Get the free DEBT CONVERSION AGREEMENT - thecse.com

Show details

DEBT CONVERSION AGREEMENT THIS AGREEMENT is effective as of the day of, 2015 (the Effective Date). BETWEEN: CI ELO WASTE SOLUTIONS CORP. Suite 102, 4016 Charles St, Red Deer, Alberta, T4S 2A8 (hereinafter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt conversion agreement

Edit your debt conversion agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt conversion agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

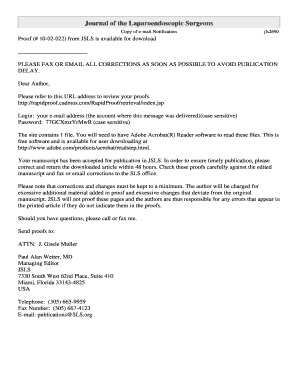

Editing debt conversion agreement online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit debt conversion agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt conversion agreement

How to fill out a debt conversion agreement?

01

Start by gathering all necessary information: Before filling out a debt conversion agreement, gather all the relevant information regarding the debt that needs to be converted. This includes the original amount, outstanding balance, interest rate, and any other terms associated with the debt.

02

Understand the terms and conditions: Take the time to carefully read and comprehend the terms and conditions stated in the debt conversion agreement. Familiarize yourself with the conversion ratio, conversion price, and any other essential provisions outlined in the agreement.

03

Fill in the parties involved: Identify the parties involved in the agreement. This typically includes the creditor or lender, who is willing to convert the debt, and the debtor or borrower, who owes the debt. Ensure accurate names, addresses, and contact information are provided for both parties.

04

Specify the debt details: Clearly state the details of the debt being converted, including the original loan or credit agreement number, the outstanding principal balance, and any interest or late fees incurred.

05

Outline the conversion terms: Describe the terms of the debt conversion, such as the conversion price, conversion ratio, and any restrictions or limitations imposed. These terms determine how much of the debt will be converted into another form, such as equity or shares.

06

Include representations and warranties: Both parties involved may need to provide representations and warranties to ensure the validity of the agreement. This may include guaranteeing that they have the authority to enter into the agreement and that the debt being converted is valid and enforceable.

07

Signatures and dates: Once all the necessary information has been filled out, ensure that both parties sign the debt conversion agreement. Include the date of signing to establish the timeline of the agreement.

Who needs a debt conversion agreement?

01

Individuals with outstanding debts: People who have debts that they wish to convert into a different form or structure may employ a debt conversion agreement. This allows them to change the nature or terms of their debt, potentially offering more favorable conditions.

02

Businesses looking to restructure debts: Companies facing financial challenges or seeking to reorganize their debts may utilize a debt conversion agreement. This allows them to convert outstanding debts into equity, bonds, or other financial instruments, alleviating the burden of excessive debt.

03

Lenders or creditors willing to negotiate: Lenders or creditors who are open to converting their loans or credits into different forms may also initiate a debt conversion agreement. This can help them diversify their investment portfolio, reduce the risk associated with bad debts, or fulfill regulatory requirements.

In conclusion, filling out a debt conversion agreement requires understanding the terms, accurately providing necessary information, specifying debt details, outlining conversion terms, including representations and warranties, and obtaining signatures. Such agreements are useful for individuals, businesses, and creditors looking to modify the structure of debts while ensuring a legally binding and mutually beneficial arrangement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the debt conversion agreement in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your debt conversion agreement and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete debt conversion agreement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your debt conversion agreement. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit debt conversion agreement on an Android device?

With the pdfFiller Android app, you can edit, sign, and share debt conversion agreement on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is debt conversion agreement?

A debt conversion agreement is a legal contract that outlines the terms under which a debt will be converted to equity.

Who is required to file debt conversion agreement?

The parties involved in the debt conversion agreement are required to file the agreement with the appropriate regulatory bodies.

How to fill out debt conversion agreement?

To fill out a debt conversion agreement, one must include details of the debt being converted, terms of the conversion, and signatures of all parties involved.

What is the purpose of debt conversion agreement?

The purpose of a debt conversion agreement is to formalize the terms of converting debt into equity and ensure that all parties are in agreement.

What information must be reported on debt conversion agreement?

The debt conversion agreement must include details of the debt being converted, terms of the conversion, names of the parties involved, and signatures.

Fill out your debt conversion agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Conversion Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.