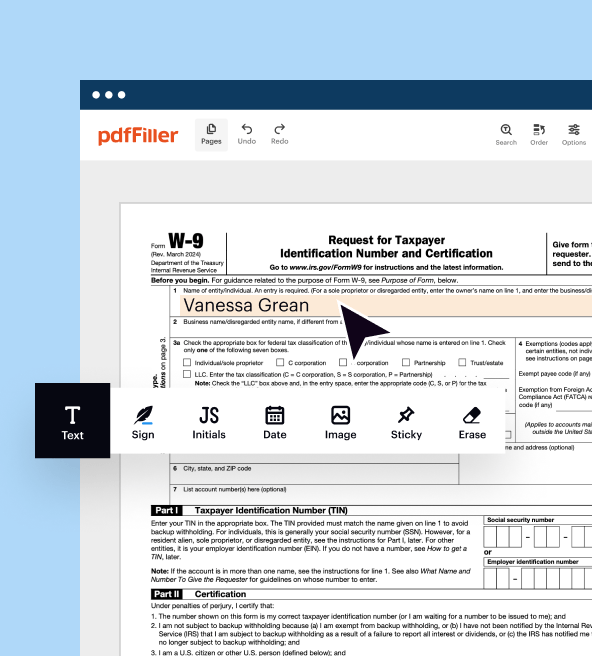

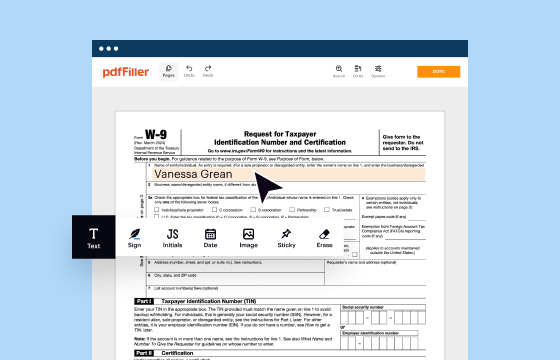

How to edit az form 301 nonrefundable

How to fill out az form 301 nonrefundable

Latest updates to az form 301 nonrefundable

All You Need to Know About az form 301 nonrefundable

What is az form 301 nonrefundable?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

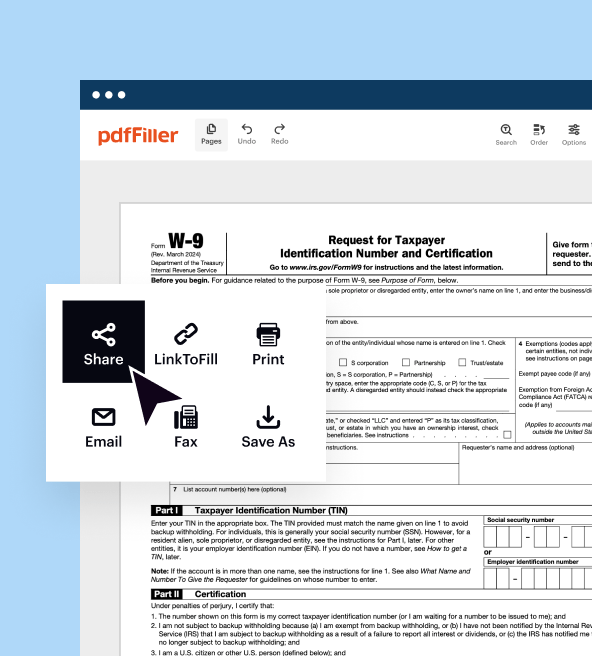

Where do I send the form?

FAQ about az form 301 nonrefundable

What should I do if I need to correct a mistake on my az form 301 nonrefundable after submission?

If you need to correct a mistake on your az form 301 nonrefundable, you can submit an amended return. Ensure that you clearly indicate the changes made and reference any previous submissions. It's recommended to keep a copy of both the original and amended forms for your records.

How can I verify the status of my az form 301 nonrefundable after filing?

To verify the status of your az form 301 nonrefundable, you can check online through the appropriate state department's website. Typically, they provide a tracking feature where you can enter your details to see if your form has been received and is being processed.

Are there any common errors to avoid when filing the az form 301 nonrefundable?

Yes, common errors include mismatched names or identification numbers and incomplete sections of the form. Carefully double-check all information before submission to minimize the chance of rejection or delays in processing.

What should I do if my az form 301 nonrefundable submission is rejected?

If your az form 301 nonrefundable submission is rejected, review the rejection code provided and rectify the identified issue. After making corrections, you can re-submit the form to avoid further complications.

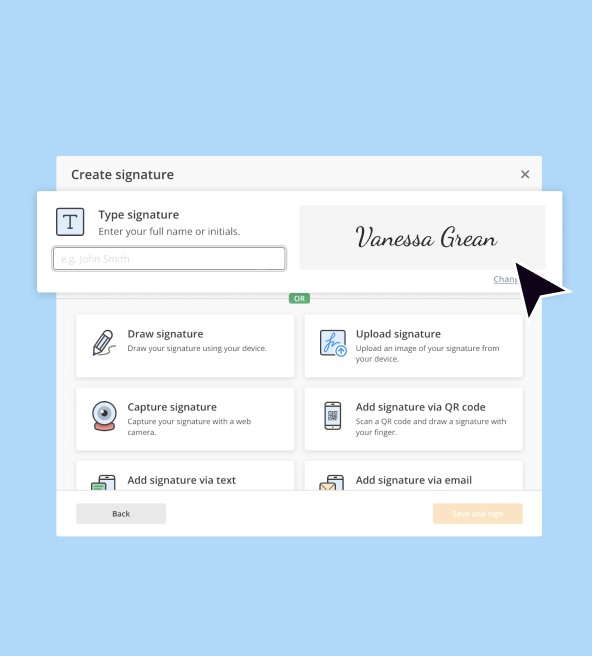

Is an e-signature acceptable for filing the az form 301 nonrefundable?

Yes, an e-signature is acceptable for filing the az form 301 nonrefundable, provided it meets the specific requirements outlined by the state. Always ensure that your e-signature complies with legal standards to avoid issues.