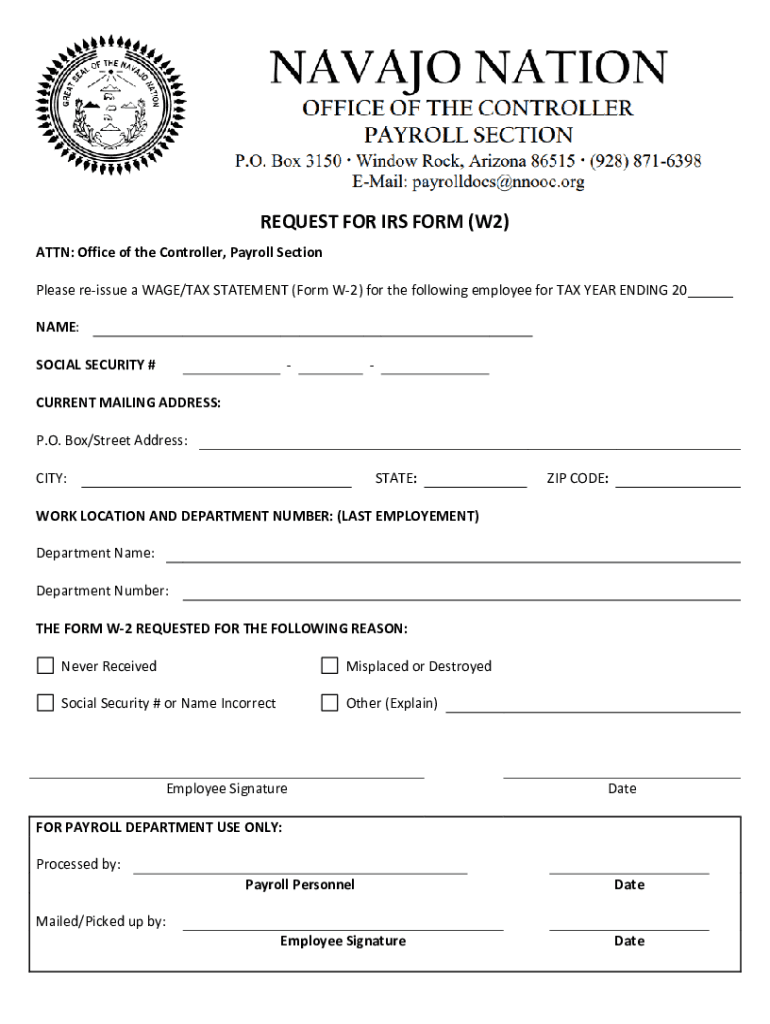

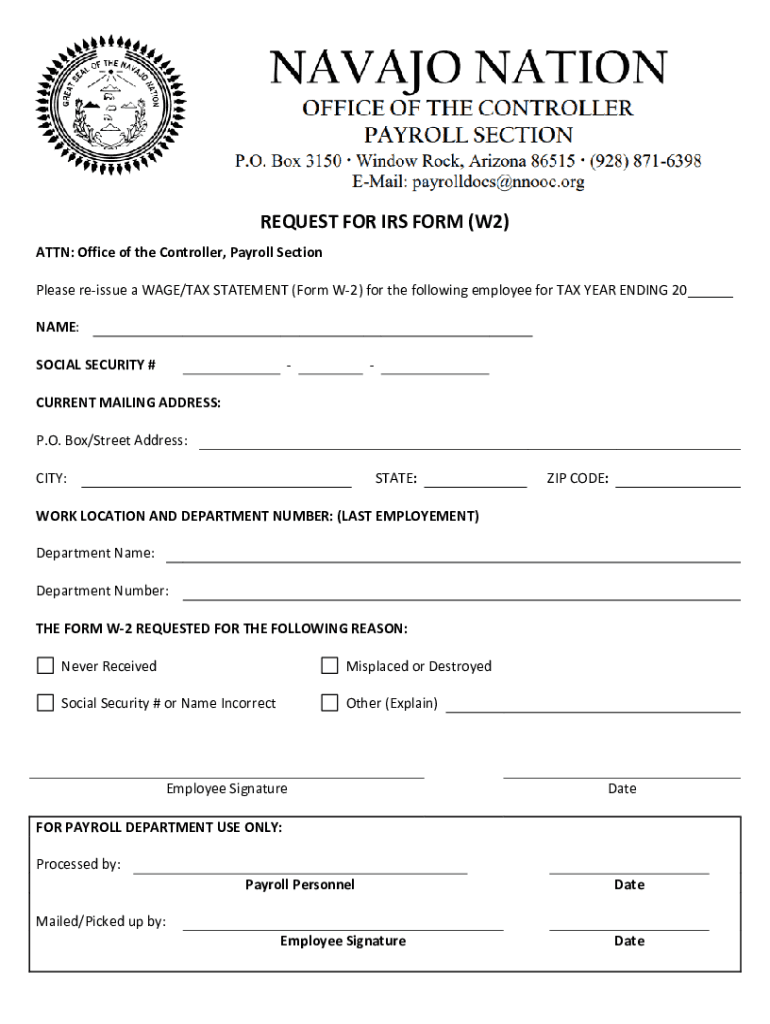

AZ Navajo Nation Request for IRS Form (W2) 2015-2026 free printable template

Show details

10 Oct 2013 ... 45%;: L? W 2,0. If 000079. UNIT: Mk. DATE OF REQUEST: July 19, 2013DIVISION: NATURAL RESOURCES. REQUESTING PARTY: Michelle HenryDEPARTMENT: Administration. PHONE NUMBER: 1928! 871

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ Navajo Nation Request for IRS Form

Edit your AZ Navajo Nation Request for IRS Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ Navajo Nation Request for IRS Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ Navajo Nation Request for IRS Form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ Navajo Nation Request for IRS Form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out AZ Navajo Nation Request for IRS Form

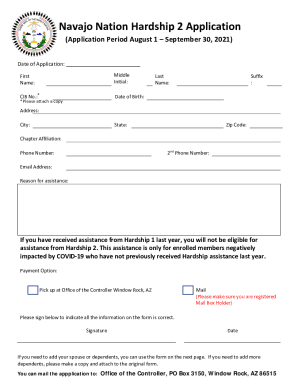

How to fill out AZ Navajo Nation Request for IRS Form (W2)

01

Obtain the AZ Navajo Nation Request for IRS Form (W2) from the appropriate Navajo Nation authority or website.

02

Fill out your personal information, including your name, Social Security number, and contact details at the top of the form.

03

Indicate the tax year for which you are requesting the Form W2.

04

Provide the name and address of your employer or the organization from which you are requesting the W2.

05

Specify any additional information required, such as reasons for the request or any supporting documentation needed.

06

Sign and date the form to certify that the information you provided is accurate.

07

Submit the completed form to the designated Navajo Nation office, either by mail or in person, as instructed.

Who needs AZ Navajo Nation Request for IRS Form (W2)?

01

Individuals who worked for employers under the jurisdiction of the Navajo Nation and require a W2 form for tax filing.

02

Employees who did not receive their W2 in a timely manner or lost their original copies and need a replacement.

03

Businesses and organizations on the Navajo Nation that need to report wages paid to employees for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What should I write for my goals?

Rather than just write out your goals in a topline way, write at least a paragraph on how it feels to achieve your goal. Acting like you have already achieved your goal will start to connect the dots between where you are now and the steps you need to take to achieve your goals.

How do you fill out goals?

When writing goals, follow the SMART goal framework as part of your writing process for each specific goal. S= Specific: The objective is crystal clear. M = Measurable: It must be a measurable goal, otherwise, there can be confusion on whether the key result was accomplished. A = Attainable Goal. R = Realistic Goal.

What are 5 goals for equity?

Equity Goals Goal 1: Comparably high academic achievement and other student outcomes. Goal 2: Equitable access and inclusion. Goal 3: Equitable treatment. Goal 4: Equitable opportunity to learn. Goal 5: Equitable resources. Goal 6: Accountability.

How do you write goals examples?

SMART Goal Example: Specific: I'm going to write a 60,000-word sci-fi novel. Measurable: I will finish writing 60,000 words in 6 months. Achievable: I will write 2,500 words per week. Relevant: I've always dreamed of becoming a professional writer.

What is a smart goal for equity?

SMART goals are: Specific and Strategic: Goals address what, why, who, where, when, and which and are aligned with the State's top equitable access priorities. Measurable: Goals are quantifiable and/or establish tangible indicators of progress. Action-oriented: Goals use active verbs to identify key actions.

What is an equity goal for work?

What is equity in the workplace? Equity in the workplace is the idea that all employees are provided with fair and equal opportunities based on their individual needs. Equity recognizes that not all employees are afforded the same opportunities and addresses the imbalance of opportunities available to them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify AZ Navajo Nation Request for IRS Form without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like AZ Navajo Nation Request for IRS Form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit AZ Navajo Nation Request for IRS Form online?

With pdfFiller, it's easy to make changes. Open your AZ Navajo Nation Request for IRS Form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit AZ Navajo Nation Request for IRS Form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share AZ Navajo Nation Request for IRS Form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

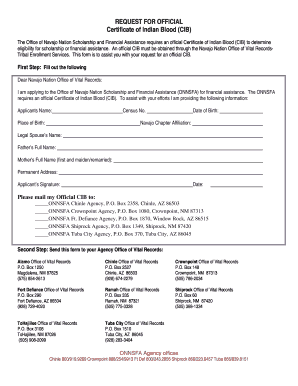

What is AZ Navajo Nation Request for IRS Form (W2)?

The AZ Navajo Nation Request for IRS Form (W2) is a document that is used by the Navajo Nation in Arizona to report earnings to the Internal Revenue Service (IRS) for individuals employed within the Nation.

Who is required to file AZ Navajo Nation Request for IRS Form (W2)?

Employers within the Navajo Nation who withhold taxes from their employees' paychecks are required to file the AZ Navajo Nation Request for IRS Form (W2) for each employee.

How to fill out AZ Navajo Nation Request for IRS Form (W2)?

To fill out the AZ Navajo Nation Request for IRS Form (W2), employers must enter their business information, the employee's details, including their Social Security number, and report the total wages paid and the amount of taxes withheld.

What is the purpose of AZ Navajo Nation Request for IRS Form (W2)?

The purpose of the AZ Navajo Nation Request for IRS Form (W2) is to provide a record of income earned by employees and to report this information to the IRS for tax purposes.

What information must be reported on AZ Navajo Nation Request for IRS Form (W2)?

The AZ Navajo Nation Request for IRS Form (W2) must report the employee's total compensation, Social Security wages, Medicare wages, and any federal, state, or local taxes withheld, along with the employer's contact information.

Fill out your AZ Navajo Nation Request for IRS Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Navajo Nation Request For IRS Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.