NY RS 5042 2016 free printable template

Get, Create, Make and Sign NY RS 5042

How to edit NY RS 5042 online

Uncompromising security for your PDF editing and eSignature needs

NY RS 5042 Form Versions

How to fill out NY RS 5042

How to fill out NY RS 5042

Who needs NY RS 5042?

Instructions and Help about NY RS 5042

Public employee pensions are under the microscope some in the media and government continue to unfairly cast defined benefit pension plans as unsustainable but here in New York that storyline just doesn't hold water our pension fund is strong secure and sustainable State Controller Thomas P Dipole all public pension systems are not equal the advantage we have in New York is that we have a well-funded strong public pension system or investments continue to do well in fact the New York State common retirement fund is as strong as it has ever been and is now valued and more than 160 billion dollars we have regained the historic losses sustained during the Great Recession and then some, but these past few years have not been pain-free contribution rates rose significantly after the market collapse at the start of the Great Recession and the rates that we charge our employers to certainly hire them we'd like them to be the good news is the rates are starting to decrease depending on market conditions I certainly hope and expect that that trend will continue downward some critics suggest moving workers out of defined benefit pension plans in into individual retirement accounts but time and again controller Dipole has said not on his watch dollar-for-dollar defined benefit plans are more cost-effective and certainly do a better job of providing retirement security 401k style plans come with a greater cost there's greater risk involved and I think we need to keep in mind when retirees are secured with a pension that they're receiving and with their Economic Security they're more likely to stay in the state live in the state and spend their money in the state recycling billions of dollars back into our economy due to misleading reports in the media you may think that every state and local retiree gets a huge pension payout but here are the true statistics for all the tales of bloated public pensions less than 1 of retirees receive 100000 per year or more the average pension is under 21000 per year 68 of retirees receive less than 30000 annually and one in seven retirees roughly 55000 receive less than 5000 a year I've instituted a series of reforms to ensure transparency and accountability of the management of the pension fund the fund is safe and secure, and we're working each and every day to keep it that way for our current retirees and those working men and women who look forward to being retirees in the future

People Also Ask about

What counts towards federal retirement?

Does military service count towards GS pay scale?

What is military service credit?

What does ers stand for in retirement?

Does military service count towards federal retirement?

Does military service count as working for the federal government?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY RS 5042 in Gmail?

How do I complete NY RS 5042 online?

How do I make edits in NY RS 5042 without leaving Chrome?

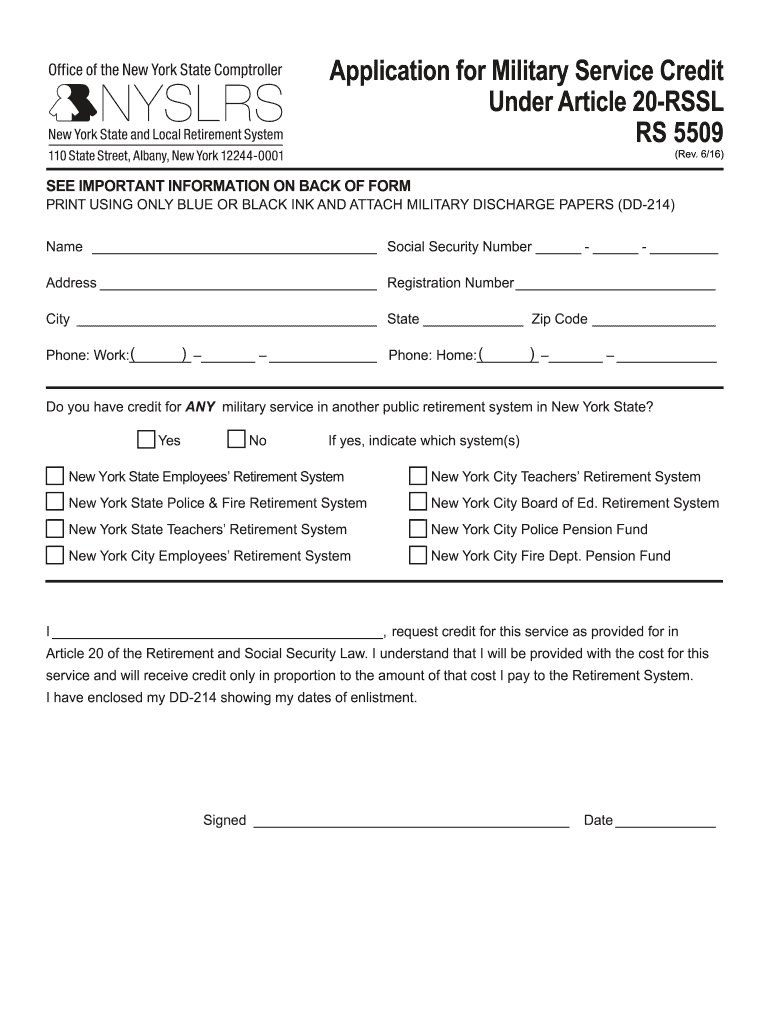

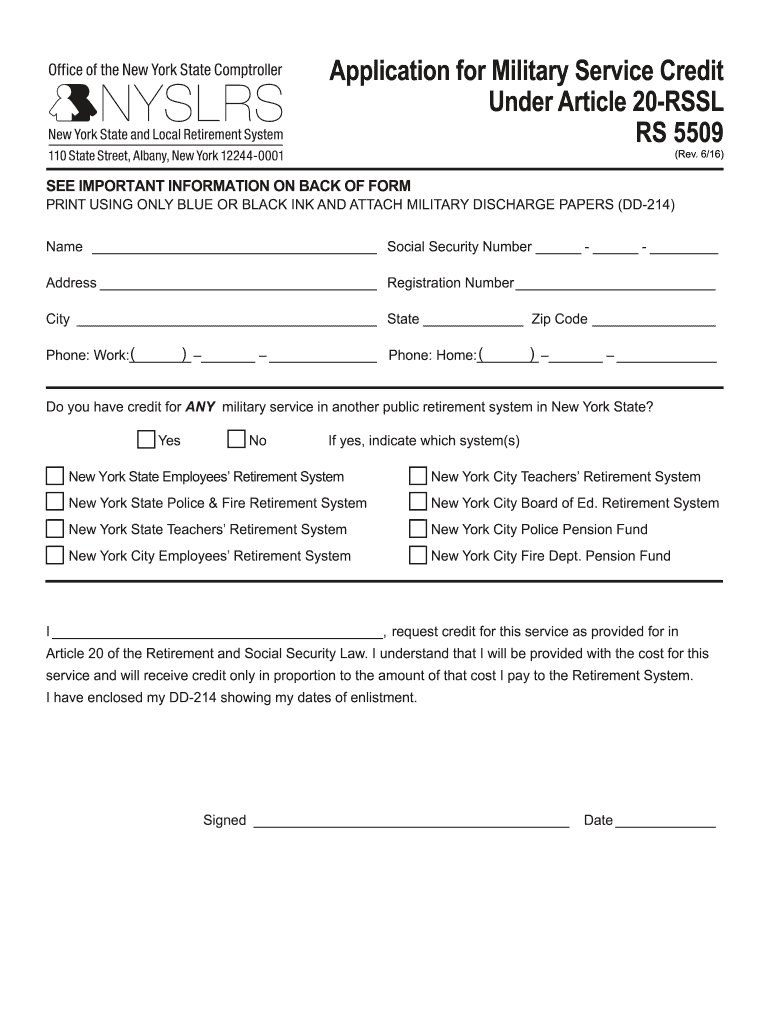

What is NY RS 5042?

Who is required to file NY RS 5042?

How to fill out NY RS 5042?

What is the purpose of NY RS 5042?

What information must be reported on NY RS 5042?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.