Get the free United States Liability Insurance Group Non Profit Package

Show details

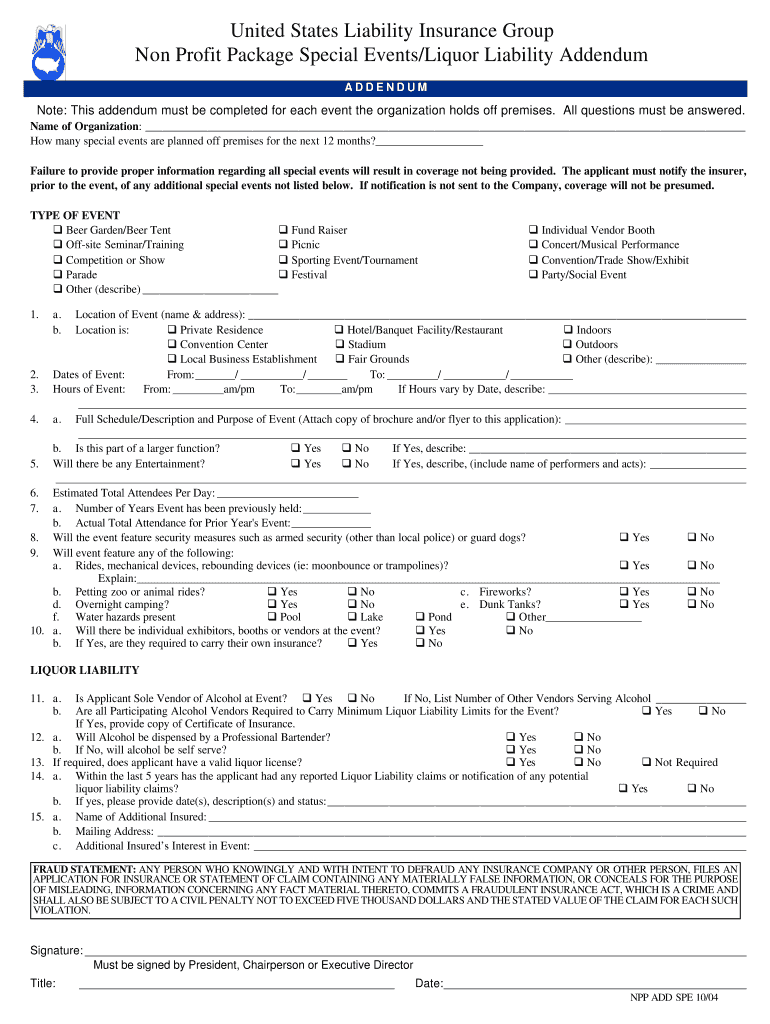

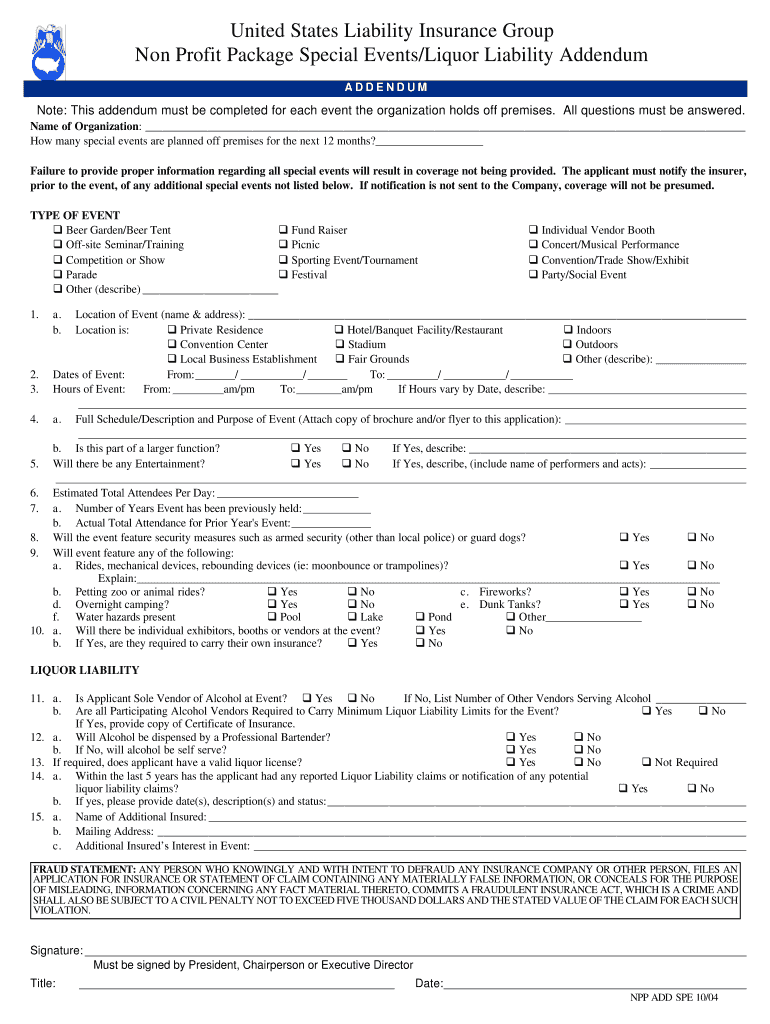

United States Liability Insurance Group Non Profit Package Special Events/Liquor Liability Addendum Note: This addendum must be completed for each event the organization holds off premises. All questions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign united states liability insurance

Edit your united states liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united states liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing united states liability insurance online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit united states liability insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out united states liability insurance

How to fill out united states liability insurance:

01

Gather relevant information: Before starting, collect all the necessary details, such as your personal information, business details (if applicable), and any supporting documents related to the insurance.

02

Choose an insurance provider: Research different insurance providers in the United States that offer liability insurance. Compare their coverage options, premiums, and customer reviews to make an informed decision.

03

Contact the insurance provider: Once you've selected a provider, reach out to them either through their website, phone, or in-person. Inform them of your intention to acquire liability insurance and inquire about their application process.

04

Obtain the necessary forms: The insurance provider will provide you with the required forms to fill out. You may receive these forms physically or digitally via email or their website.

05

Read the instructions: Carefully read through the instructions provided with the forms. Understand the specific requirements and any supporting documents needed to complete the application accurately.

06

Complete the forms accurately: Fill out the forms, ensuring accuracy in every detail. Provide your personal information, business details (if applicable), and any other information requested by the insurance provider.

07

Provide supporting documents: Attach any necessary supporting documents, such as previous insurance policies, proof of financial stability, or additional paperwork the provider may require to evaluate your application.

08

Review and double-check: Go through the completed forms and supporting documents multiple times to ensure accuracy and completeness. Mistakes or missing information could delay the processing of your application.

09

Submit the application: Once you are confident that all the necessary information and documents are included correctly, submit the application to the insurance provider. Follow their specific instructions regarding submission methods and deadlines.

10

Wait for approval: After submission, the insurance provider will review your application. The processing time may vary depending on the provider and the complexity of your insurance needs. Be patient and wait for their decision.

Who needs united states liability insurance?

01

Business owners: If you own a business, liability insurance can protect you from potential legal and financial risks associated with accidents, property damage, or injuries that may occur on your premises or as a result of your products or services.

02

Independent contractors: Independent contractors who work for themselves may also need liability insurance. It provides coverage for any damages or injuries caused during their work, safeguarding them from potential lawsuits or financial losses.

03

Professionals: People in certain professions, such as doctors, lawyers, architects, or engineers, may be legally required or strongly advised to have liability insurance. This coverage helps protect against claims of professional negligence or malpractice that could lead to substantial financial liabilities.

04

Homeowners: Homeowners can benefit from liability insurance to protect themselves if someone gets injured on their property or if they accidentally cause property damage to others. It provides essential coverage in case of a lawsuit or costly legal settlements.

05

Renters: Even if you don't own a home, you can still be held responsible for accidents or damages that occur in your rented property. Liability insurance can provide coverage for personal injury or property damage caused by you or your belongings to others' property.

Note: The need for liability insurance varies based on individual circumstances, professions, and legal requirements. It is always advisable to consult with an insurance professional or legal expert to determine the specific liability insurance needs for your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my united states liability insurance in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your united states liability insurance and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit united states liability insurance in Chrome?

united states liability insurance can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out united states liability insurance on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your united states liability insurance. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is united states liability insurance?

United States liability insurance is a type of insurance that provides financial protection to the insured against claims or lawsuits resulting from injuries or damages caused to other people or their property.

Who is required to file united states liability insurance?

Individuals, businesses, or organizations that want to protect themselves from potential legal claims for damages or injuries may be required to have united states liability insurance.

How to fill out united states liability insurance?

To fill out united states liability insurance, you will need to provide information about your business or personal assets, potential risks, coverage limits, and other relevant details as required by the insurance provider.

What is the purpose of united states liability insurance?

The purpose of united states liability insurance is to protect individuals, businesses, or organizations from financial losses due to legal claims or lawsuits for damages or injuries caused to third parties.

What information must be reported on united states liability insurance?

The information that must be reported on united states liability insurance typically includes details about the insured party, coverage limits, premium payments, potential risks, and any claims or lawsuits that have occurred.

Fill out your united states liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

United States Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.