Get the free To open our credit application form - Western Equipment

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to open our credit

Edit your to open our credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to open our credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing to open our credit online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit to open our credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out to open our credit

How to fill out to open our credit?

01

Gather necessary documents: Start by collecting all the required documents such as identification proof, proof of address, income statements, and any other financial documents that the bank or lending institution may require.

02

Research different lenders: Before filling out any credit application, it's important to do thorough research on different lenders to find the one that suits your needs best. Compare interest rates, terms and conditions, repayment options, and any fees associated with the credit.

03

Fill out the application accurately: Carefully fill out the credit application form, ensuring that all the information provided is accurate and up-to-date. Double-check for any errors or missing details that could potentially delay the approval process.

04

Provide relevant financial information: In the application, you may be required to provide information about your current employment, monthly income, expenses, and any other debts or loans you may have. It's important to be honest and transparent when providing these details.

05

Choose the desired credit limit: If the application allows you to select a credit limit, consider your financial situation and needs before deciding on an appropriate limit. Make sure it aligns with your ability to repay the borrowed amount within the given timeframe.

Who needs to open our credit?

01

Individuals looking to establish a credit history: Opening a credit account is essential for building a credit history. If you are just starting out and have little or no credit history, opening a credit account can help you establish a positive credit score, which will be beneficial in the long run.

02

Those in need of additional funds: If you require extra funds to make a large purchase, cover unexpected expenses, or invest in your business, opening a credit account can provide you with the necessary financial flexibility.

03

Individuals aiming to improve credit score: For individuals with poor or average credit scores, opening a credit account and making timely repayments can help improve your creditworthiness over time. This may result in better loan terms, lower interest rates, and increased borrowing capacity in the future.

Overall, filling out a credit application correctly and understanding who would benefit from opening a credit account are crucial steps in the process. Whether you are starting out, need extra funds, or want to improve your credit score, following these steps can put you on the path to successfully opening a credit account.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit to open our credit from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including to open our credit, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send to open our credit for eSignature?

Once your to open our credit is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get to open our credit?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific to open our credit and other forms. Find the template you want and tweak it with powerful editing tools.

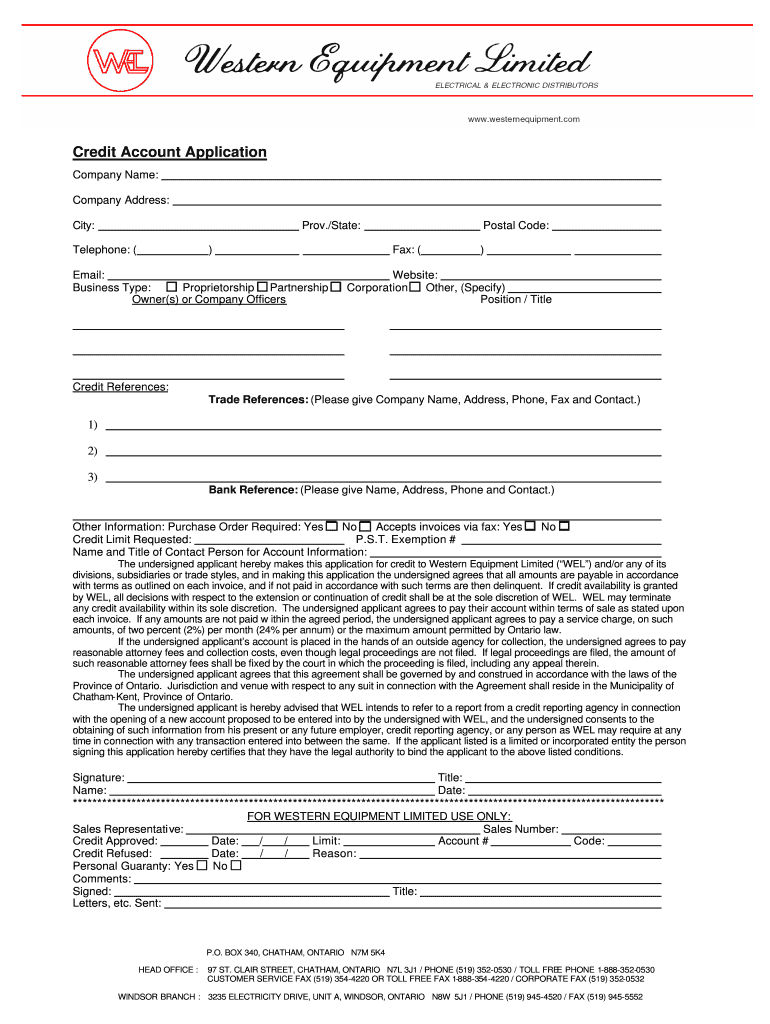

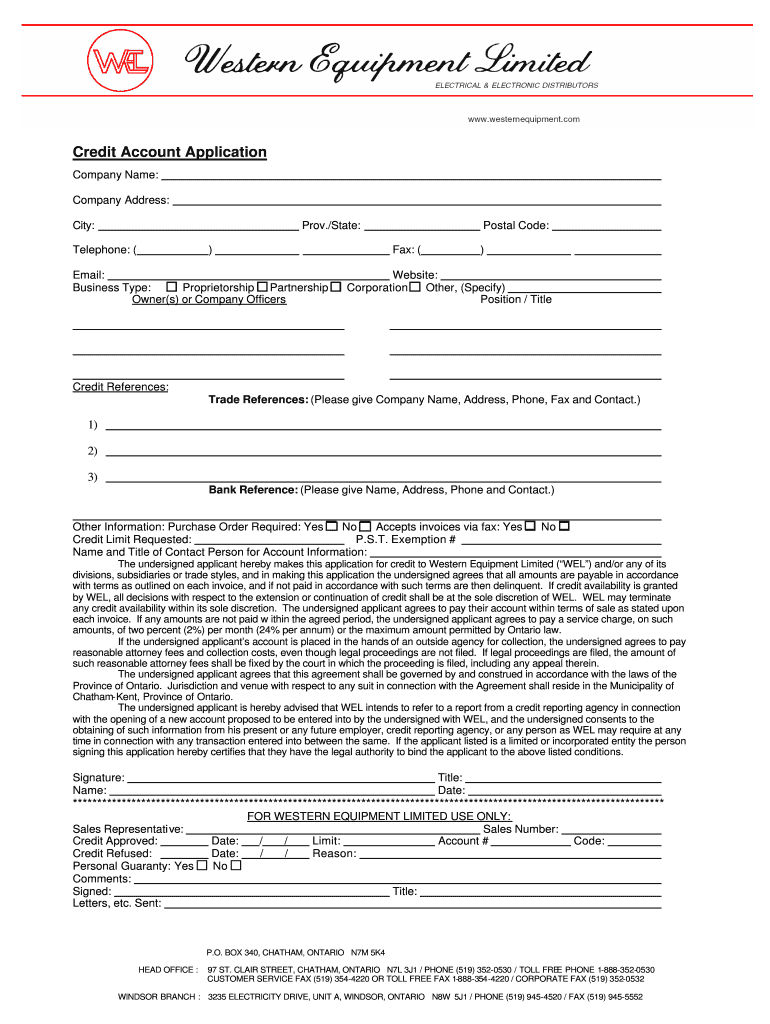

What is to open our credit?

Opening our credit refers to applying for a line of credit or a loan from a financial institution.

Who is required to file to open our credit?

Individuals or businesses who are in need of financial assistance and meet the requirements set by the financial institution.

How to fill out to open our credit?

To open our credit, one must fill out a credit application form provided by the financial institution, providing information such as personal details, financial status, and credit history.

What is the purpose of to open our credit?

The purpose of opening our credit is to obtain financial assistance in the form of a loan or line of credit to meet specific needs or goals.

What information must be reported on to open our credit?

Information such as personal details, financial status, employment history, credit history, and any other relevant information requested by the financial institution.

Fill out your to open our credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To Open Our Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.