Get the free International Trust and Estate Planning - GSRP

Show details

NONPROFIT ORG U.S. Postage PAID ALI-ABA Eleventh Annual Advanced ALI-ABA Course of Study for Counselors to Foreign and U.S. Clients attend live on site or via live video webcast International Trust

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international trust and estate

Edit your international trust and estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international trust and estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international trust and estate online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit international trust and estate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international trust and estate

How to fill out international trust and estate?

01

Begin by gathering all relevant financial and legal documents, including property deeds, bank statements, investment portfolios, and wills.

02

Consult with an experienced international trust and estate attorney who can guide you through the process and help you understand the legal requirements and tax implications.

03

Identify the beneficiaries and trustees of the international trust or estate. Consider their eligibility and suitability for the roles and ensure their willingness to participate.

04

Determine the assets that will be included in the trust or estate. These may include real estate properties, financial investments, intellectual property rights, and other valuable assets.

05

Establish the terms and conditions of the trust or estate, such as the distribution of assets, management of funds, and provisions for any special circumstances or contingencies.

06

Comply with the relevant legal and tax requirements of the jurisdictions involved. This may include submitting necessary forms, paying any applicable taxes, and adhering to local regulations.

07

Regularly review and update the trust or estate documents to reflect any changes in personal circumstances, beneficiaries, or assets.

Who needs international trust and estate?

01

Individuals or families with significant international assets or business interests may require international trust and estate planning to ensure proper management and protection of their wealth.

02

Expatriates or individuals living abroad who have assets located in multiple countries may benefit from an international trust or estate structure to simplify administration and minimize tax liabilities.

03

Business owners with international operations or cross-border investments may utilize international trust and estate planning strategies to safeguard their business interests and facilitate smooth succession or ownership transitions.

04

High-net-worth individuals or families looking to preserve their wealth for future generations may opt for international trust and estate structures to protect and grow their assets, while also providing for their loved ones.

05

Individuals seeking to minimize their estate taxes or protect their assets from potential creditors or legal disputes may find international trust and estate planning to be valuable tools in achieving their goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is international trust and estate?

International trust and estate refers to assets held in a trust or estate located outside of one's country of residence.

Who is required to file international trust and estate?

Individuals who have a financial interest in or signature authority over foreign trusts or estates are required to file international trust and estate forms.

How to fill out international trust and estate?

International trust and estate forms can be filled out electronically or on paper, following the instructions provided by the Internal Revenue Service (IRS).

What is the purpose of international trust and estate?

The purpose of filing international trust and estate forms is to report foreign financial assets and ensure compliance with tax laws.

What information must be reported on international trust and estate?

Information such as the name of the foreign trust or estate, the country where it is located, and details of the assets must be reported on international trust and estate forms.

How do I edit international trust and estate straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing international trust and estate right away.

How do I fill out international trust and estate using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign international trust and estate and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit international trust and estate on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as international trust and estate. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your international trust and estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Trust And Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

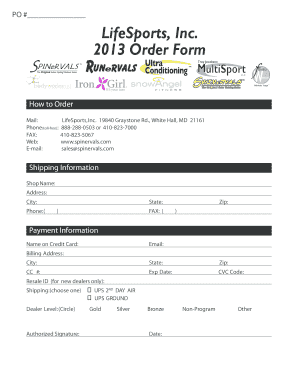

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.