Get the free Online Payment Tracking Guide

Show details

Online Payment Tracking Guideline Payment Tracking Guide

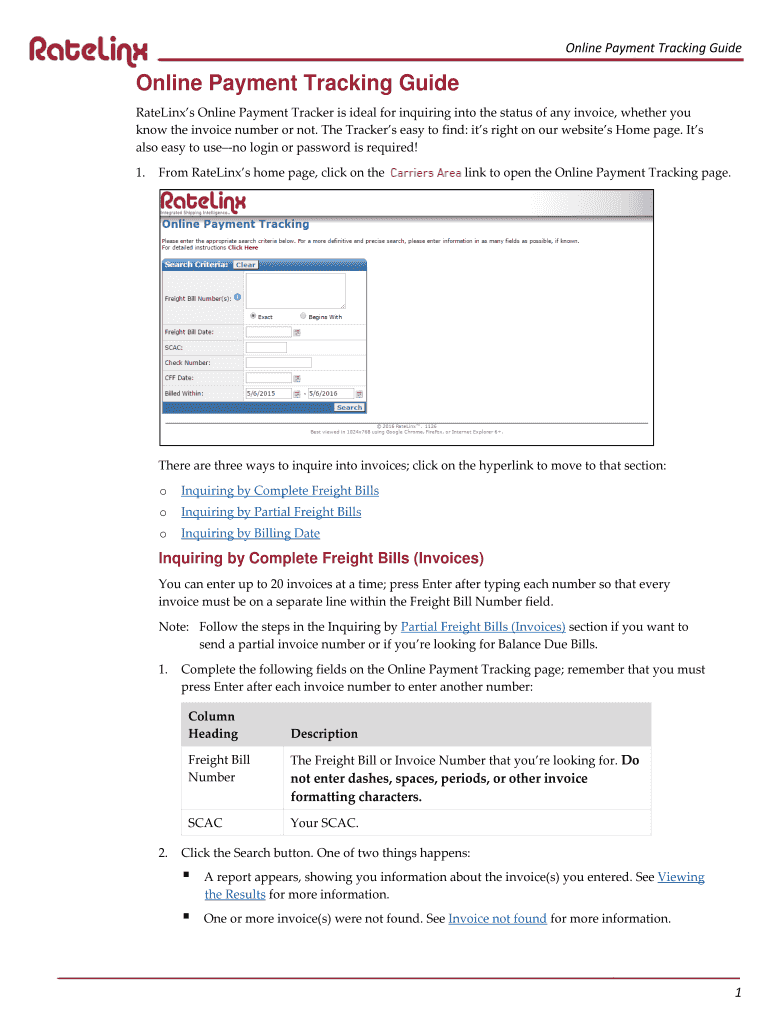

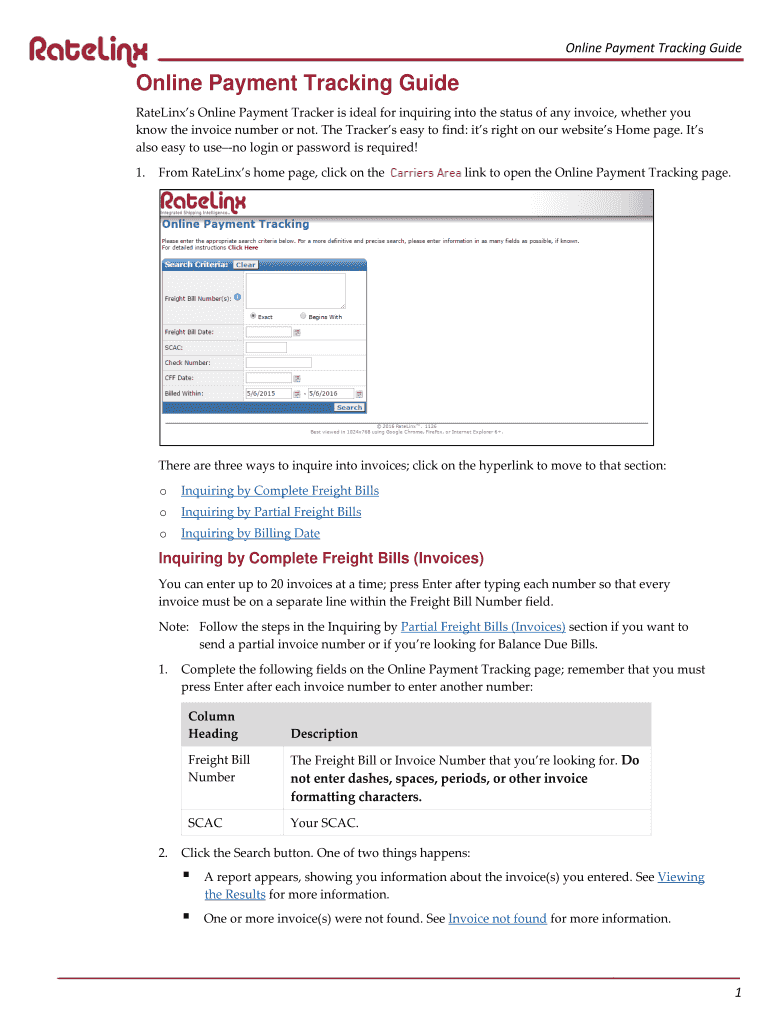

Ratlines Online Payment Tracker is ideal for inquiring into the status of any invoice, whether you

know the invoice number or not. The Trackers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign online payment tracking guide

Edit your online payment tracking guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online payment tracking guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing online payment tracking guide online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit online payment tracking guide. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out online payment tracking guide

How to fill out an online payment tracking guide:

01

Start by gathering all necessary information: Make sure you have all the relevant payment details, such as invoice numbers, payment dates, and amounts.

02

Choose a reliable online payment tracking tool: There are various online payment tracking tools available, such as QuickBooks, PayPal, or specialized software specific to your industry. Select one that aligns with your needs and preferences.

03

Set up your accounts: Create an account on the chosen online payment tracking tool and configure your settings. This may involve inputting your business details, preferred currency, and linking your bank account for accurate tracking.

04

Add payment sources: Connect your various payment sources to the tracking tool. This can include credit cards, bank accounts, online payment systems, or any other sources from which you receive payments.

05

Enter payment information: Start recording your payment data by entering details like the payment date, customer name, payment method, and invoice number. Be consistent in how you input information to maintain accuracy.

06

Categorize payments: Organize your payments into categories to facilitate tracking and analysis. This may include creating categories such as sales, refunds, expenses, or different types of income.

07

Track invoices and due dates: Keep track of outstanding invoices and their due dates. This will help you monitor unpaid bills and stay on top of your cash flow.

08

Regularly reconcile transactions: Reconcile your recorded payments with your bank statements to ensure accuracy. This step helps identify any discrepancies or missing transactions.

09

Generate reports: Utilize the reporting features of your chosen online payment tracking tool to gain insights into your payment history, cash flow, and financial trends. These reports can be handy for financial planning and decision-making.

Who needs an online payment tracking guide?

01

Small business owners: Tracking payments is crucial for small business owners to maintain accurate financial records, monitor cash flow, and ensure timely invoice payments.

02

Freelancers and contractors: Individuals who work on freelance projects or offer contract-based services can benefit from tracking payments to ensure accurate billing and manage their income effectively.

03

Non-profit organizations: Non-profit organizations must track donations, grants, and other forms of contributions accurately to maintain transparency and comply with regulations.

04

E-commerce businesses: With numerous online transactions, e-commerce businesses need to track payments efficiently to manage customer orders, refunds, and inventory.

05

Individuals managing personal finances: Those who want to keep tabs on their personal income, expenses, and bill payments can use online payment tracking tools to simplify the process and maintain financial organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send online payment tracking guide to be eSigned by others?

Once you are ready to share your online payment tracking guide, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit online payment tracking guide on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing online payment tracking guide, you can start right away.

How do I edit online payment tracking guide on an iOS device?

Create, edit, and share online payment tracking guide from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is online payment tracking guide?

Online payment tracking guide is a tool used to monitor and keep record of online payments.

Who is required to file online payment tracking guide?

Any business or individual who receives online payments is required to file an online payment tracking guide.

How to fill out online payment tracking guide?

You can fill out online payment tracking guide by entering details of each online payment received, including date, amount, and payer information.

What is the purpose of online payment tracking guide?

The purpose of online payment tracking guide is to maintain accurate records of online payments for financial and regulatory purposes.

What information must be reported on online payment tracking guide?

Information such as date of payment, amount received, name of payer, and method of payment must be reported on online payment tracking guide.

Fill out your online payment tracking guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Payment Tracking Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.