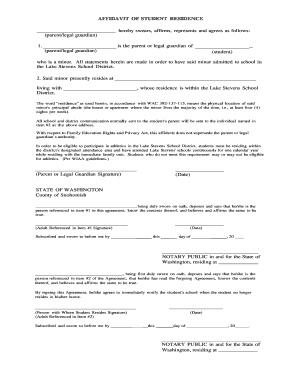

A property owner or contractor may issue a written demand that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Get the free Itemized Statement – Individual

Show details

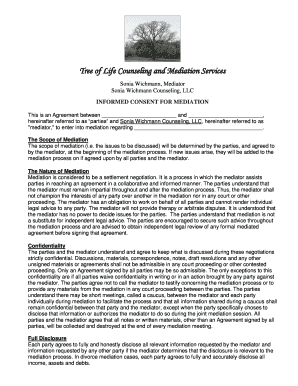

This document serves as a formal itemized statement required under N.Y. Lien Law § 38 for individuals who have provided labor and/or materials for property improvements. It includes details on the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign itemized statement individual

Edit your itemized statement individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your itemized statement individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out itemized statement individual

How to fill out Itemized Statement – Individual

01

Gather all relevant financial documents, including receipts and invoices.

02

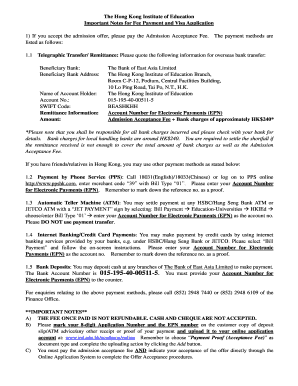

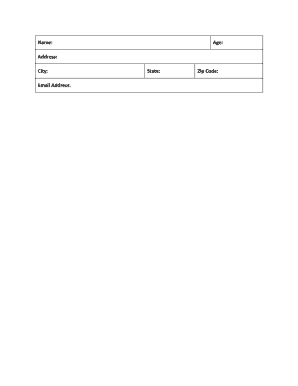

Start by entering your personal information at the top of the Itemized Statement form, such as your name and address.

03

List each item being claimed individually in the designated columns.

04

For each item, specify the date of the expense, a description of the item, and the amount spent.

05

Ensure that you categorize items correctly, such as travel, meals, or office supplies.

06

Total the amounts in the designated section to ensure the sum is accurate.

07

Attach any required supporting documents, like receipts, to validate your claims.

08

Review the completed form for accuracy and completeness before submission.

Who needs Itemized Statement – Individual?

01

Individuals who are self-employed or freelancers.

02

Those claiming deductions for business expenses on their tax returns.

03

People seeking reimbursement for work-related expenses from their employers.

04

Anyone organizing their financial records for personal budgeting or analysis.

Fill

form

: Try Risk Free

People Also Ask about

How do you write an itemized statement?

(ˈaɪtəˌmaɪzd bɪl ) noun. British. An itemized bill is a piece of paper which you are given before you pay for goods or services, listing the cost of each item purchased rather than just the total cost. You should always request an itemized bill.

What is an itemized billing statement?

An Itemized Original Receipt must, at the least, have the following items on the receipt: Name of Merchant. Address/Phone # (at least one way to contact the merchant) Description of each item purchased. Price for each item purchased. Tax for the taxable items. Grand Total. Date of Purchase. Method of payment.

How do you write an itemized statement?

An Itemized Original Receipt must, at the least, have the following items on the receipt: Name of Merchant. Address/Phone # (at least one way to contact the merchant) Description of each item purchased. Price for each item purchased. Tax for the taxable items. Grand Total. Date of Purchase. Method of payment.

What is an itemized statement in a medical billing example?

An itemized bill is a detailed statement provided by a healthcare provider or medical facility that lists all the individual services, procedures, and supplies used during a patient's treatment or care.

What is an itemized statement?

The itemized bill contains details of what had been done. This bill will have columns titled as Service Code, CPT Code, HCPCS Code, Revenue Code, and / or Diagnosis.

What is the meaning of itemized bill?

Call the number for the hospital's billing department, typically located on the consolidated bill sent in the mail. Choose the relevant option to speak with a human about your bill. When a human picks up, ask: "I'd like an itemized statement. Could you post it to my online portal or mail me a copy directly?"

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Itemized Statement – Individual?

An Itemized Statement – Individual is a detailed financial report that lists all sources of income and deductions for an individual taxpayer to provide a comprehensive overview for tax reporting and compliance.

Who is required to file Itemized Statement – Individual?

Individuals who choose to itemize deductions instead of taking the standard deduction on their tax returns are required to file an Itemized Statement – Individual.

How to fill out Itemized Statement – Individual?

To fill out an Itemized Statement – Individual, one must gather all relevant financial documents, list each source of income and each deduction, categorize them accordingly, and ensure all values are accurate and supported by proper documentation.

What is the purpose of Itemized Statement – Individual?

The purpose of an Itemized Statement – Individual is to provide the tax authority with detailed information about the individual's income and deductions, which can affect their taxable income and tax liability.

What information must be reported on Itemized Statement – Individual?

The information that must be reported on an Itemized Statement – Individual includes total income, eligible deductions such as medical expenses, mortgage interest, property taxes, charitable contributions, and any other relevant financial details that impact taxation.

Fill out your itemized statement individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Itemized Statement Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.