Get the free private mortgage insurance

Show details

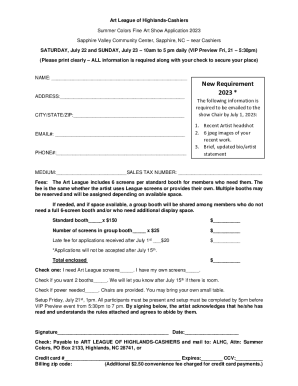

HPA HOMEOWNERSMGICPROTECTION ACT OF 1998pmi private mortgage insurance cancellationMortgage Guaranty Insurance Corporation MAGIC Plaza, Milwaukee, Wisconsin 53202 www.mgic.com 2010 Mortgage Guaranty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private mortgage insurance

Edit your private mortgage insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private mortgage insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing private mortgage insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit private mortgage insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private mortgage insurance

How to fill out private mortgage insurance:

01

Gather all necessary documents: Before filling out private mortgage insurance (PMI), ensure you have important documents such as loan terms, income proof, credit history, and property information readily available.

02

Understand the PMI application process: Study the application form and instructions provided by the PMI provider or lender. Familiarize yourself with the specific requirements and guidelines for filling out the form accurately.

03

Complete personal information: Begin by entering your personal details, including your full name, contact information, social security number, and current address. Provide accurate information to avoid any delays or complications.

04

Provide loan details: Indicate the relevant details regarding your mortgage loan, including the loan amount, interest rate, and term. These details help assess the risk and calculate the premium for the PMI.

05

Submit income verification: To support your application, include documents such as pay stubs, tax returns, or bank statements that demonstrate your income and ability to make mortgage payments.

06

Provide credit history: PMI providers evaluate your creditworthiness to determine the premium rate. Include information about your credit score, outstanding debts, and any previous bankruptcies or foreclosures.

07

Specify property information: Enter details about the property, including its address, market value, and appraisal. This information assists in determining the loan-to-value ratio.

08

Review and submit: Once you have completed filling out the PMI application form, carefully review all the information provided for accuracy. Make any necessary amendments or corrections before submitting the application to your lender or PMI provider.

Who needs private mortgage insurance:

01

Borrowers with less than 20% down payment: Private mortgage insurance generally applies to borrowers who make a down payment of less than 20% of the home's purchase price or appraised value. It acts as protection for the lender against potential default.

02

Conventional loan applicants: Private mortgage insurance is typically required for borrowers applying for conventional mortgage loans, which are not insured or guaranteed by government entities such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA).

03

High-risk borrowers: Individuals with lower credit scores or a history of late payments may be perceived as high-risk borrowers. In such cases, lenders may require private mortgage insurance to mitigate the risk involved in lending to these borrowers.

04

Homebuyers seeking lower monthly payments: Private mortgage insurance allows homebuyers to secure a loan with a smaller down payment, reducing the initial financial burden. By spreading the cost of the mortgage insurance premium over monthly payments, borrowers can achieve more affordable mortgage installments.

Note: Private mortgage insurance requirements may vary depending on the lender and the specific loan program. It is advisable to consult with your lender or mortgage professional to understand the precise guidelines and requirements for filling out private mortgage insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in private mortgage insurance without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing private mortgage insurance and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit private mortgage insurance on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign private mortgage insurance. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out private mortgage insurance on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your private mortgage insurance. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is private mortgage insurance?

Private mortgage insurance is a type of insurance that protects the lender in case the borrower defaults on the loan.

Who is required to file private mortgage insurance?

Borrowers who put down less than 20% of the home's purchase price are typically required to have private mortgage insurance.

How to fill out private mortgage insurance?

Private mortgage insurance is typically arranged by the lender and is included in the monthly mortgage payment.

What is the purpose of private mortgage insurance?

The purpose of private mortgage insurance is to protect the lender in case the borrower defaults on the loan.

What information must be reported on private mortgage insurance?

The policy number, coverage amount, and premium amount must be reported on private mortgage insurance.

Fill out your private mortgage insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Mortgage Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.