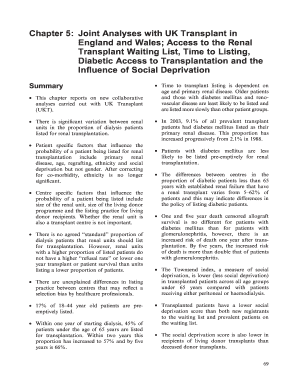

Get the free Form 8-K (HSA PSA) 5 9 11_FINAL AS FILED - Industrial Income Trust

Show details

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of the earliest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8-k hsa psa

Edit your form 8-k hsa psa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8-k hsa psa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8-k hsa psa online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 8-k hsa psa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8-k hsa psa

How to fill out form 8-k hsa psa:

01

Begin by obtaining the necessary form. Form 8-K HSA PSA is typically available on the website of the Securities and Exchange Commission (SEC). You can download it from there.

02

Read the instructions carefully. The SEC provides detailed instructions for filling out form 8-K HSA PSA. Make sure you understand all the requirements and guidelines before proceeding.

03

Start by providing basic identification information. This includes your company name, address, and contact details. Fill in all the required fields accurately.

04

Indicate the date of the event triggering the submission of form 8-K HSA PSA. This could be a merger, acquisition, change in corporate governance, or any other significant event that falls within the SEC's reporting requirements.

05

Outline the specific details of the event. Describe it clearly and concisely, ensuring that all relevant information is included. Use precise language and avoid any unnecessary jargon.

06

Attach any necessary exhibits. If there are supporting documents or additional information related to the event, make sure to include them with the form. This could include contracts, agreements, or financial statements, among others.

07

Review the completed form thoroughly. Double-check all the information provided to ensure accuracy and completeness. Mistakes or omissions can lead to potential penalties or complications.

08

Submit the form to the SEC. Follow the specified submission procedures outlined in the instructions. This may involve mailing a physical copy or filing electronically through the SEC's online submission system.

09

Keep a copy for your records. It's important to maintain your own copy of the filled-out form 8-K HSA PSA for future reference and compliance purposes.

Who needs form 8-k hsa psa?

01

Publicly traded companies: Form 8-K HSA PSA is primarily required for companies that are publicly traded in the United States. This includes corporations listed on stock exchanges like the New York Stock Exchange or NASDAQ.

02

Companies undergoing significant events: Form 8-K HSA PSA is typically filed when a company experiences a significant event that triggers reporting obligations. This can include mergers or acquisitions, changes in management or corporate governance, bankruptcy filings, or other major developments.

03

Companies subject to SEC regulations: Any company subject to the reporting requirements of the Securities and Exchange Commission must file form 8-K HSA PSA when necessary. Compliance with SEC regulations is essential for maintaining transparency and providing relevant information to investors and regulatory authorities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8-k hsa psa?

Form 8-K is a report required to be filed by public companies with the SEC to announce major events that shareholders should know about. HSA PSA stands for Health Savings Account (HSA) and Prescribing and Supportive Administration (PSA). This form would likely be related to health benefits offered by a company.

Who is required to file form 8-k hsa psa?

Public companies are required to file Form 8-K with the SEC.

How to fill out form 8-k hsa psa?

Form 8-K can be filled out electronically on the SEC's EDGAR system.

What is the purpose of form 8-k hsa psa?

The purpose of Form 8-K is to inform shareholders and the public about significant events that may have an impact on the company.

What information must be reported on form 8-k hsa psa?

Information related to Health Savings Account (HSA) and Prescribing and Supportive Administration (PSA) benefits would need to be reported on this form.

How can I send form 8-k hsa psa for eSignature?

form 8-k hsa psa is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute form 8-k hsa psa online?

pdfFiller has made it simple to fill out and eSign form 8-k hsa psa. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit form 8-k hsa psa on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as form 8-k hsa psa. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your form 8-k hsa psa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8-K Hsa Psa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.