Get the free ANNUAL ACCOUNTS IN EURO (2 decimals) - tcs.com

Show details

40 NR. 1 No. 0446.780.020 Date of the deposition PP. EUR E. D. C 1.1 ANNUAL ACCOUNTS IN EURO (2 decimals) NAME: TATA CONSULTANCY SERVICES BELGIUM Legal form: PLC Address: Boulevard Brand Wit lock

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual accounts in euro

Edit your annual accounts in euro form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual accounts in euro form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual accounts in euro online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual accounts in euro. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

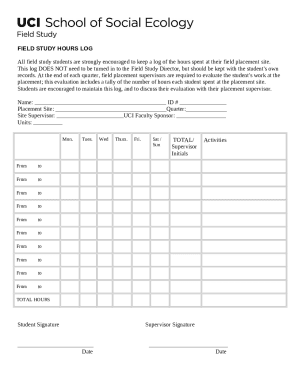

How to fill out annual accounts in euro

How to fill out annual accounts in euro?

01

Begin by gathering all financial documents and records, including income statements, balance sheets, and cash flow statements. Make sure all numbers are accurate and up-to-date.

02

Determine the correct currency for the annual accounts, which in this case is the euro. Ensure that all monetary values are converted to euros for consistency.

03

Start by entering the relevant company information, such as the name, address, and fiscal year, at the top of the annual accounts form.

04

Create sections or categories for income, expenses, assets, liabilities, and equity. Divide the accounts accordingly and include subcategories if necessary.

05

Enter the amounts in euros for each account, ensuring that they are correctly categorized and accounted for. Double-check all calculations and ensure that debits and credits are properly balanced.

06

Include any additional information or explanatory notes that may be required to provide a clear understanding of the financial status and transactions.

07

Review the completed annual accounts thoroughly for any errors or inconsistencies. Make any necessary adjustments and ensure that all figures are accurate and in alignment with accounting standards and regulations.

Who needs annual accounts in euro?

01

Companies operating within the Eurozone are typically required to prepare and submit their annual accounts in euros. This includes both publicly-traded companies and privately-owned businesses.

02

Financial institutions and banks often require businesses to present their annual accounts in euros for loan applications or other financial arrangements.

03

Companies conducting international business or trading with entities using the euro may also need to provide annual accounts in euros to maintain consistency and facilitate financial transactions.

04

Government authorities and regulatory bodies may mandate companies to present annual accounts in euros for taxation purposes, auditing requirements, or legal compliance.

05

Investors, shareholders, and potential business partners may request annual accounts in euros to evaluate the financial performance and stability of a company before making investment decisions or entering into partnerships.

Overall, it is important to prepare and fill out annual accounts in euros accurately and comprehensively to ensure transparency, legality, and efficient financial management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the annual accounts in euro in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your annual accounts in euro and you'll be done in minutes.

How do I edit annual accounts in euro straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing annual accounts in euro right away.

Can I edit annual accounts in euro on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as annual accounts in euro. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is annual accounts in euro?

Annual accounts in euro refer to the financial statements of a company that are prepared on a yearly basis and reported in euros.

Who is required to file annual accounts in euro?

All companies operating in the European Union and using the euro as their currency are required to file annual accounts in euro.

How to fill out annual accounts in euro?

Annual accounts in euro can be filled out by following the financial reporting standards and guidelines specific to the country where the company is registered.

What is the purpose of annual accounts in euro?

The purpose of annual accounts in euro is to provide stakeholders with a clear and accurate overview of the financial performance and position of a company.

What information must be reported on annual accounts in euro?

Annual accounts in euro typically include a balance sheet, income statement, cash flow statement, and notes to the accounts.

Fill out your annual accounts in euro online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Accounts In Euro is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.