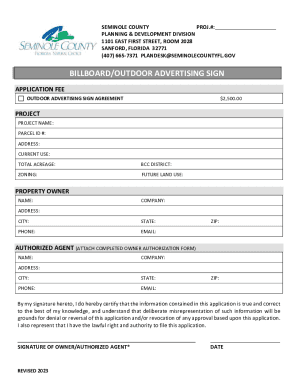

Get the free Non Borrower Income Contribution Form - Pdfsdocuments.com

Show details

Non Borrower Income Contribution Form.pdf DOWNLOAD HERE NON BORROWER CREDIT AUTHORIZATION FORM Contact Your Lender http://contactlender.com/documents/Bank of America/Non Borrower Authorization Form.pdf

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non borrower income contribution

Edit your non borrower income contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non borrower income contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non borrower income contribution online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non borrower income contribution. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non borrower income contribution

How to Fill Out Non Borrower Income Contribution:

01

Begin by gathering all necessary documentation related to the non borrower's income. This may include pay stubs, tax returns, or any other proof of income.

02

Fill out the non borrower income contribution section of the form, providing all the required information as accurately as possible. This may include the non borrower's name, relationship to the borrower, their employer, income amount, and frequency (such as monthly or annually).

03

If the non borrower has multiple sources of income, ensure that all sources are documented and accounted for. This may involve submitting additional documentation or attaching separate forms, if required.

04

Double-check all the information provided for accuracy and completeness. Mistakes or missing information can lead to delays in processing or even rejection of the application.

05

Once all the necessary information has been filled out, sign the form as required. This may involve both the borrower and the non borrower signing, depending on the specific requirements of the form or lender.

06

Submit the completed form along with any supporting documentation to the appropriate party. This may be a mortgage lender, a financial institution, or any other entity requesting the non borrower income contribution.

Who Needs Non Borrower Income Contribution:

01

Non borrower income contribution is typically required when applying for a loan or mortgage. Lenders may include this requirement to assess the overall financial situation of the borrower and ensure that they will be able to meet the repayment obligations.

02

Non borrower income contribution may be necessary when the borrower's income alone is insufficient to qualify for the loan. In such cases, the income of a spouse, partner, or other individual may be considered to strengthen the borrower's financial position.

03

In certain situations, such as when a borrower has a low credit score or limited credit history, non borrower income contribution can help in proving a stable financial situation and increasing the chances of loan approval.

04

It is important to note that the specific requirements for non borrower income contribution may vary depending on the lender, loan type, and other factors. It is always advisable to consult with the lender or seek professional advice to fully understand the requirements and implications of non borrower income contribution.

Fill

form

: Try Risk Free

People Also Ask about

What is a non-borrower contribution form?

Non-borrower financial contribution form. This form is to be completed by individuals at your property address who are not on the loan as borrowers, but who have agreed to include their income in the review of your Mortgage Assistance Application. Name of non-borrower.

What is a contribution letter?

What is a letter of contribution? A donor or donation acknowledgment letter, or charitable contribution acknowledgment letter, is a letter nonprofits send to thanking their donors for their gift.

What is a contribution letter for loan modification?

These documents are used by your lender to show that you have stable, regular income that is enough to support resuming a regular mortgage payment.

What is a non-borrower household income?

Non-Borrower Household Income - The non-borrower's income must be at least 30% of the total monthly qualifying income being used by the borrower. See Fannie Mae 1019 HomeReady Non-Borrower Income Worksheet.

Can you use non-borrower income to qualify for mortgage?

DU will consider a non-occupant borrower's income as qualifying income for a principal residence with certain loan-to value (LTV) ratio limitations. For manually underwritten loans, the income from a non-occupant borrower may be considered as acceptable qualifying income.

What is an example of a loan modification letter?

I am writing to request a loan modification in order to continue making payments on my loan. The account number is . Based on my and expenses, I cannot make my loan payments. In place of my payment of per month, I ask that you alter my payments to , which will be paid .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non borrower income contribution directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign non borrower income contribution and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send non borrower income contribution for eSignature?

non borrower income contribution is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the non borrower income contribution electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your non borrower income contribution and you'll be done in minutes.

What is non borrower income contribution?

Non borrower income contribution is the income provided by someone who is not listed as a borrower on a loan application.

Who is required to file non borrower income contribution?

Anyone who is providing non borrower income contribution for a loan application is required to file it.

How to fill out non borrower income contribution?

You can fill out a non borrower income contribution form provided by the lender and submit it along with other required documents.

What is the purpose of non borrower income contribution?

The purpose of non borrower income contribution is to show additional income that can help with loan approval.

What information must be reported on non borrower income contribution?

You must report details of the non borrower's income, such as source, amount, and frequency.

Fill out your non borrower income contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Borrower Income Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.