SC SCH. TC-43 2015 free printable template

Show details

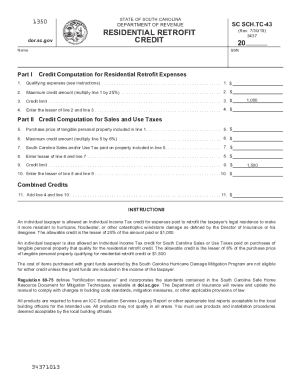

1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC SCH.TC43 RESIDENTIAL RETROFIT CREDIT (Rev. 9/16/15) 3437 20 Attach to your Income Tax Return Names As Shown On Tax Return Part I SSN Credit Computation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC SCH TC-43

Edit your SC SCH TC-43 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC SCH TC-43 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC SCH TC-43 online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC SCH TC-43. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SCH. TC-43 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC SCH TC-43

How to fill out SC SCH. TC-43

01

Gather all necessary financial documents and records that demonstrate your income and expenses.

02

Start by downloading the SC SCH. TC-43 form from the appropriate tax authority's website.

03

Fill in your personal details, including your name, address, and Social Security number.

04

Report your income information accurately in the designated sections of the form.

05

List your expenses in the corresponding fields, ensuring you have the receipts and documentation.

06

Double-check your entries for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the SC SCH. TC-43 form along with your tax return before the deadline.

Who needs SC SCH. TC-43?

01

Individuals who have specific income and expense reporting requirements for state tax purposes.

02

Taxpayers who are claiming deductions related to certain types of income.

03

Residents of South Carolina who need to report supplemental income or specific deductions to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the $800 tax rebate in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

How do you qualify for the SC tuition tax credit?

How many credit hours must a student complete to be eligible for the credit? The student must complete at least 30 credit hours (15 if only attending one semester) at the end of the taxable year for which the credit is claimed, or its equivalent as determined by the SC Commission on Higher Education.

Is the SC $800 tax rebate taxable?

ing to the IRS, South Carolinians who have received the state tax rebate don't have to report it for federal tax purposes “if the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit.”

What is the SC surplus refund for 2023?

As outlined in the legislation approving the rebates, the SCDOR set the rebate cap – the maximum amount taxpayers can receive – at $800. Rebates issued in March 2023 will also be capped at $800. Tax liability is what's left after subtracting your credits from the Individual Income Tax that you owe.

What is the EITC credit for 2023 in South Carolina?

Eligible tax filers in South Carolina can currently claim a nonrefundable state EITC, with a credit worth 125% of the federal credit beginning in tax year 2023.

How to file SC solar tax credit?

To claim the South Carolina tax credit for solar, you must file Form SC1040TC as part of your state tax return. The corresponding code is 038 SOLAR ENERGY OR SMALL HYDROPOWER SYSTEM CREDIT: For installing a solar energy system or small hydropower system in a South Carolina facility (TC-38).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SC SCH TC-43 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign SC SCH TC-43 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit SC SCH TC-43 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including SC SCH TC-43. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit SC SCH TC-43 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your SC SCH TC-43 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is SC SCH. TC-43?

SC SCH. TC-43 is a South Carolina state tax form used to report certain tax credits, specifically related to the taxation of corporations and other business entities.

Who is required to file SC SCH. TC-43?

Any corporation or business entity in South Carolina that is claiming the associated tax credits must file SC SCH. TC-43.

How to fill out SC SCH. TC-43?

To fill out SC SCH. TC-43, collect the necessary financial information about the business, report the relevant tax credits, and accurately complete the form according to the instructions provided by the South Carolina Department of Revenue.

What is the purpose of SC SCH. TC-43?

The purpose of SC SCH. TC-43 is to provide the South Carolina Department of Revenue with the necessary information to properly assess and allocate tax credits claimed by businesses.

What information must be reported on SC SCH. TC-43?

SC SCH. TC-43 requires the reporting of specific tax credit amounts, business identification details, and any other relevant financial information that supports the calculation of the claimed credits.

Fill out your SC SCH TC-43 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC SCH TC-43 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.