Get the free Payroll Service Set-up & Authorization - Epaypayroll

Show details

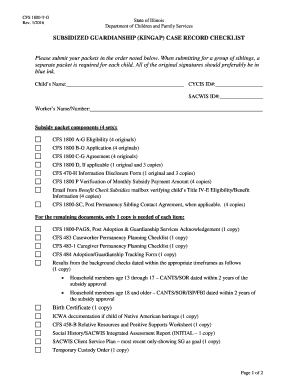

CLIENT REQUIREMENTS and CHECK LIST Saving businesses time and money NEED RECEIVED N/A Client Sales Rep. DESCRIPTION EDD & EIN #'s A document confirming your Federal & State ID Number & State Tax Rate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll service set-up amp

Edit your payroll service set-up amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll service set-up amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll service set-up amp online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payroll service set-up amp. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll service set-up amp

How to fill out payroll service set-up amp:

01

Gather all necessary information: Start by collecting important details such as your company's legal name, tax ID number, and contact information. You may also need employee information, including their names, addresses, Social Security numbers, and tax withholding details.

02

Choose a payroll service provider: Research and select a reliable payroll service provider that suits your specific needs. Consider factors such as cost, services offered, user-friendliness of their software, and customer support.

03

Set up your account: Follow the instructions provided by the payroll service provider to set up your account. This may involve creating a username and password for logging in to their platform.

04

Enter company information: Fill out the necessary fields with your company's information, including legal name, address, phone number, and tax ID number. This step ensures that your payroll service accurately identifies your organization.

05

Add employee details: Input the relevant information for each employee, such as their name, mailing address, and Social Security number. Include any tax withholding details, such as federal and state tax allowances, unemployment insurance rates, and retirement plan contributions.

06

Set up payment methods: Choose the payment method you prefer, such as direct deposit or printed checks. Ensure that you provide accurate banking information for direct deposit, such as the routing number and account number.

07

Determine pay periods and schedules: Specify the frequency of pay periods (weekly, biweekly, semimonthly, or monthly) and establish the dates on which employees will be paid. This information will help the payroll service calculate wages accurately.

08

Review and save your settings: Before finalizing the setup process, review all the information you have entered to ensure its accuracy. Save your settings and make any necessary adjustments.

Who needs payroll service set-up amp:

01

Small business owners: Entrepreneurs who have recently established their businesses may benefit from utilizing payroll service set-up amp. It helps them efficiently manage employee salaries, taxes, and other payroll-related tasks without the need for extensive knowledge in payroll administration.

02

Businesses with growing employee numbers: As a company expands and hires more employees, manually processing payroll becomes time-consuming and prone to errors. Implementing a payroll service set-up amp can streamline the process and accommodate the increasing workload.

03

Companies seeking compliance with tax regulations: Payroll calculations involve complex tax calculations and compliance requirements. Using a payroll service helps ensure accurate tax withholding and reporting, reducing the risk of penalties or errors.

04

Organizations with limited resources: Small businesses or nonprofit organizations often have limited personnel and financial resources. Outsourcing payroll services enables them to focus on their core operations while leaving payroll management to professionals.

05

Companies aiming for increased efficiency: By automating payroll processes through a payroll service set-up amp, businesses can free up valuable time and resources. This allows them to focus on strategic initiatives and other crucial aspects of their operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payroll service set-up amp?

Payroll service set-up amp is a form or process used to set up payroll services for a company.

Who is required to file payroll service set-up amp?

Employers or businesses that are setting up payroll services for their employees are required to file payroll service set-up amp.

How to fill out payroll service set-up amp?

To fill out payroll service set-up amp, you need to provide information about the company, employees, wages, deductions, and other relevant payroll details.

What is the purpose of payroll service set-up amp?

The purpose of payroll service set-up amp is to ensure that employees are paid accurately and on time, and to comply with legal requirements.

What information must be reported on payroll service set-up amp?

Information such as employee details, wages, deductions, benefits, taxes, and any other relevant payroll information must be reported on payroll service set-up amp.

How do I edit payroll service set-up amp in Chrome?

payroll service set-up amp can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the payroll service set-up amp in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your payroll service set-up amp right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out payroll service set-up amp on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your payroll service set-up amp. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your payroll service set-up amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Service Set-Up Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.