Get the free Valuation of Intangible Assets in Franchise

Show details

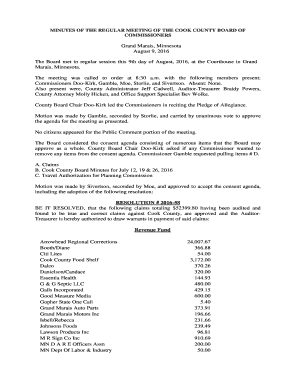

Evaluation of Intangible Assets in FranchiseCompanies and Multinational Groups:A Current IssueBRUCES. SCHAEFFER Anoint.ANH. Title assets. Also referred

to as intellectual properties

(ill. Have become

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign valuation of intangible assets

Edit your valuation of intangible assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your valuation of intangible assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing valuation of intangible assets online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit valuation of intangible assets. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out valuation of intangible assets

How to fill out valuation of intangible assets:

01

Gather information: Start by collecting all relevant information about the intangible assets you need to value. This may include patents, trademarks, copyrights, customer lists, software, etc. Make sure to have all the necessary documentation and supporting evidence.

02

Identify the appropriate valuation method: There are various methods for valuing intangible assets, such as cost approach, market approach, or income approach. Understand which method is most suitable for the assets in question and apply it accordingly.

03

Assign a value: Based on the chosen valuation method, determine the value of each intangible asset. This may involve analyzing market comparables, calculating projected future cash flows, or assessing replacement cost.

04

Consider the legal and contractual factors: Take into account any legal or contractual restrictions or obligations associated with the intangible assets. These could impact their value and should be factored in during the valuation process.

05

Obtain professional assistance if needed: Valuing intangible assets can be complex, especially for businesses with multiple assets or unique circumstances. If you are unsure or lack expertise in this area, consider seeking help from a professional valuation expert or consulting firm.

06

Document and justify your valuation: Properly record the valuation process, assumptions made, and the reasoning behind the assigned values. This documentation is crucial for transparency and ensuring the accuracy of the valuation.

07

Review and update periodically: Intangible asset values can change over time due to various factors. Regularly review and update your valuations to reflect any changes in market conditions, technological advancements, or other relevant factors.

Who needs valuation of intangible assets:

01

Business owners and managers: Valuing intangible assets is important for determining the overall value of a business and its intellectual property. This information is crucial for strategic decision-making, attracting investors, and securing loans.

02

Investors and financial institutions: Investors often require accurate valuations of a company's intangible assets to assess the risks and potential returns of their investment. Financial institutions also consider these valuations when evaluating loan applications.

03

Accountants and auditors: Valuations of intangible assets are essential for financial reporting and compliance purposes. Accountants and auditors rely on accurate and well-documented valuations to ensure the financial statements reflect the true value of the company's assets.

04

Intellectual property professionals: Intellectual property lawyers, patent attorneys, and other IP professionals may require valuations of intangible assets for various legal purposes. These valuations can be used in cases of infringement, licensing negotiations, or disputes regarding ownership rights.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my valuation of intangible assets in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your valuation of intangible assets and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I edit valuation of intangible assets on an iOS device?

Use the pdfFiller mobile app to create, edit, and share valuation of intangible assets from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out valuation of intangible assets on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your valuation of intangible assets. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is valuation of intangible assets?

Valuation of intangible assets is the process of determining the worth of assets that do not have a physical form, such as patents, trademarks, and goodwill.

Who is required to file valuation of intangible assets?

Companies or individuals who own intangible assets and are required to report them for financial or regulatory purposes are required to file valuation of intangible assets.

How to fill out valuation of intangible assets?

Valuation of intangible assets can be filled out by hiring a professional valuation firm or using valuation software to assess the value of the assets based on various methods such as cost, income, and market approach.

What is the purpose of valuation of intangible assets?

The purpose of valuation of intangible assets is to accurately determine the value of assets for financial reporting, tax planning, mergers and acquisitions, and other business transactions.

What information must be reported on valuation of intangible assets?

Information such as a description of the intangible asset, the valuation method used, assumptions made, and the final estimated value must be reported on valuation of intangible assets.

Fill out your valuation of intangible assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Valuation Of Intangible Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.