Get the free take care wageworks

Get, Create, Make and Sign takecarewageworks form

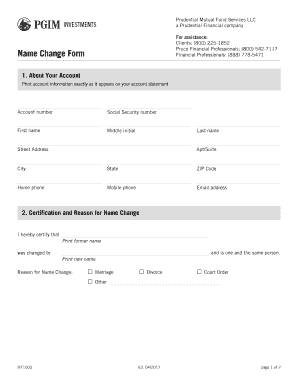

How to edit takecarewageworks claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out take care wageworks claim form

How to Fill Out Take Care Wage Works:

Who Needs Take Care Wage Works:

Video instructions and help with filling out and completing take care wageworks

Instructions and Help about takecarewageworks forms

A dependent care flexible spending account FSA is pre-tax money you set aside out of your paycheck to cover day care costs with a dependent care FSA you can pay for fees for licensed daycare or adult care facilities and even before and after school care programs and summer day camps for dependents under 13 the money you put in your FSA is taken from your pay before federal state or social security taxes this decreases your taxable income and increases your take-home pay so how does an FSA work when choosing your benefits you must decide how much money you want to put in your dependent care FSA for the entire year, although there are limits the amount you choose for the year is taken out of your paycheck in equal amounts and placed in your flexible spending account unlike a Health FSA where you have access to your total contribution for the year on the first day your benefits become active with your dependent care FSA you must have enough money available in your account to cover any expenses unlike a health FSA where you can carry over up to $500 to the next year with your dependent care FSA you are not able to carry over any unused dollars so use it or lose it how do I get my money out of the FSA to pay for these expenses most FSA plans offer an FSA debit card which allows you to pay for approved expenses directly at the place you get care or buy medicine the card will only work for FSA eligible expenses and is the most convenient way to use your FSA if your FSA doesn't offer a debit card you will pay out of pocket and then send a copy of the receipt to your FSA provider who will issue a check to pay you back when can I use a dependent care FSA dependent care FSA's can be used to pay for the cost of daycare for kids up to thirteen years old elder care if you were taking care of a parent or spouse and care for physically or mentally challenged dependents heads up you can only use this type of FSA if you and your spouse are working and/or in school if you are separated from your spouse only the parent with physical custody of the child can use the dependent FSA and remember dependent care FSA's are not prefunded, so you can only withdraw from the account as much as you have put into it to sum it up a dependent care FSA is a pre-tax savings account to be used for daycare costs you decide at the beginning of the plan year how much to contribute for the next twelve months and your account will be funded as you go most FSA's offer a debit card, so you can conveniently use the funds in your account you

People Also Ask about claims takecareclaims

What is take care WageWorks?

Who uses WageWorks?

How do I get my money from WageWorks?

What is take care WageWorks Flex spending?

Where can you use WageWorks card?

What is the purpose of WageWorks?

How do I take care of my WageWorks balance?

What is a WageWorks card?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out take care wageworks form using my mobile device?

Can I edit take care wageworks form on an Android device?

How do I complete take care wageworks form on an Android device?

What is take care wage works?

Who is required to file take care wage works?

How to fill out take care wage works?

What is the purpose of take care wage works?

What information must be reported on take care wage works?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.