Get the free Deadlines for Filing a Disclosure Statement - pso ahrq

Show details

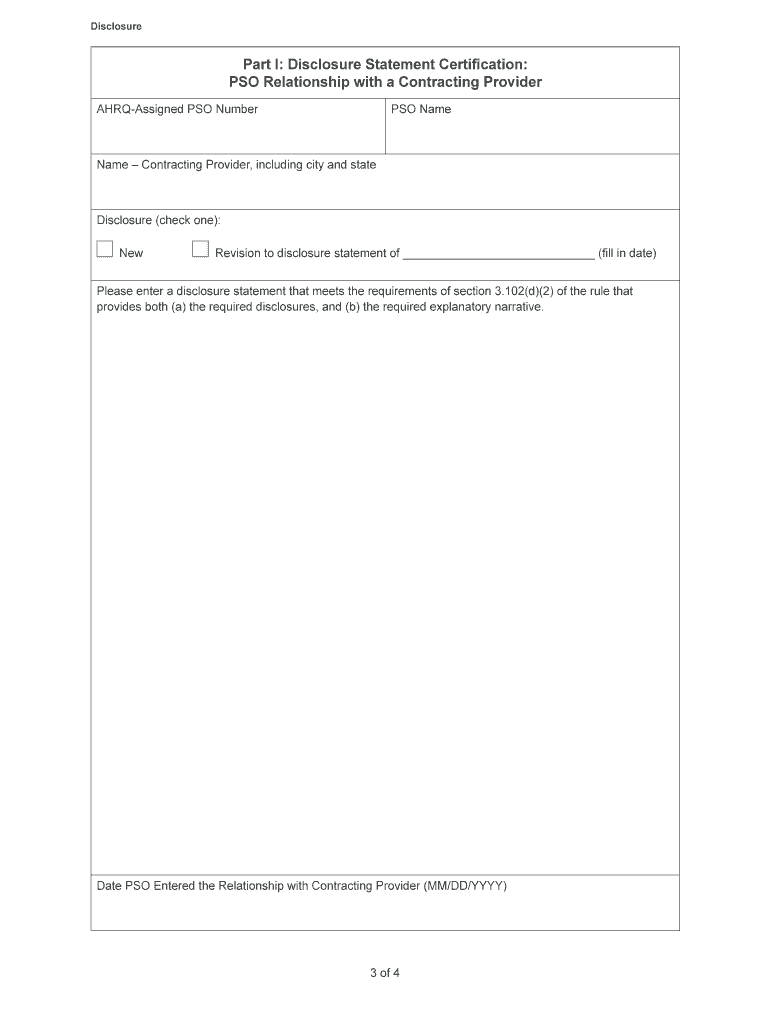

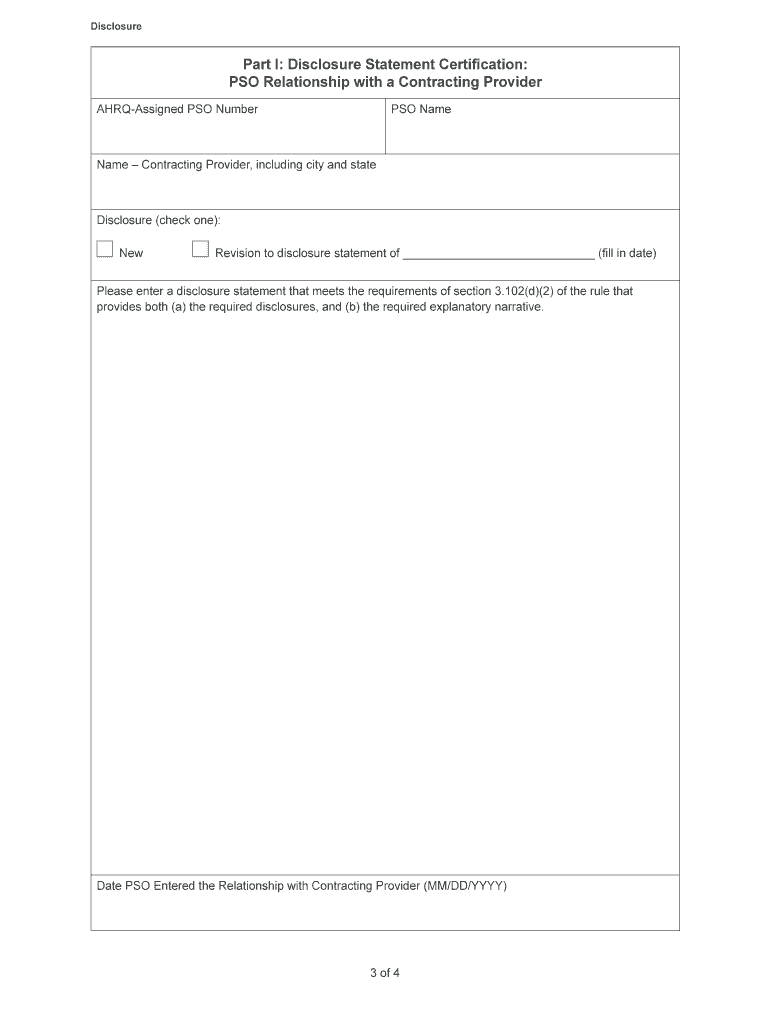

2 of 4. Deadlines for Filing a Disclosure Statement. If disclosure is required, the Secretary must receive a disclosure statement no later than 45 calendar days after.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deadlines for filing a

Edit your deadlines for filing a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deadlines for filing a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deadlines for filing a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deadlines for filing a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deadlines for filing a

How to fill out deadlines for filing a:

01

Identify the specific deadline: Determine the exact date and time by which the filing needs to be completed. This could be a deadline set by a government agency, a court, or any other relevant authority.

02

Gather all necessary documents: Ensure that you have all the required paperwork and information to complete the filing. This may include forms, supporting documents, evidence, or any other specific requirements.

03

Create a timeline: Break down the tasks associated with the filing into smaller, manageable steps. Set deadlines for each step to ensure that you stay on track and complete the filing in a timely manner.

04

Allocate resources: Determine the resources required to complete the filing, such as personnel, equipment, or funds. Make sure you have everything you need to fulfill the filing requirements.

05

Review and double-check: Before submitting the filing, review all the information and documents carefully. Double-check for any errors or missing information. It is crucial to ensure accuracy and completeness to avoid any delays or complications.

Who needs deadlines for filing a:

01

Individuals: Many individuals may need to meet filing deadlines for various purposes, such as tax returns, visa applications, college applications, or legal documents like wills or contracts.

02

Businesses: Businesses must comply with various filing deadlines, including tax filings, annual reports, financial statements, trademark registrations, or licenses. Failure to meet these deadlines can result in penalties or legal consequences.

03

Government agencies: Government departments and agencies often require individuals or organizations to adhere to specific filing deadlines. This could include submitting permit applications, environmental impact reports, grant proposals, or other regulatory filings.

04

Legal professionals: Lawyers and legal professionals often have to file documents within court-imposed deadlines. This could involve filing lawsuits, motions, appeals, or other legal documents as per the court's requirements.

05

Non-profit organizations: Non-profit organizations may have filing deadlines for tax-exempt status applications, annual reports, financial statements, or grant proposals.

Meeting filing deadlines is crucial for individuals, businesses, government agencies, legal professionals, and non-profit organizations to ensure compliance, maintain legal status, avoid penalties, and effectively carry out their responsibilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deadlines for filing a to be eSigned by others?

When you're ready to share your deadlines for filing a, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit deadlines for filing a on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign deadlines for filing a right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit deadlines for filing a on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute deadlines for filing a from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is deadlines for filing a?

Deadlines for filing a refer to the dates by which a specific form or document must be submitted or filed.

Who is required to file deadlines for filing a?

Individuals, organizations or entities designated by law or regulation are required to file deadlines for filing a.

How to fill out deadlines for filing a?

Deadlines for filing a are typically filled out by providing the necessary information and signatures as required by the form or document.

What is the purpose of deadlines for filing a?

The purpose of deadlines for filing a is to ensure that important information is submitted in a timely manner to comply with regulations or deadlines.

What information must be reported on deadlines for filing a?

The specific information required to be reported on deadlines for filing a will vary depending on the form or document being filed.

Fill out your deadlines for filing a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deadlines For Filing A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.