FlexBank Section 125 Premium Only Plan Document Application 2013 free printable template

Show details

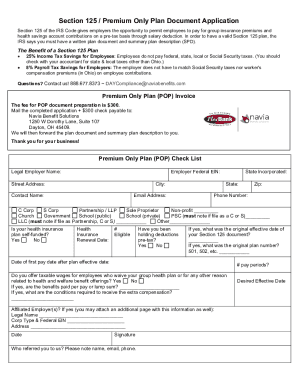

Section 125 / Premium Only Plan Document Application

Restatement to include IRS required HSA language

Pre-Tax Payment of Insurance Premiums and HSA Contributions

Most employers today permit their

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FlexBank Section 125 Premium Only Plan

Edit your FlexBank Section 125 Premium Only Plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FlexBank Section 125 Premium Only Plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FlexBank Section 125 Premium Only Plan online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FlexBank Section 125 Premium Only Plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FlexBank Section 125 Premium Only Plan Document Application Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FlexBank Section 125 Premium Only Plan

How to fill out FlexBank Section 125 Premium Only Plan Document

01

Start by gathering all company information including name, address, and tax identification number.

02

Determine the eligible employees who will participate in the plan.

03

Outline the benefits that will be offered under the Premium Only Plan, such as health insurance premiums.

04

Specify the method of employee contributions to the plan (pre-tax or after-tax).

05

Ensure compliance with IRS regulations by including appropriate disclaimers and legal language.

06

Include details on the effective date of the plan and any eligibility requirements.

07

Have employees sign their enrollment and consent forms to participate in the plan.

08

Maintain a signed copy of the document for your records and provide copies to participants.

Who needs FlexBank Section 125 Premium Only Plan Document?

01

Employers seeking to offer pre-tax benefit options for health insurance premiums.

02

Businesses looking to reduce payroll taxes while providing employees with affordable health care options.

03

HR departments managing employee benefits for companies that want to utilize Section 125 plans.

Fill

form

: Try Risk Free

People Also Ask about

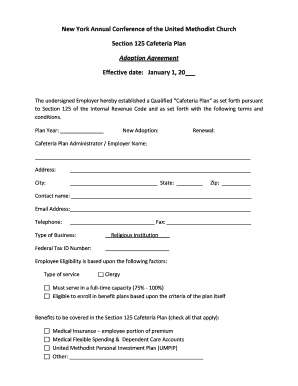

What are the 4 most common types of cafeteria plans?

Here are four examples of cafeteria 125 healthcare benefits for employees: Premium-only plan (POP) With a POP plan, employees pay for their health insurance benefits with their pretax income. Health savings account (HSA) Flexible spending accounts (FSA) Dependent care assistance plan (DCAP)

What is an example of a Section 125 plan?

Common examples of Section 125 Cafeteria Plans include: Contributions to a Health Savings Account (HSA) Health Flexible Spending Accounts (FSAs) Premium Only Plans (POPs) Dependent Care Flexible Spending Accounts.

What is Section 125 example?

A common example of a Section 125 plan is a flexible spending account (FSA), in which employees set aside pretax dollars from their paycheck to be used for qualifying medical expenses. The benefit of setting this money aside is that employees can save up to 30% on local, state and federal taxes.

What qualifies as a Section 125 plan?

A section 125 plan is the only means by which an employer can offer employees a choice between taxable and nontaxable benefits without the choice causing the benefits to become taxable. A plan offering only a choice between taxable benefits is not a section 125 plan.

Can I write my own section 125 plan?

The written plan must be in place — signed by the employer with the Summary Plan Description and election forms copied to employees — before any pre-tax salary deductions are taken.

How do I create a section 125 plan?

Starting a section 125 plan requires following these three simple steps: Complete the necessary plan documents. Notify employees that you are offering a Section 125 cafeteria plan. Hire a TPA to administer your Section 125 plan and process reimbursements.

What must be included in a Section 125 plan document?

The written plan must specifically describe all benefits and establish rules for eligibility and elections. A section 125 plan is the only means by which an employer can offer employees a choice between taxable and nontaxable benefits without the choice causing the benefits to become taxable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit FlexBank Section 125 Premium Only Plan from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your FlexBank Section 125 Premium Only Plan into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send FlexBank Section 125 Premium Only Plan for eSignature?

FlexBank Section 125 Premium Only Plan is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit FlexBank Section 125 Premium Only Plan on an iOS device?

You certainly can. You can quickly edit, distribute, and sign FlexBank Section 125 Premium Only Plan on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is FlexBank Section 125 Premium Only Plan Document?

The FlexBank Section 125 Premium Only Plan Document outlines a tax-advantaged health benefits program that allows employees to pay their insurance premiums with pre-tax dollars, reducing their taxable income.

Who is required to file FlexBank Section 125 Premium Only Plan Document?

Employers that offer a Section 125 Premium Only Plan to their employees are required to file the FlexBank Section 125 Premium Only Plan Document.

How to fill out FlexBank Section 125 Premium Only Plan Document?

To fill out the FlexBank Section 125 Premium Only Plan Document, employers must provide necessary details regarding the plan's structure, specify eligible benefits, and ensure compliance with IRS regulations.

What is the purpose of FlexBank Section 125 Premium Only Plan Document?

The purpose of the FlexBank Section 125 Premium Only Plan Document is to provide a legal framework for the administration of a Premium Only Plan, ensuring that both employers and employees can benefit from tax savings.

What information must be reported on FlexBank Section 125 Premium Only Plan Document?

The FlexBank Section 125 Premium Only Plan Document must report details such as the plan start and end dates, the types of premium payments covered, employee eligibility criteria, and other relevant compliance information.

Fill out your FlexBank Section 125 Premium Only Plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FlexBank Section 125 Premium Only Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.