Get the free RECEIPTS (ORIGINAL) MUST ACCOMPANY ALL EXPENDITURES IN EXCESS OF $25 - provinceiv

Show details

PROVINCE IV TRAVEL & EXPENSE REPORT RECEIPTS (ORIGINAL) MUST ACCOMPANY ALL EXPENDITURES IN EXCESS OF $25.00 ***EXPENSES MUST BE LESS THAN 6 MONTHS OLD*** PLEASE TYPE OR PRINT CLEARLY NAME STREET CITY/STATE/ZIP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign receipts original must accompany

Edit your receipts original must accompany form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your receipts original must accompany form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing receipts original must accompany online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit receipts original must accompany. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out receipts original must accompany

How to fill out receipts original must accompany:

01

Fill in all the necessary information: Start by entering the date of the transaction, followed by the name and address of the business or individual you are receiving payment from. Make sure to include their contact information as well.

02

Itemize the products or services: List each item or service that was provided, along with their corresponding prices. Be as specific as possible to avoid any confusion or disputes later on. Also, mention any applicable taxes or discounts.

03

Include payment details: Indicate the method of payment, such as cash, check, credit card, or online transfer. If payment was made via check, mention the check number as well.

04

Provide your own information: Fill in your own name, address, and contact details. This is important for the recipient to be able to contact you if needed.

05

Sign the receipt: At the bottom of the receipt, leave a space for your signature. By signing, you confirm that all the information provided is accurate and the transaction has been completed.

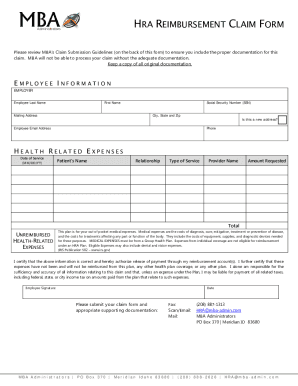

Who needs receipts original must accompany:

01

Business owners: If you are a business owner, it is crucial to provide original receipts with your financial records. This helps in tracking income, expenses, and calculating profits accurately. It also serves as evidence in case of any audits or legal requirements.

02

Individuals claiming reimbursements: If you are seeking reimbursement from your employer or any other organization, providing original receipts helps validate your claims. This ensures that the expenses are genuine and can be properly documented.

03

Taxpayers: Original receipts are often required by tax authorities as proof of expenses in order to claim deductions. Whether it is personal expenses or business-related deductions, having original receipts strengthens your case during tax audits.

04

Law enforcement authorities: In certain situations, law enforcement agencies might require original receipts as evidence in criminal investigations. This could include cases related to fraud, money laundering, or any other financial crimes.

Remember, always keep a copy of the receipt for your own records as well. It is important to maintain organized and accurate financial documentation, whether you are a business owner or an individual.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send receipts original must accompany to be eSigned by others?

receipts original must accompany is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in receipts original must accompany without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing receipts original must accompany and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit receipts original must accompany on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing receipts original must accompany right away.

What is receipts original must accompany?

Receipts original must accompany is a document that must be submitted with the original receipts for verification purposes.

Who is required to file receipts original must accompany?

All individuals or entities who are required to submit receipts for reimbursement or expense claims are required to file receipts original must accompany.

How to fill out receipts original must accompany?

To fill out receipts original must accompany, simply attach the original receipts to the document and ensure all necessary information is visible and legible.

What is the purpose of receipts original must accompany?

The purpose of receipts original must accompany is to provide supporting documentation for expenses claimed and verify the accuracy of the transactions.

What information must be reported on receipts original must accompany?

The receipts original must accompany should include details such as date of transaction, amount spent, vendor name, and description of the expense.

Fill out your receipts original must accompany online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Receipts Original Must Accompany is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.